Annual Report 2015

131

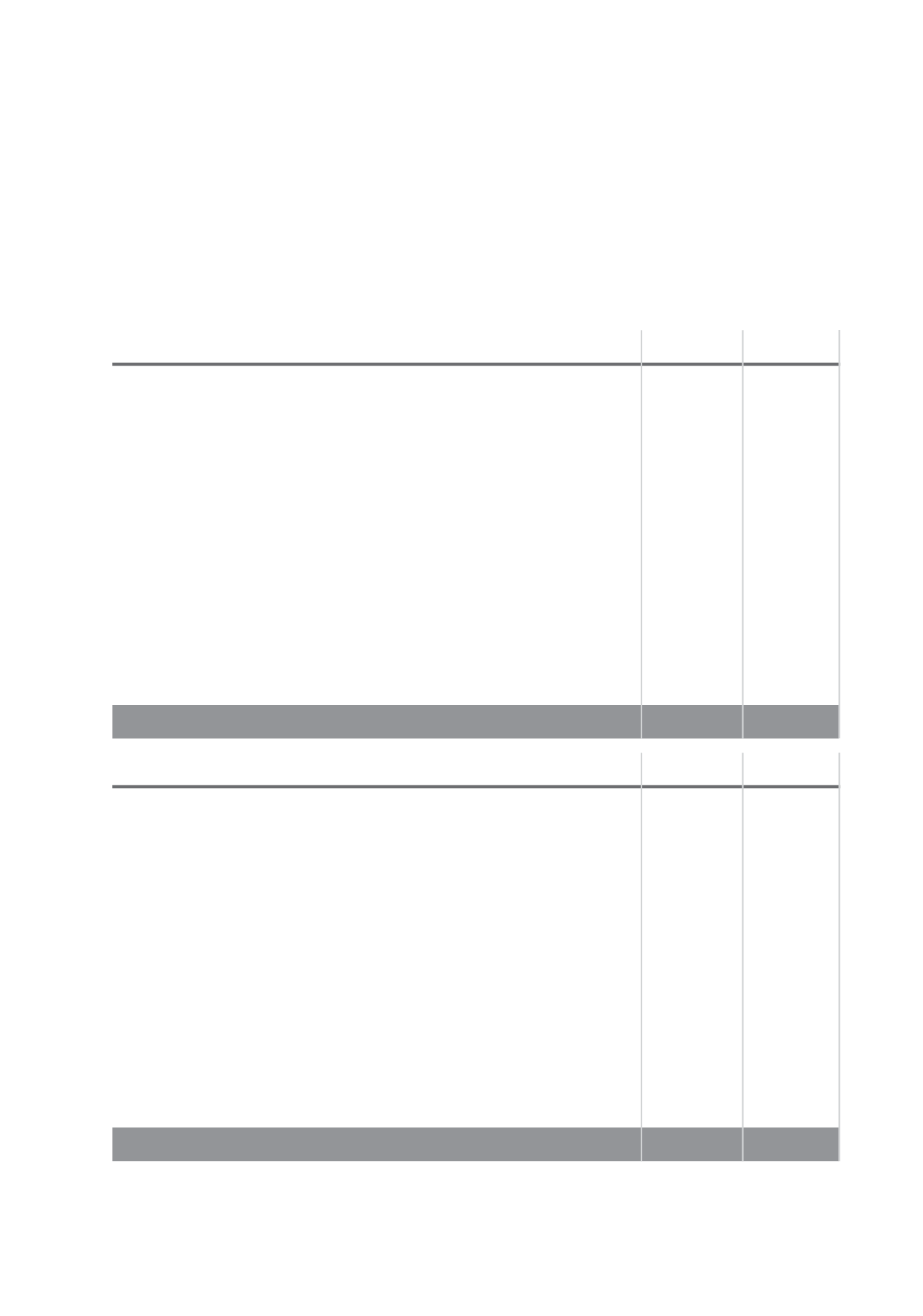

23 FAIR VALUE

23.1 Carrying values and fair values

The following table summarises the carrying amounts and the fair values of the Group’s financial assets and liabilities:

Carrying

Fair Unrecognised

value

value

gain/(loss)

2015

Financial assets

Cash, due from banks and Treasury Bills

14,635,642

14,635,642

–

Investment interest receivable

74,400

74,400

–

Advances

33,007,998

32,806,167

(201,831)

Investment securities

8,094,392

8,094,392

–

Other financial assets

309,357

309,357

–

Financial liabilities

–

Customers’ current, savings and deposit accounts

49,711,582

49,729,973

(18,391)

Borrowings and other fund raising instruments

3,140,704

3,140,704

–

Debt securities in issue

1,192,952

1,292,125

(99,173)

