Republic Bank Limited

108

For the year ended September 30, 2015. Expressed in thousands of Trinidad and Tobago dollars ($’000) except where otherwise stated

Notes to theConsolidatedFinancial Statements

4

Financial

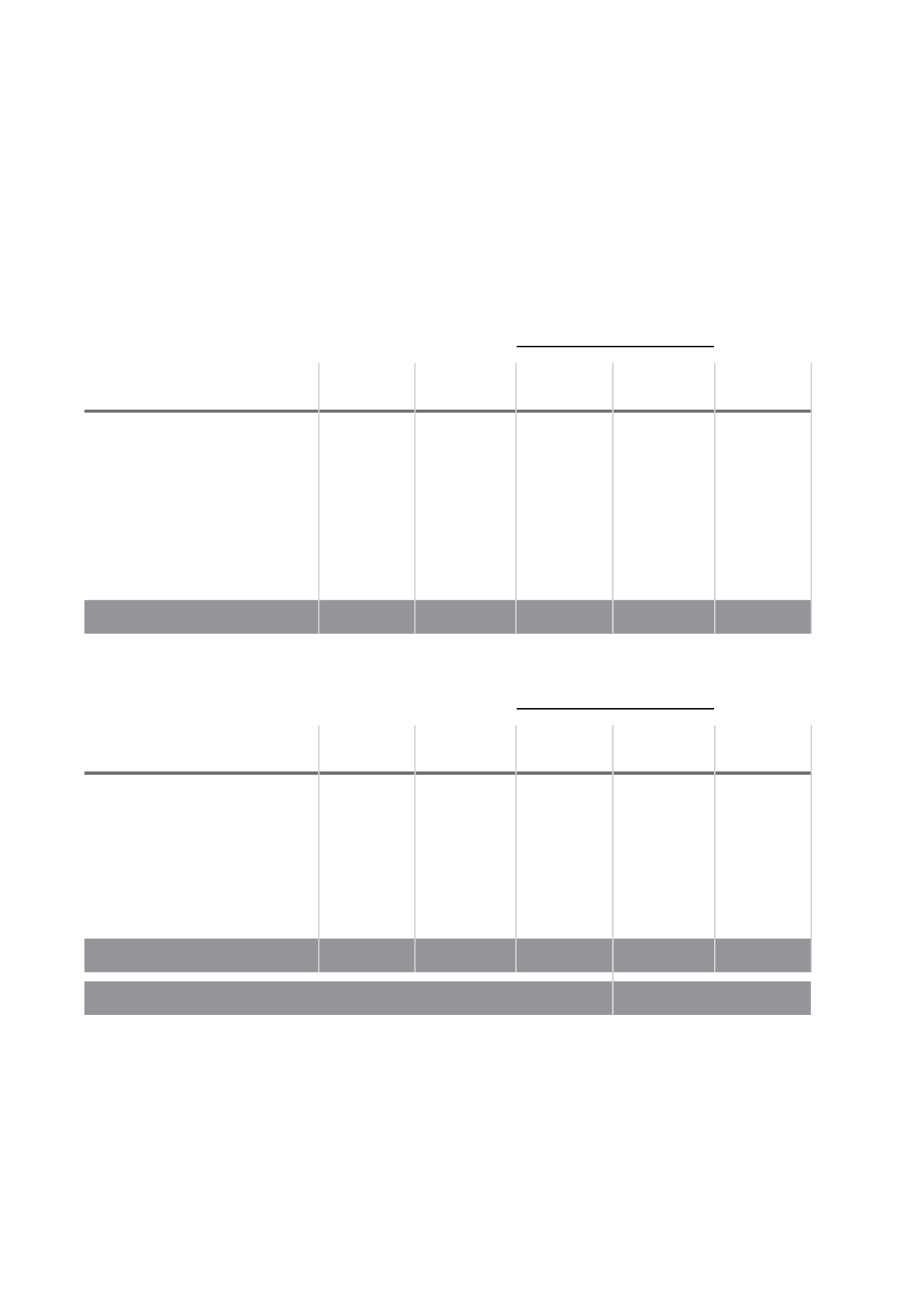

10 DEFERRED TAX ASSETS AND LIABILITIES

Components of deferred tax assets and liabilities

a) Deferred tax assets

(Credit)/charge

Opening

Acquisition

Exchange Consolidated

Closing

balance

of

and other statement of

balance

2014

Subsidiaries adjustments

income

OCI

2015

Post-retirement

medical benefits

123,717

–

(597)

8,381

(21,448)

110,053

Leased assets

24,496

–

–

(9,717)

–

14,779

Unrealised reserve

4,930

–

1,328

27

1,527

7,812

Unearned loan

origination fees

29,767

–

19

1,593

–

31,379

Other

1,244

–

–

5,473

(4)

