109

2014 ANNUAL REPORT

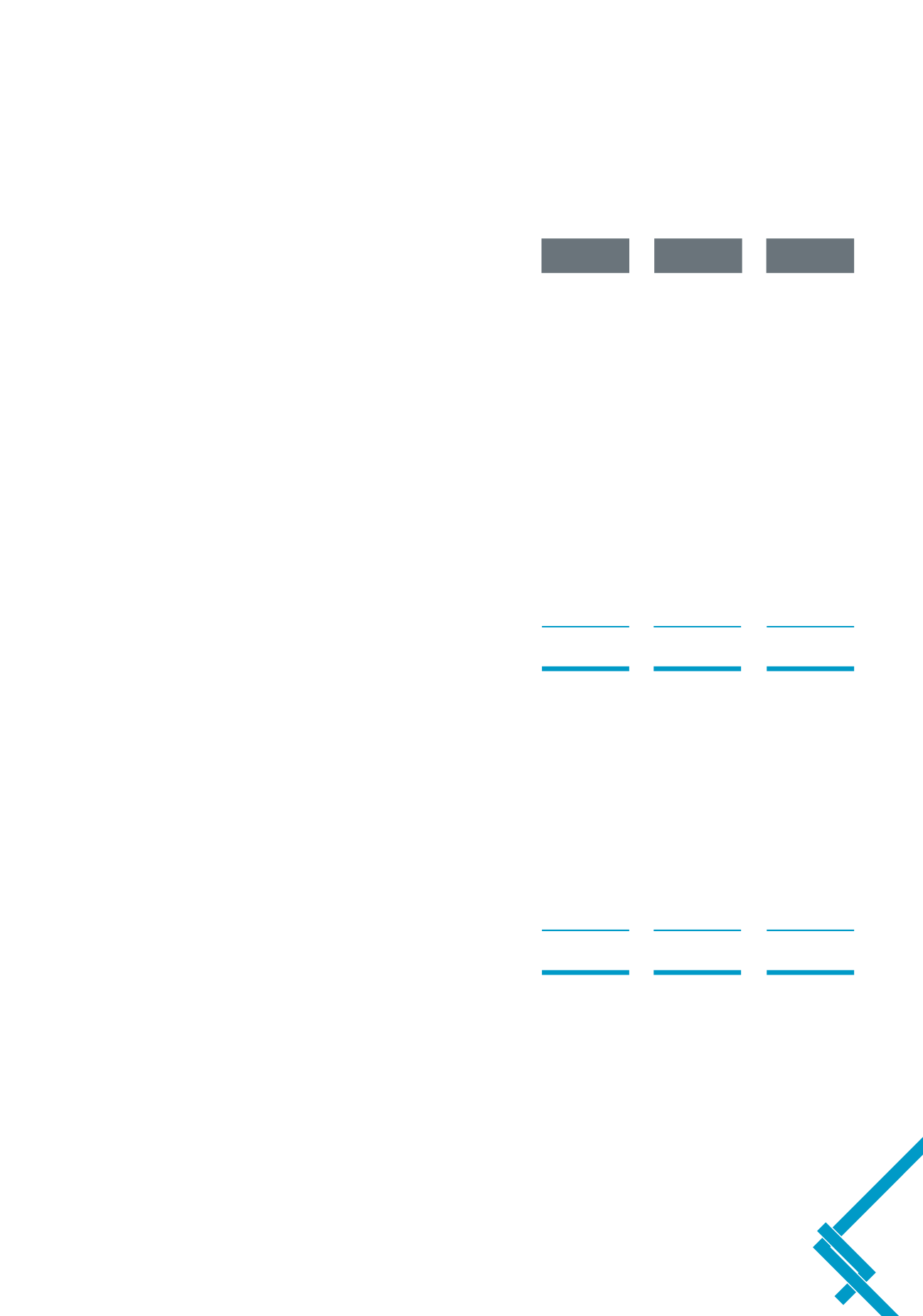

25 Maturity analysis of assets and liabilities

The table below analyses the discounted assets and liabilities of the Group based on the remaining period at September 30 to the contractual

maturity date. See Note 21.3 - ‘Liquidity risk’ - for an analysis of the financial liabilities based on contractual undiscounted repayment

obligations.

