Annual Report 2015

141

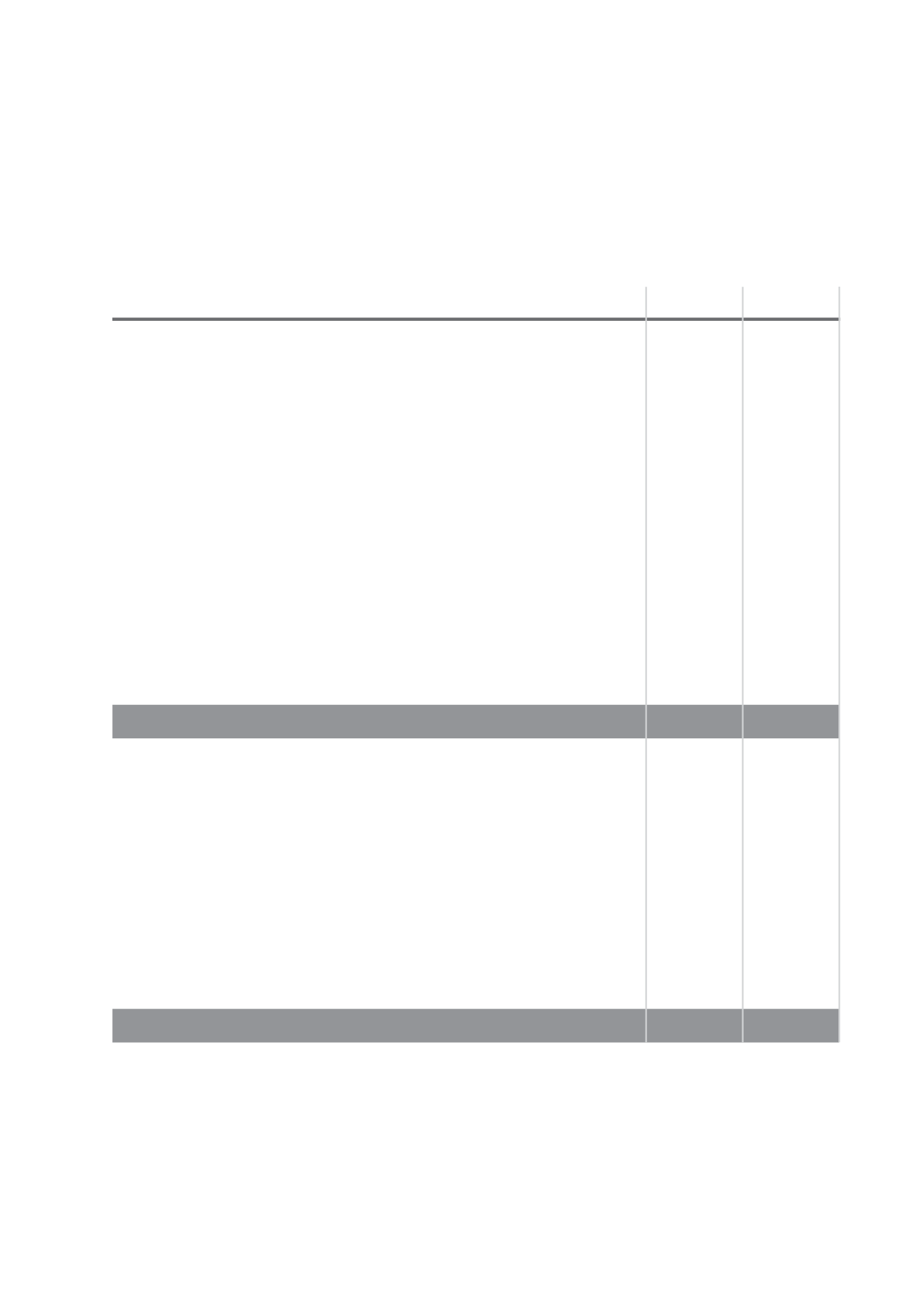

26 MATURITY ANALYSIS OF ASSETS AND LIABILITIES

(continued)