6,713

184,154

–

750

5,757

(19,925)

170,736

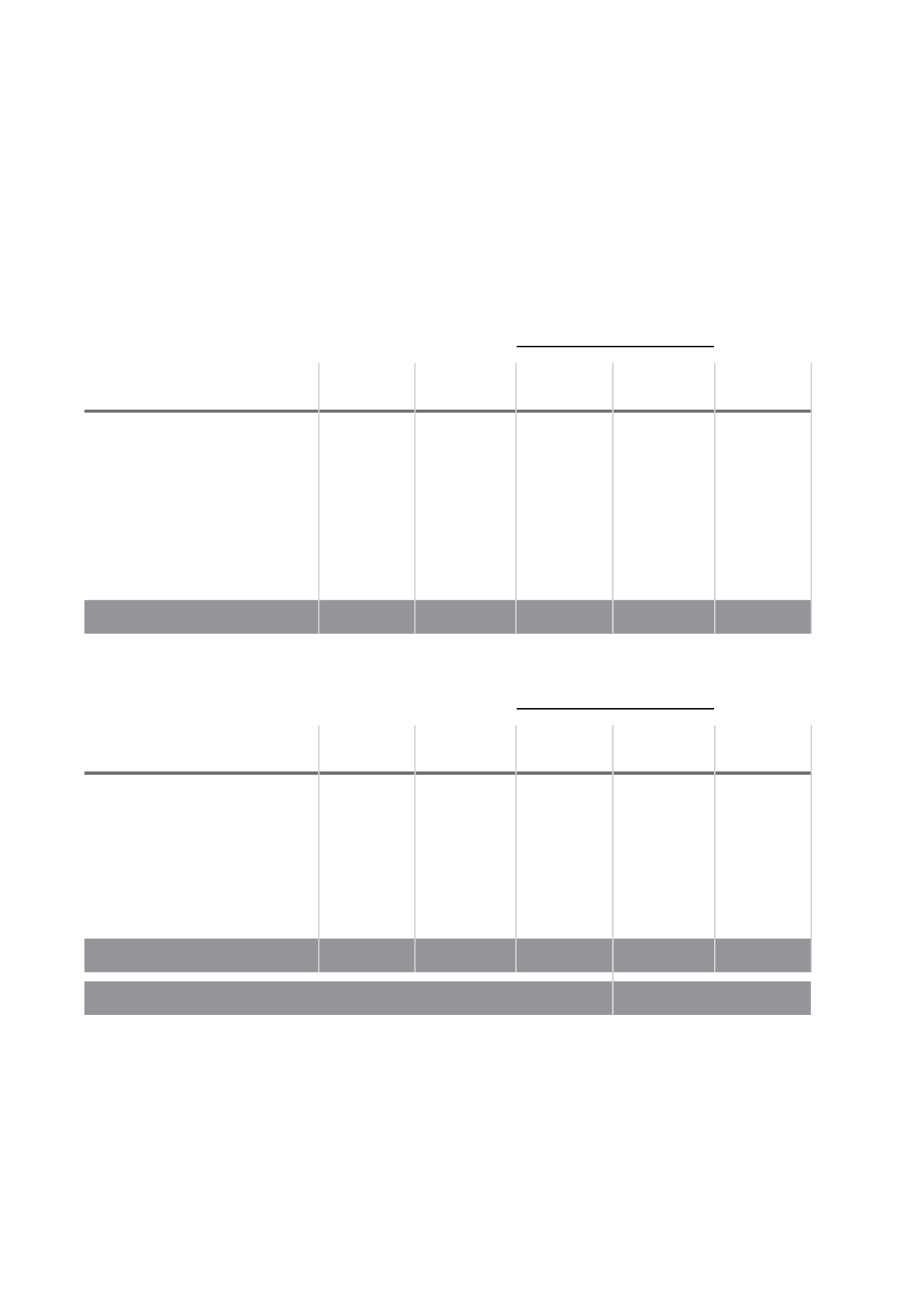

b) Deferred tax liabilities

Charge/(credit)

Opening

Acquisition

Exchange Consolidated

Closing

balance

of

and other statement of

balance

2014

Subsidiaries adjustments

income

OCI

2015

Pension asset

323,323

–

2,051

(9,948)

(7,579)

307,847

Leased assets

32,304

–

–

(4,435)

–

27,869

Premises and

equipment

70,855

2,619

(2,586)

1,658

–

72,546

Unrealised reserve

41,554

–

55

–

(32,134)

9,475

Other

–

2,284

–

–

(10)

2,274

468,036

4,903

(480)

(12,725)

(39,723)

420,011

Net credit to consolidated statement of income

18,482