Republic Bank Limited

126

For the year ended September 30, 2015. Expressed in thousands of Trinidad and Tobago dollars ($’000) except where otherwise stated

Notes to theConsolidatedFinancial Statements

4

Financial

21 RISK MANAGEMENT

(continued)

21.3 Liquidity risk

(continued)

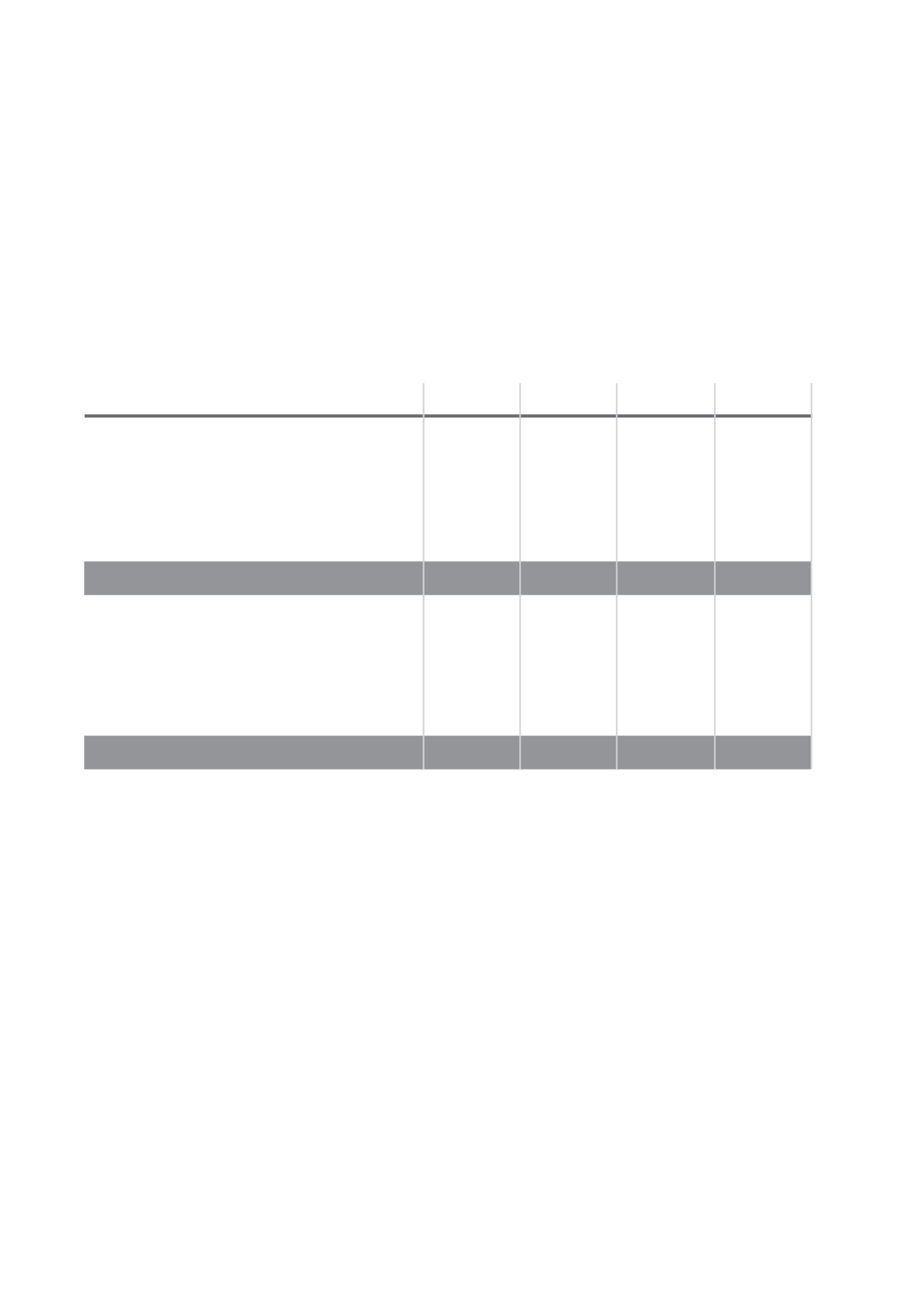

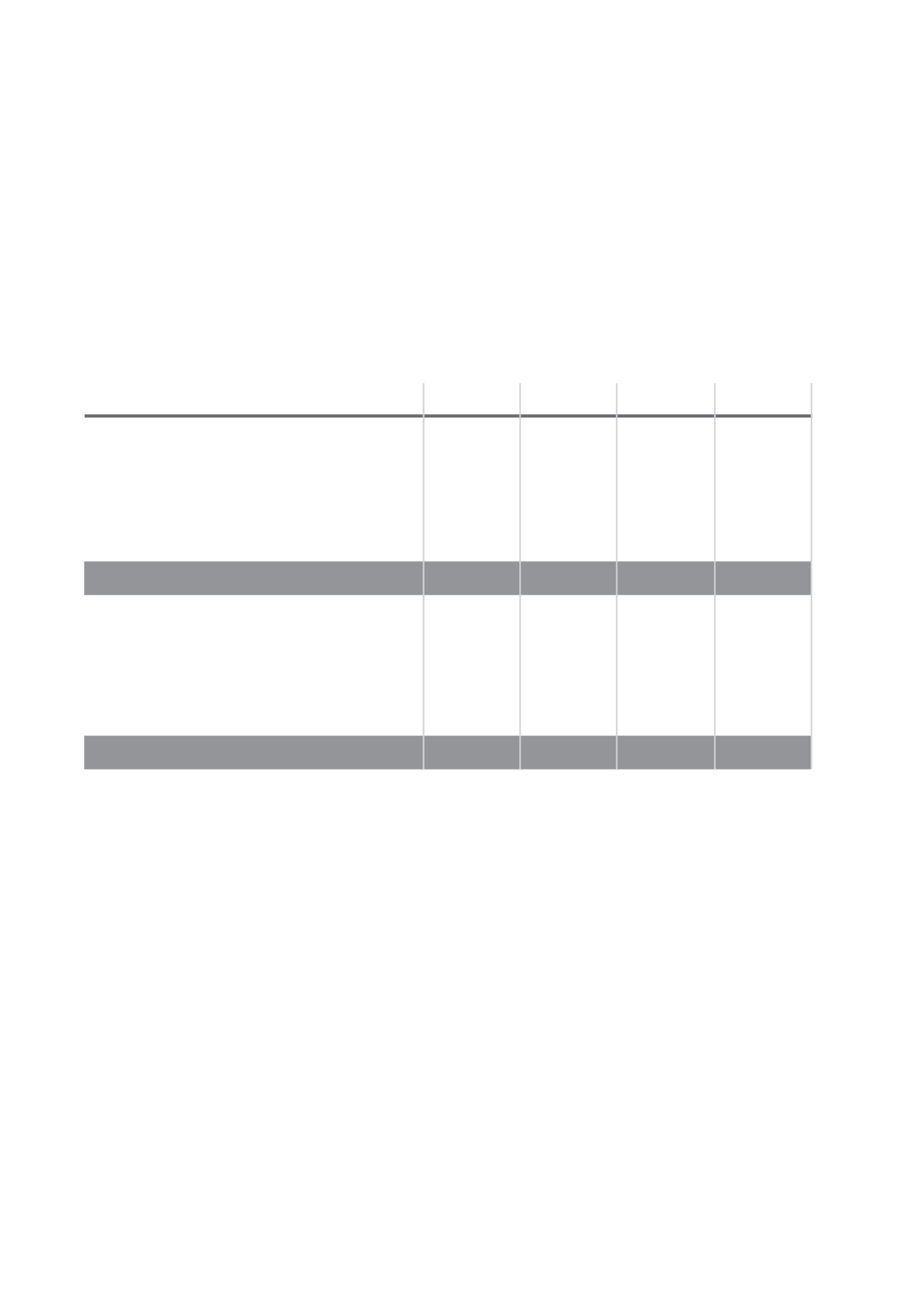

21.3.1 Analysis of financial liabilities by remaining contractual maturities

(continued)

Financial liabilities - off statement of financial position

On

Up to one

1 to 5

Over 5

demand

year

years

years

Total

2015

Acceptances

391,149

389,352

327,499

666

1,108,666

Guarantees and

indemnities

8,222

227,053

35,313

30,573

301,161

Letters of credit

85,533

223,577

–

–

309,110

Total

484,904

839,982

362,812

31,239

1,718,937

2014

Acceptances

283,600

241,865

215,951

671

742,087

Guarantees and

indemnities

121

52,294

17,204

37,279

106,898

Letters of credit

54,433

63,283

–

–

117,716

Total

338,154

357,442

233,155

37,950

966,701

The Group expects that not all of the contingent liabilities or commitments will be drawn before expiry of the

commitments.

21.4 Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to changes in market

variables such as interest rates, foreign exchange rates and equity prices.

21.4.1 Interest rate risk

Interest rate risk arises from the possibility that changes in interest rates will affect future cash flows or the fair values

of financial instruments. The Group has an Asset/Liability Committee which reviews on a monthly basis the non-credit

and non-operational risk for the Parent and each subsidiary. Asset and Liability management is a vital part of the risk

management process of the Group. The mandate of the Committee is to approve strategies for the management of

the non-credit risks of the Group, including interest rate, foreign exchange, liquidity and market risks.

The primary tools currently in use are gap analysis, interest rate sensitivity analysis and exposure limits for financial

instruments. The limits are defined in terms of amount, term, issuer, depositor and country. The Group is committed to

refining and defining these tools to be in line with international best practice.

The table below summarises the interest-rate exposure of the Group’s statement of financial position. Interest on

financial instruments classified as floating is repriced at intervals of less than one year while interest on financial

instruments classified as fixed is fixed until the maturity of the instrument.