Accrued interest payable

68,591

68,591

–

Other financial liabilities

1,148,978

1,148,978

–

Total unrecognised change in unrealised fair value

(319,395)

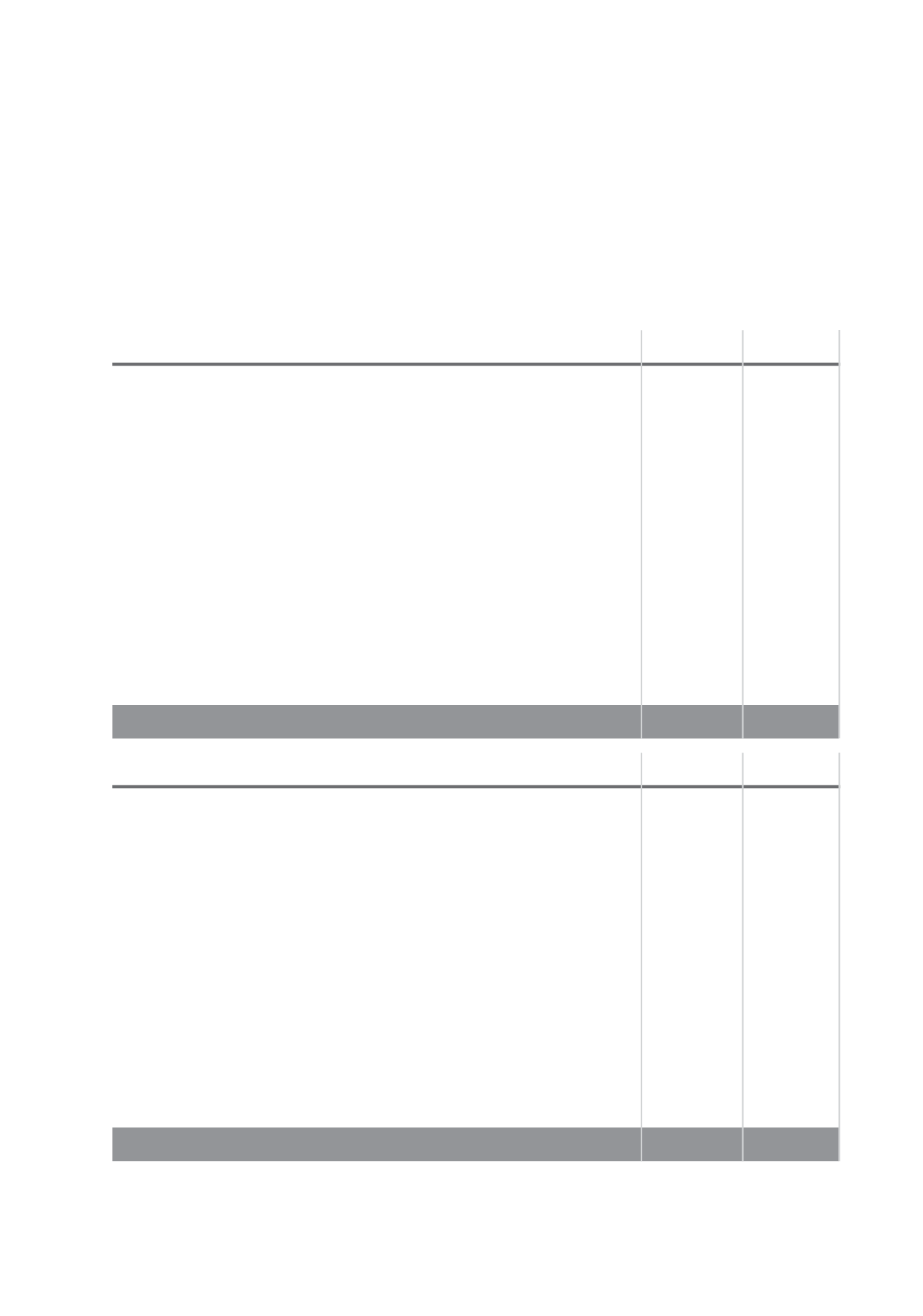

Carrying

Fair Unrecognised

value

value

gain/(loss)

2014

Financial assets

Cash, due from banks and Treasury Bills

14,815,424

14,815,424

–

Investment interest receivable

72,136

72,136

–

Advances

27,095,407

27,258,579

163,172

Investment securities

8,260,382

8,260,382

–

Other financial assets

276,213

276,213

–

Financial liabilities

Customers’ current, savings and deposit accounts

43,770,760

43,774,832

(4,072)

Borrowings and other fund raising instruments

3,427,790

3,427,790

–

Debt securities in issue

1,066,802

1,244,434

(177,631)

Accrued interest payable

40,591

40,591

–

Other financial liabilities

1,083,307

1,083,307

–

Total unrecognised change in unrealised fair value

(18,531)