REPUBLIC BANK LIMITED

110

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

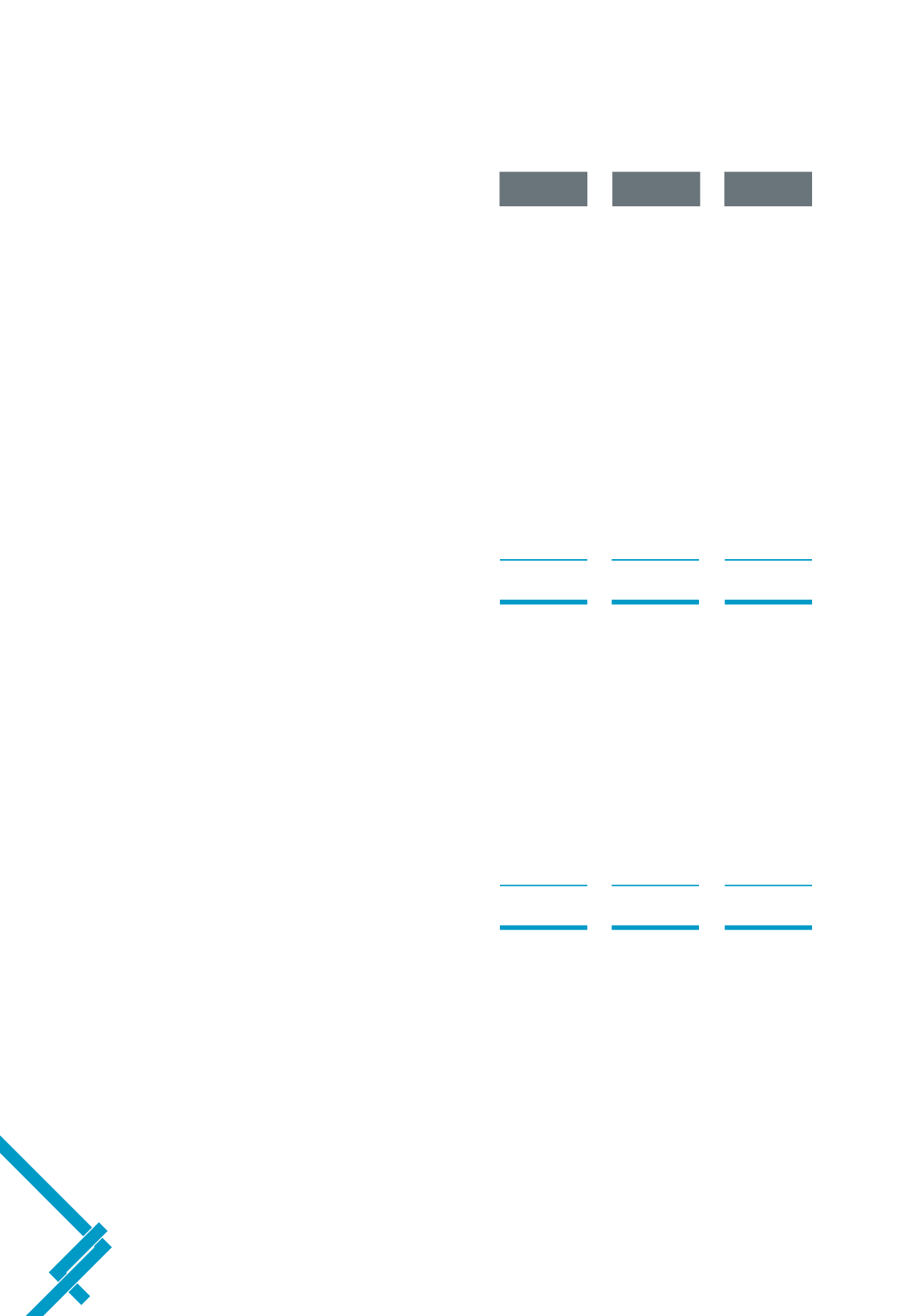

25 Maturity analysis of assets and liabilities

(continued)