Within

After

one year

one year

Total

2014

ASSETS

Cash and cash equivalents

565,225

–

565,225

Statutory deposits with Central Banks

4,834,456

–

4,834,456

Due from banks

8,345,146

–

8,345,146

Treasury Bills

5,905,053

–

5,905,053

Investment interest receivable

72,136

–

72,136

Advances

6,994,689

20,100,718

27,095,407

Investment securities

1,933,185

6,327,197

8,260,382

Investment in associated companies

–

345,942

345,942

Premises and equipment

–

1,573,503

1,573,503

Goodwill

–

300,971

300,971

Net pension asset

–

1,299,725

1,299,725

Deferred tax assets

–

184,154

184,154

Taxation recoverable

20,250

29,357

49,607

Other assets

528,982

10,827

539,809

29,199,122

30,172,394

59,371,516

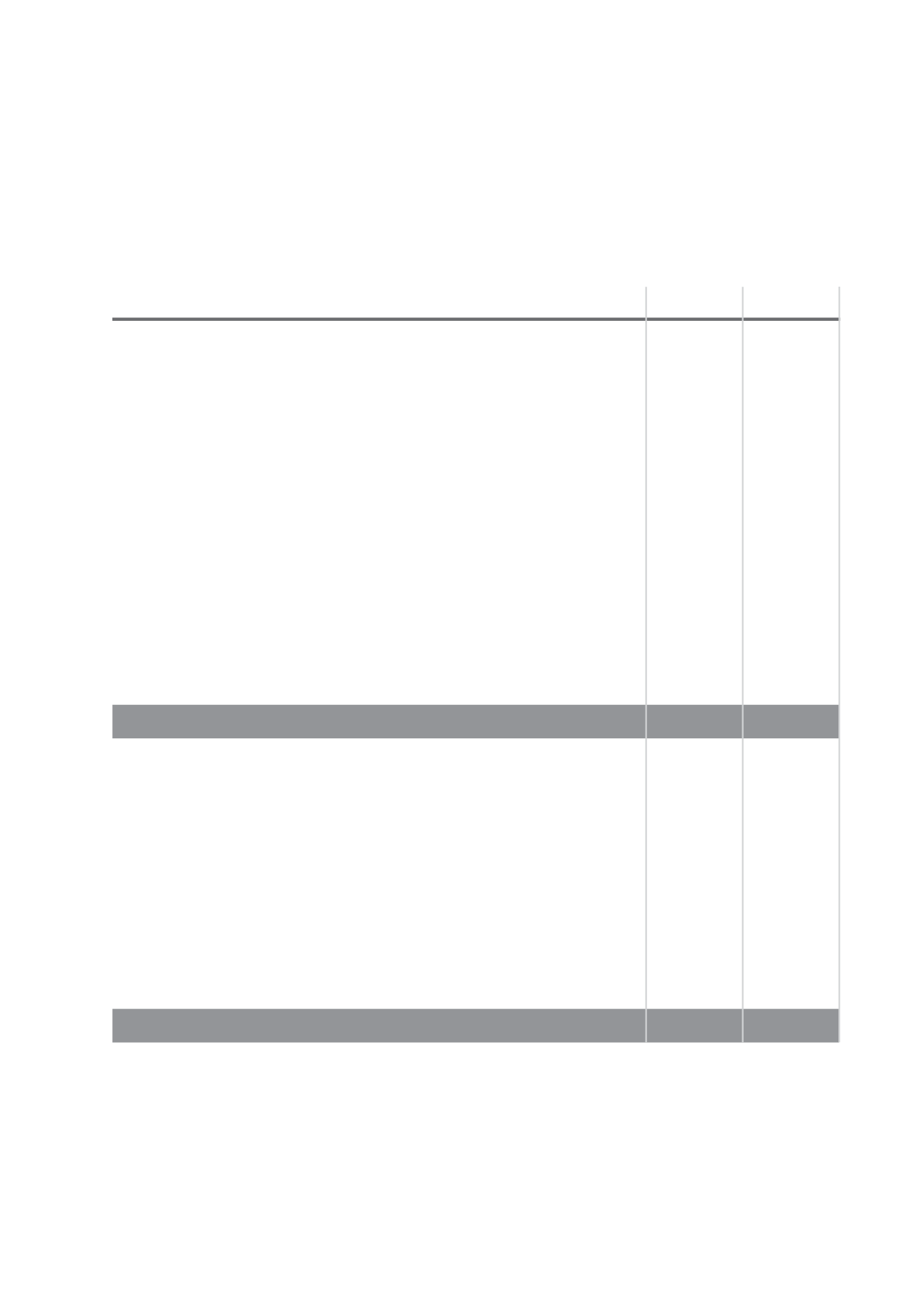

LIABILITIES

Due to banks

69,957

–

69,957

Customers’ current, savings and deposit accounts

43,761,209

9,551

43,770,760

Other fund raising instruments

3,026,007

331,826

3,357,833

Debt securities in issue

–

1,066,802

1,066,802

Net pension liability

–

57,275

57,275

Provision for post-retirement medical benefits

–

423,502

423,502

Taxation payable

73,043

–

73,043

Deferred tax liabilities

28,941

439,095

468,036

Accrued interest payable

40,413

178

40,591

Other liabilities

1,110,442

186,952

1,297,394

48,110,012

2,515,181

50,625,193