Within

After

Total

one year

one year

2014

ASSETS

Cash and cash equivalents

565,225

–

565,225

Statutory deposits with Central Banks

4,834,456

–

4,834,456

Due from banks

8,345,146

–

8,345,146

Treasury Bills

5,905,053

–

5,905,053

Investment interest receivable

72,136

–

72,136

Advances

6,994,689

20,100,718

27,095,407

Investment securities

1,933,185

6,327,197

8,260,382

Investment in associated companies

–

345,942

345,942

Premises and equipment

–

1,573,503

1,573,503

Goodwill

–

300,971

300,971

Net pension asset

–

1,299,725

1,299,725

Deferred tax assets

–

184,154

184,154

Taxation recoverable

20,250

29,357

49,607

Other assets

528,982

10,827

539,809

29,199,122

30,172,394

59,371,516

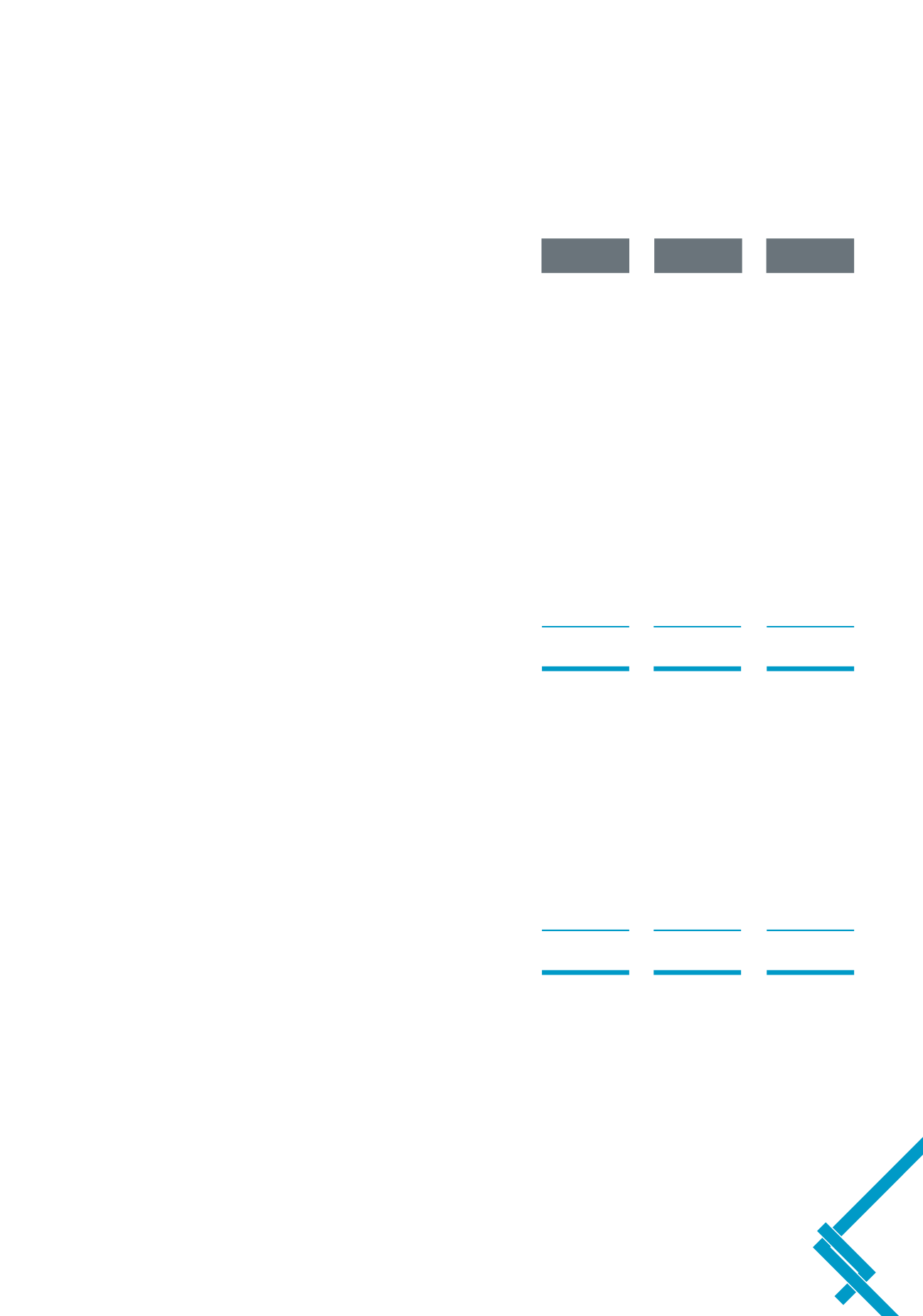

LIABILITIES

Due to banks

69,957

–

69,957

Customers’current, savings and deposit accounts

43,761,209

9,551

43,770,760

Other fund raising instruments

3,026,007

331,826

3,357,833

Debt securities in issue

–

1,066,802

1,066,802

Net pension liability

–

57,275

57,275

Provision for post-retirement medical benefits

–

423,502

423,502

Taxation payable

73,043

–

73,043

Deferred tax liabilities

28,941

439,095

468,036

Accrued interest payable

40,413

178

40,591

Other liabilities

1,110,442

186,952

1,297,394

48,110,012

2,515,181

50,625,193