Within

After

one year

one year

Total

2013

ASSETS

Cash and cash equivalents

526,383

–

526,383

Statutory deposits with Central Banks

4,332,600

–

4,332,600

Due from banks

9,237,076

–

9,237,076

Treasury Bills

5,723,076

–

5,723,076

Investment interest receivable

63,979

1,508

65,487

Advances

6,786,405

18,449,112

25,235,517

Investment securities

1,898,347

6,232,700

8,131,047

Investment in associated companies

–

445,377

445,377

Premises and equipment

96

1,583,918

1,584,014

Goodwill

–

485,971

485,971

Net pension asset

–

1,292,988

1,292,988

Deferred tax assets

6,030

136,943

142,973

Taxation recoverable

17,497

29,537

47,034

Other assets

306,392

56,430

362,822

28,897,882

28,714,483

57,612,365

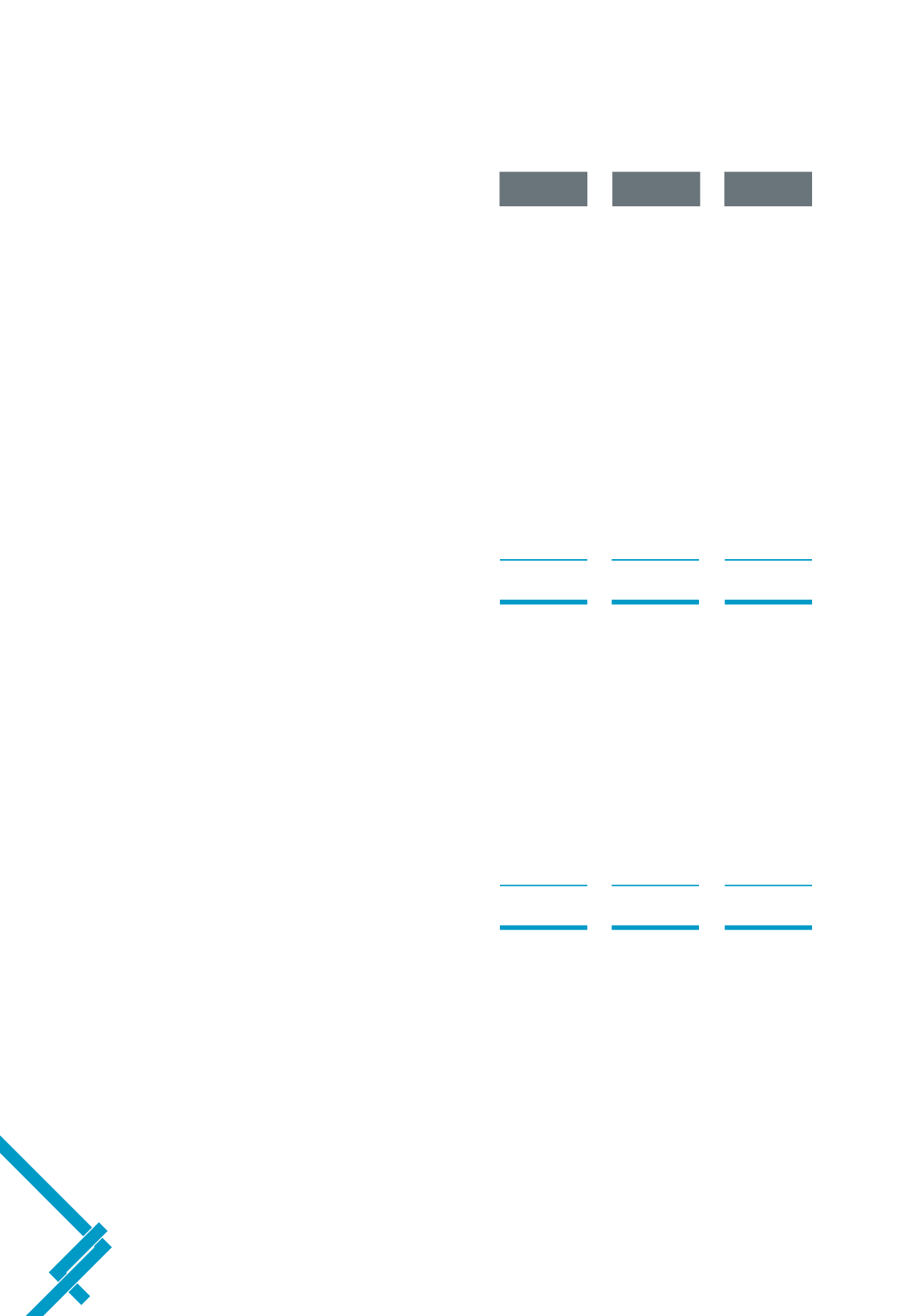

LIABILITIES

Due to banks

73,349

–

73,349

Customers’current, savings and deposit accounts

41,973,044

125,266

42,098,310

Other fund raising instruments

3,052,020

352,954

3,404,974

Debt securities in issue

150,000

1,079,058

1,229,058

Net pension liability

–

50,337

50,337

Provision for post-retirement medical benefits

–

304,850

304,850

Taxation payable

160,991

–

160,991

Deferred tax liabilities

24,958

467,302

492,260

Accrued interest payable

51,556

410

51,966

Other liabilities

1,030,799

199,437

1,230,236

46,516,716

2,579,615

49,096,331

26 Equity compensation benefits

a)

Profit sharing scheme

The total staff profit sharing for the Group was $109 million (2013:$104.7 million) (see Note 18). During the 2014 financial year, $71 million

in advances were made by Republic Bank (the Parent) to the staff profit sharing scheme (2013: $nil).