Republic Bank Limited

102

For the year ended September 30, 2015. Expressed in thousands of Trinidad and Tobago dollars ($’000) except where otherwise stated

Notes to theConsolidatedFinancial Statements

4

Financial

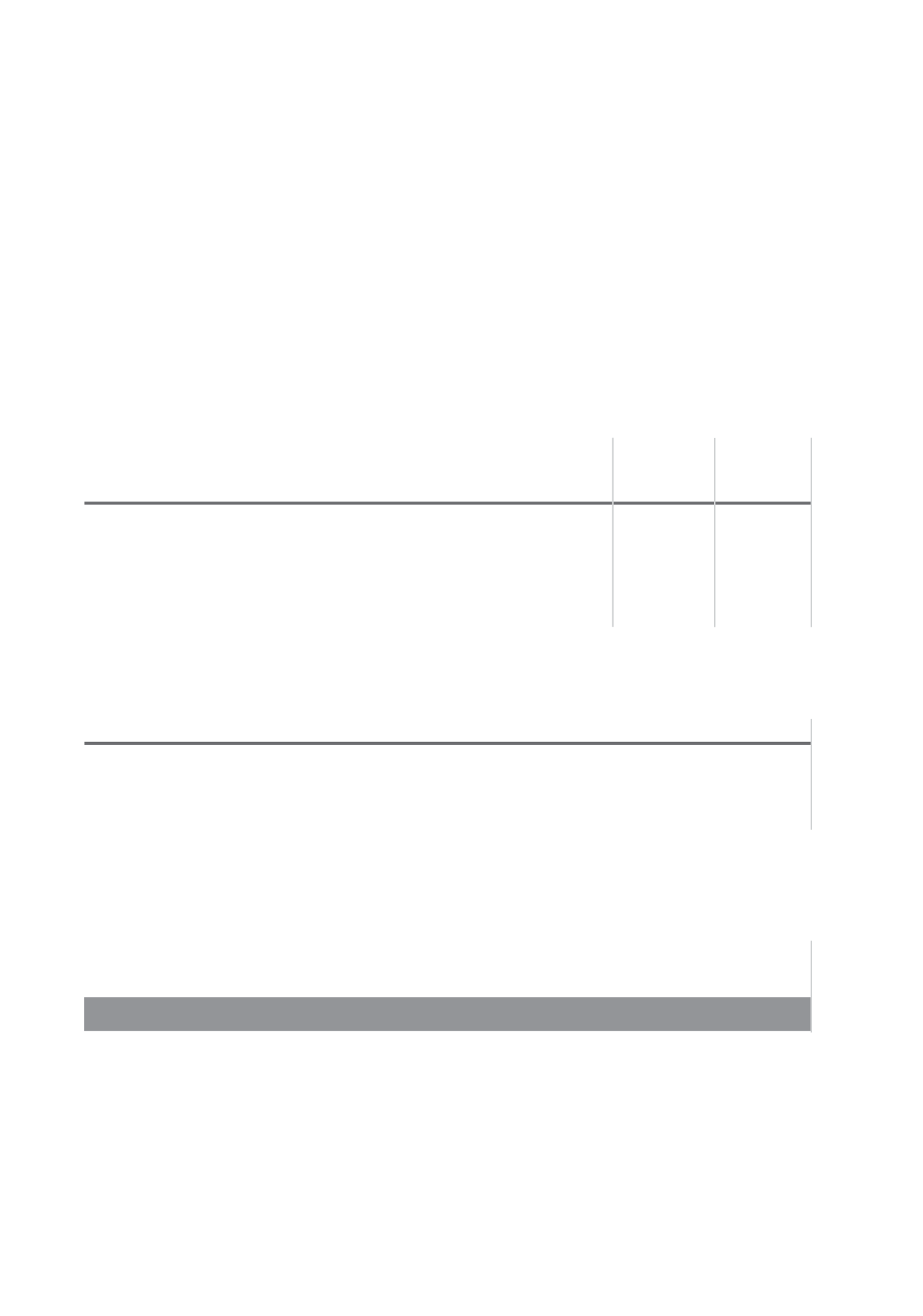

8 GOODWILL

(continued)

Impairment testing of goodwill

In accordance with IFRS 3, all assets that gave rise to goodwill were reviewed for impairment using the ‘value in use’ method. In

each case, the cash flow projections are based on financial budgets approved by senior management and the values assigned to key

assumptions reflect past performance.

