Annual Report 2015

143

27 EQUITY COMPENSATION BENEFITS

(continued)

b) Stock option plan

(continued)

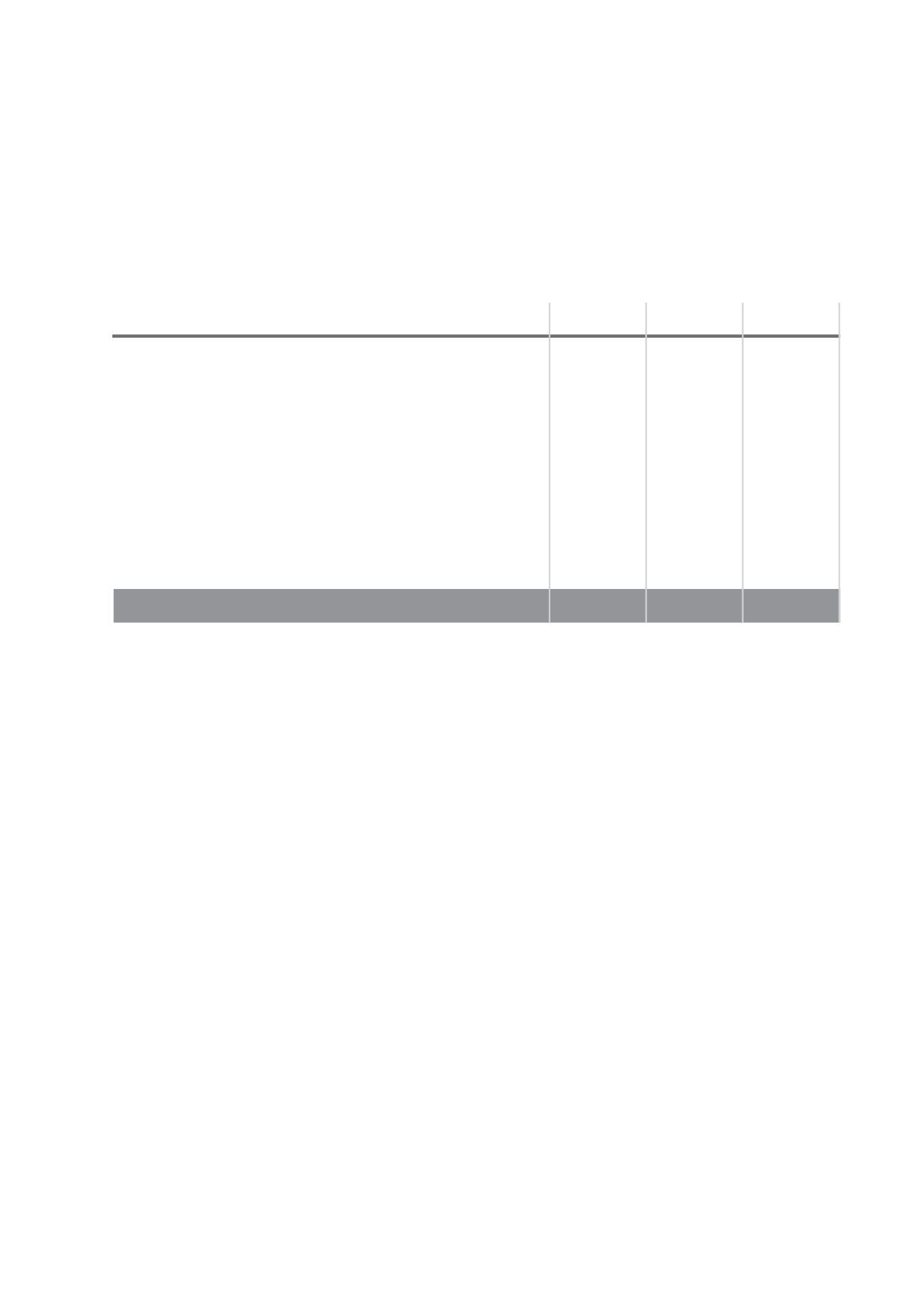

Exercise

Expiry date

price

2015

2014

15-Dec-15

$78.78

31,841

46,665

20-Dec-16

$90.19

93,301

124,503

20-Dec-17

$86.75

104,156

187,867

20-Dec-18

$80.00

137,160

167,038

20-Dec-19

$101.80

11,876

11,876

21-Feb-21

$85.94

143,481

224,419

3-Feb-22

$72.99

254,739

350,306

30-Jan-23

$92.67

336,496

336,496

31-Dec-24

$104.41

342,415

342,415

12-Dec-25

$110.03

355,800

–

1,811,265

1,791,585

As at September 30, 2015, none (2014: none) of the outstanding options were anti-dilutive and therefore not included in the

calculation of diluted earnings per share.

