Republic Bank Limited

124

For the year ended September 30, 2015. Expressed in thousands of Trinidad and Tobago dollars ($’000) except where otherwise stated

Notes to theConsolidatedFinancial Statements

4

Financial

21 RISK MANAGEMENT

(continued)

21.2 Credit risk

(continued)

21.2.3 Credit quality per category of financial assets

(continued)

Financial investment securities

(continued)

Acceptable:

Corporate securities that are current and being serviced in accordance with the terms and conditions of

the underlying agreements. Issuing company has fair financial strength and reputation.

Sub-

standard:

These securities are either greater than 90 days in arrears, display indicators of impairment, or have

been restructured during the financial year.

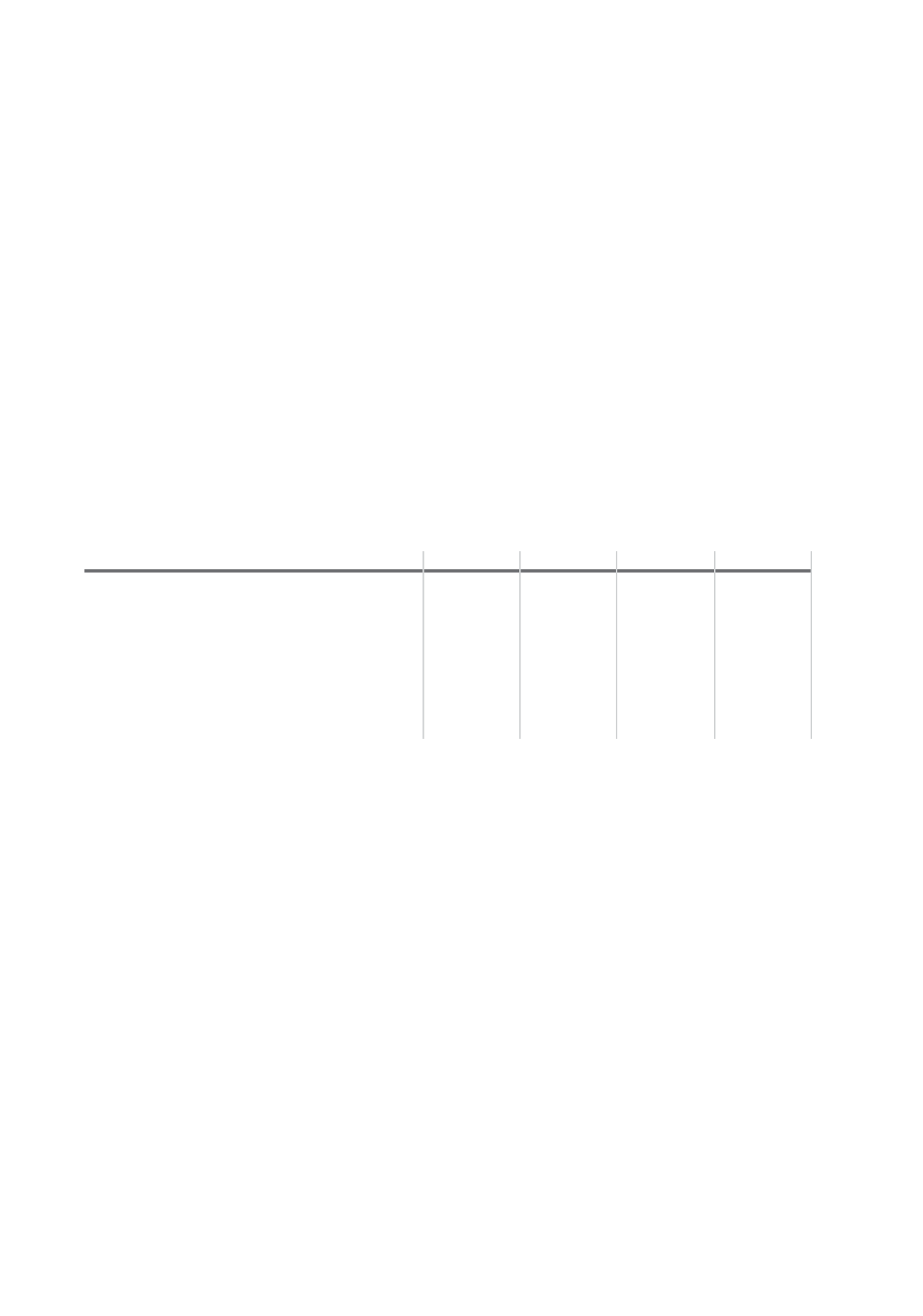

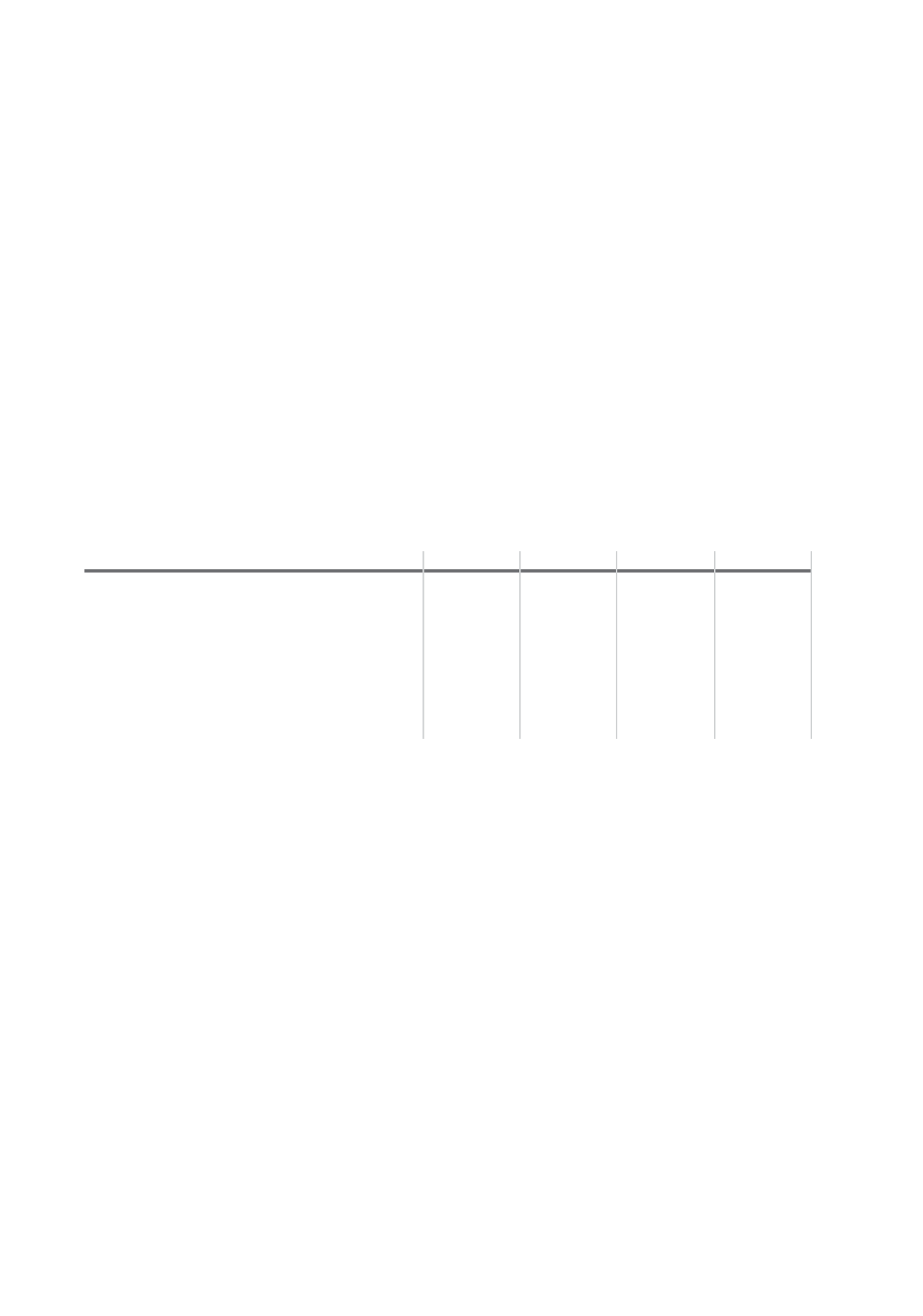

The table below illustrates the credit quality of debt security investments as at September 30:

Superior

Desirable

Acceptable Sub-standard

Total

Available-for-sale

2015

6,655,944

728,260

461,518

35,427

7,881,149

2014

5,530,809

1,801,968

707,033

163,460

8,203,270

Held to Maturity

2015

–

122,491

–

–

122,491

21.3 Liquidity risk

Liquidity risk is defined as the risk that the Group either does not have sufficient financial resources available to meet all its

obligations and commitments as they fall due, or can access these only at excessive cost.

Liquidity management is therefore primarily designed to ensure that funding requirements can be met, including the replacement

of existing funds as they mature or are withdrawn, or to satisfy the demands of customers for additional borrowings. Liquidity

management focuses on ensuring the Group has sufficient funds to meet all of its obligations.

Three primary sources of funds are used to provide liquidity – retail deposits, wholesale deposits and the capital market. A

substantial portion of the Group is funded with ‘core deposits’. The Group maintains a core base of retail and wholesale funds,

which can be drawn on to meet ongoing liquidity needs. The capital markets are accessed for medium to long-term funds as

required, providing diverse funding sources to the Group. Facilities are also established with correspondent banks, which can

provide additional liquidity as conditions demand.

The Asset/Liability Committee (ALCO) sets targets for daily float, allowable liquid assets and funding diversification in line with

system liquidity trends. While the primary asset used for short-term liquidity management is the Treasury Bill, the Group also

holds significant investments in other Government securities, which can be used for liquidity support. The Group continually

balances the need for short-term assets, which have lower yields, with the need for higher asset returns.