Annual Report 2015

127

21 RISK MANAGEMENT

(continued)

21.4 Market risk

(continued)

21.4.1 Interest rate risk

(continued)

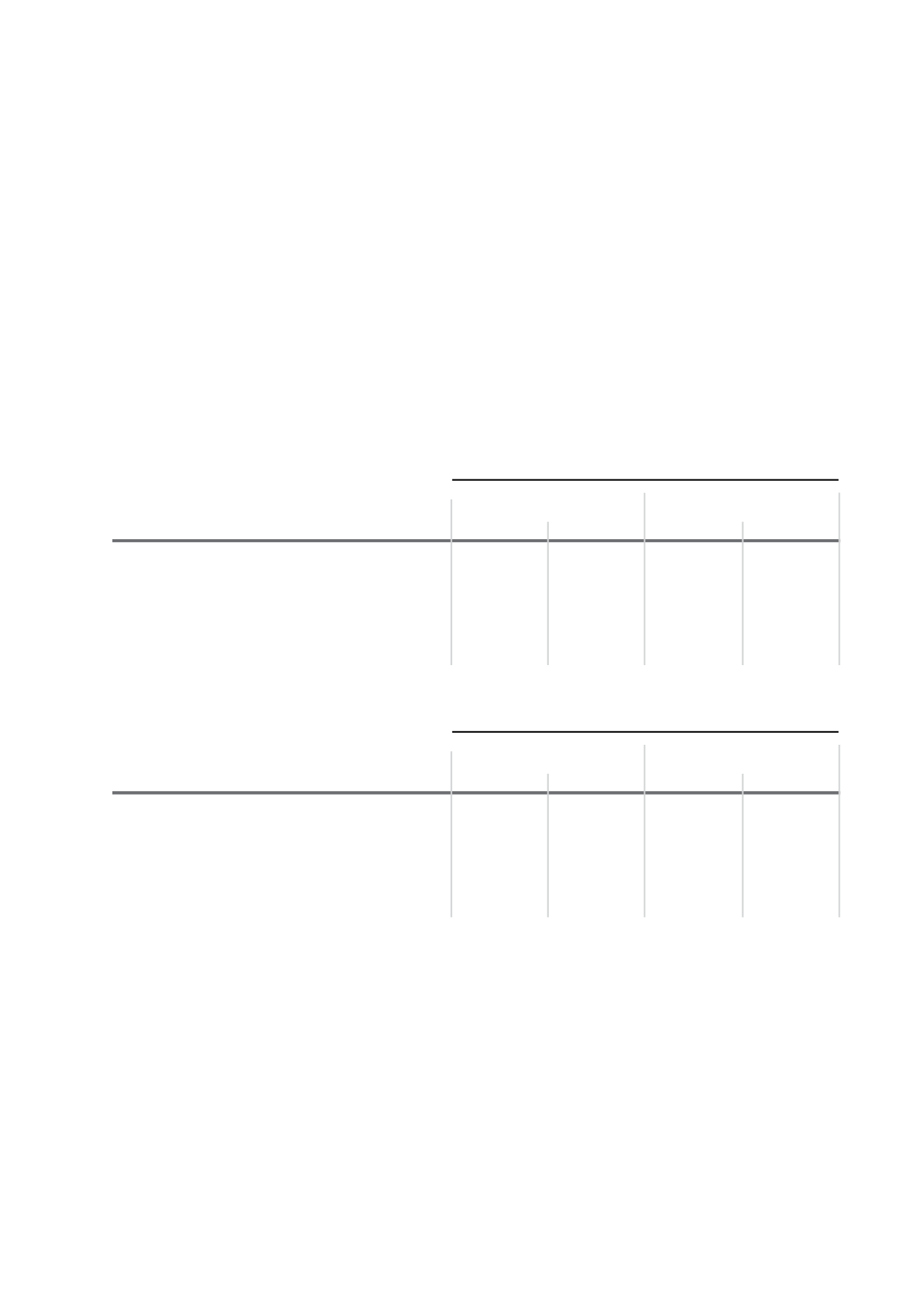

An interest rate sensitivity analysis was performed to determine the impact on net profit and equity of a reasonable

possible change in the interest rates prevailing as at September 30, with all other variables held constant. The impact

on net profit is the effect of changes in interest rates on the floating interest rates of financial assets and liabilities. The

impact on net unrealised gains is the effect of changes in interest rates on the fair value of available-for-sale financial

assets. This impact is illustrated on the following table:

Impact on net profit

2015

2014

Change in

basis points

Increase

Decrease

Increase

Decrease

TT$ Instruments

+/- 50

40,742

(40,742)

40,375

(40,375)

US$ Instruments

+/- 50

12,135

(12,135)

12,699

(12,699)

BDS$ Instruments

+/- 50

7,349

(7,349)

7,896

(7,896)

GHS Instruments

+/- 300

371

(371)

–

–

Other Currency Instruments

+/- 50

277

(277)

326

(326)