The fair value of the stock options have been determined using a binomial option-pricing model. The assumptions used in the

calculation of the fair value are as follows:

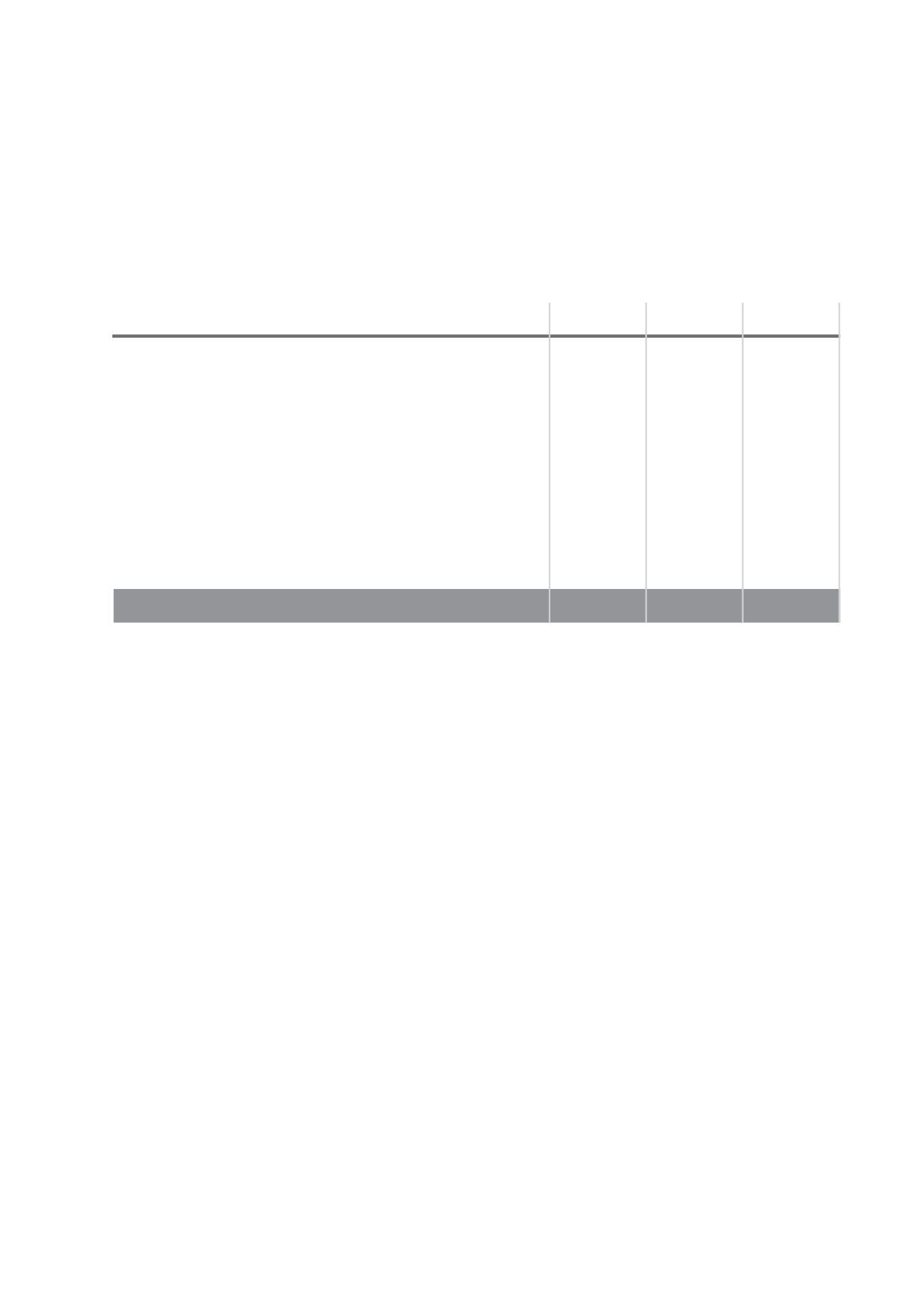

Grant date

December 18, 2014 to March 5, 2015

Number granted

355,800

Exercise price

$110.03

Share price at grant date

$118.20 to $119.75

Risk free interest rate

2.0% per annum

Expected volatility

7.5% per annum

Dividend yield

3.65% per annum

Exercise term

Option exercised when share price is twice the exercise price

Fair value

$8.53 to $10.41

The expected volatility is based on historical volatility of the share price over the last five years.

The weighted average share price for share options exercised during the year was $81.34. For options outstanding at September

30, 2015 the exercise price ranged from $72.99 to $110.03 and the weighted average remaining contractual life was 9.1

years.

The total expense for the share option plan was $5.735 million (2014: $8.150 million).