The following table highlights the goodwill and key assumptions used in value in use calculations for each cash-generating unit:

Republic Bank Republic Bank Republic Bank

(Barbados)

(Cayman)

(Guyana)

Limited

Limited

Limited

TT$ million TT$ million TT$ million

Carrying amount of goodwill

145

32

92

Basis for recoverable amount

Value in use

Value in use

Value in use

Discount rate

12%

10%

8%

Cash flow projection term

3 yrs

3 yrs

3 yrs

Terminal Growth rate

1.75%

2.5%

3%

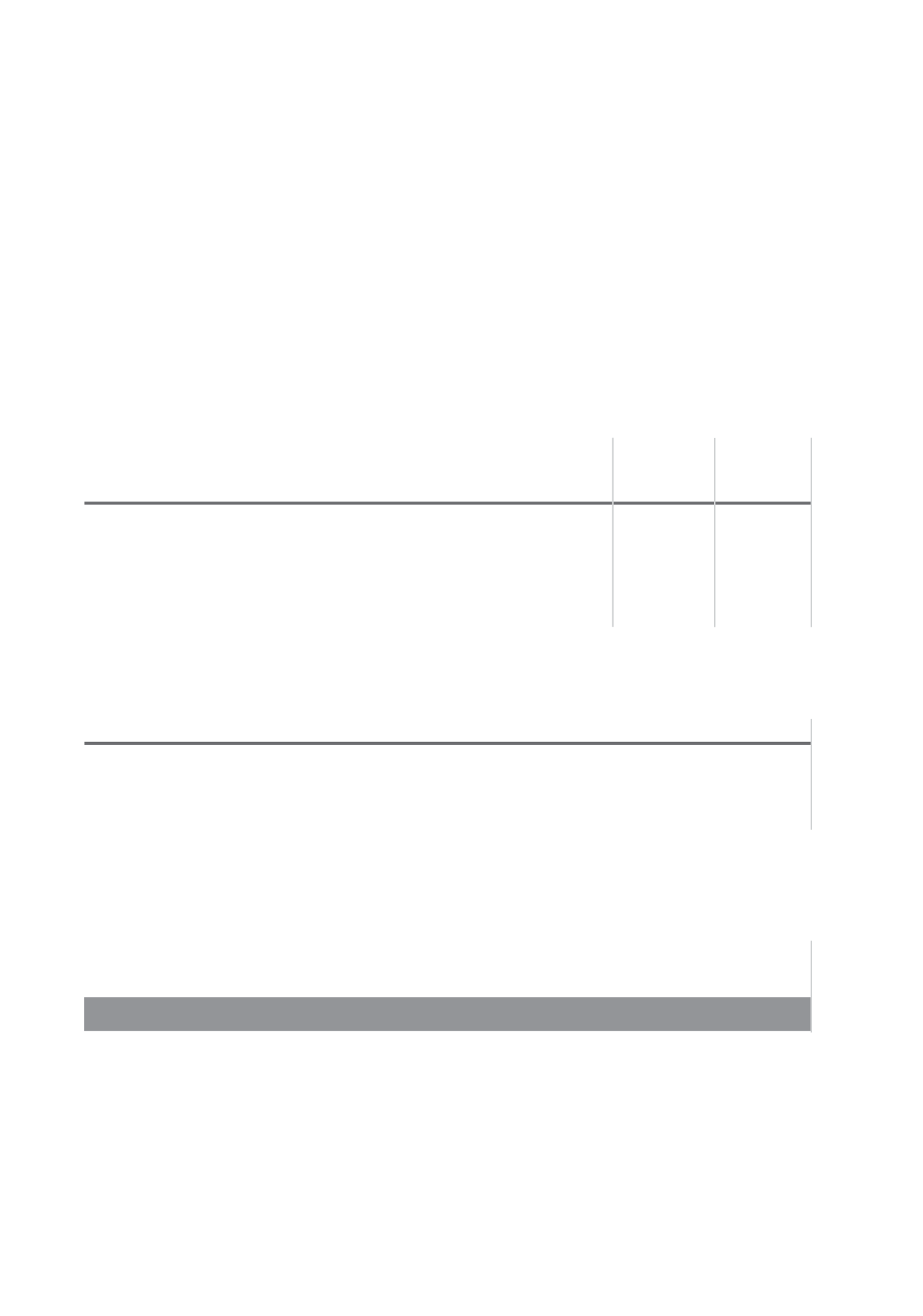

In conducting the goodwill impairment review, consideration was made for the decline in business in the Cayman Islands and the

impact on the goodwill that was acquired by Republic Bank (Cayman) Limited. Key assumptions were as follows:

Assumption

Value

Cost of Equity

10.32%

Terminal Growth Rate

2.50%

Growth in Free Cash Flows (2015 to 2023)

3% - 5%

As a result of these changes in key assumptions, the value in use of the cash generating unit was determined to be lower than the

carrying value of the company. A goodwill impairment expense of $31 million was therefore recorded for the Group’s investment in

Republic Bank (Cayman) Limited:

Carrying Value of RBL Cayman (TT$M)

472

Present value of future cashflows (TT$M)

441

Impairment

31