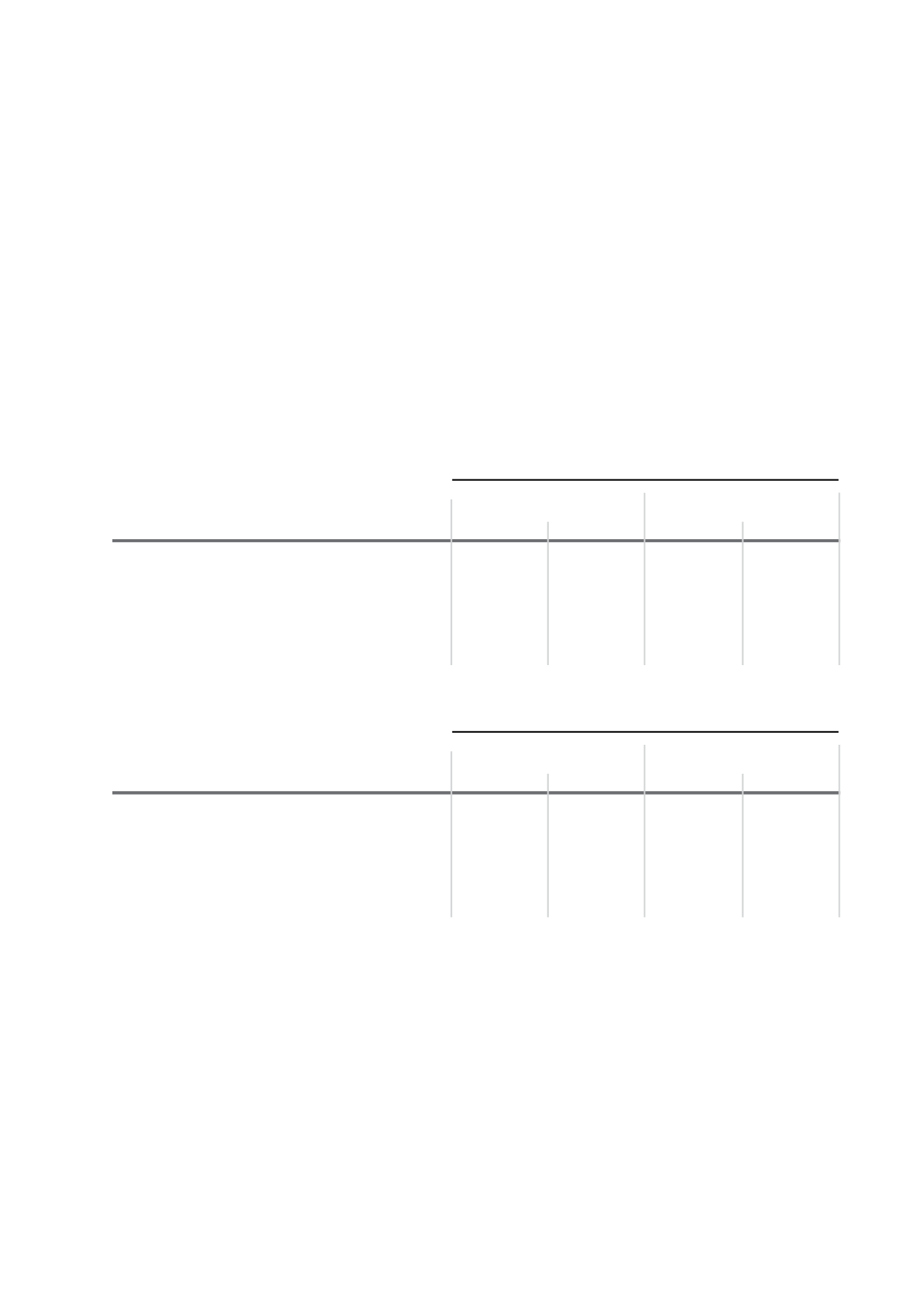

Impact on equity

2015

2014

Change in

basis points

Increase

Decrease

Increase

Decrease

TT$ Instruments

+/- 50

(42,211)

43,233

(45,251)

46,709

US$ Instruments

+/- 50

(43,270)

37,833

(54,543)

52,783

EC$ Instruments

+/- 25

(78)

78

(77)

78

BDS$ Instruments

+/- 50

(8,106)

8,419

(9,689)

10,096

Other Currency Instruments

+/- 50

(180)

239

(820)

514

21.4.2 Currency risk

Currency risk is the risk that the value of a financial instrument will fluctuate due to changes in foreign exchange rates.

The Group’s exposure to the effects of fluctuations in foreign currency exchange rates arises mainly from its investments

and overseas subsidiaries and associates. The Group’s policy is to match the initial net foreign currency investment with

funding in the same currency. The Group also monitors its foreign currency position for both overnight and intra-day

transactions.

Changes in foreign exchange rates affect the Group’s earnings and equity through differences on the re-translation

of the net assets and related funding of overseas subsidiaries and associates, from the respective local currency to TT

dollars. Gains or losses on foreign currency investment in subsidiary and associated undertakings are recognised in

reserves. Gains or losses on related foreign currency funding are recognised in the consolidated statement of income.