Annual Report 2015

121

21 RISK MANAGEMENT

(continued)

21.2 Credit risk

(continued)

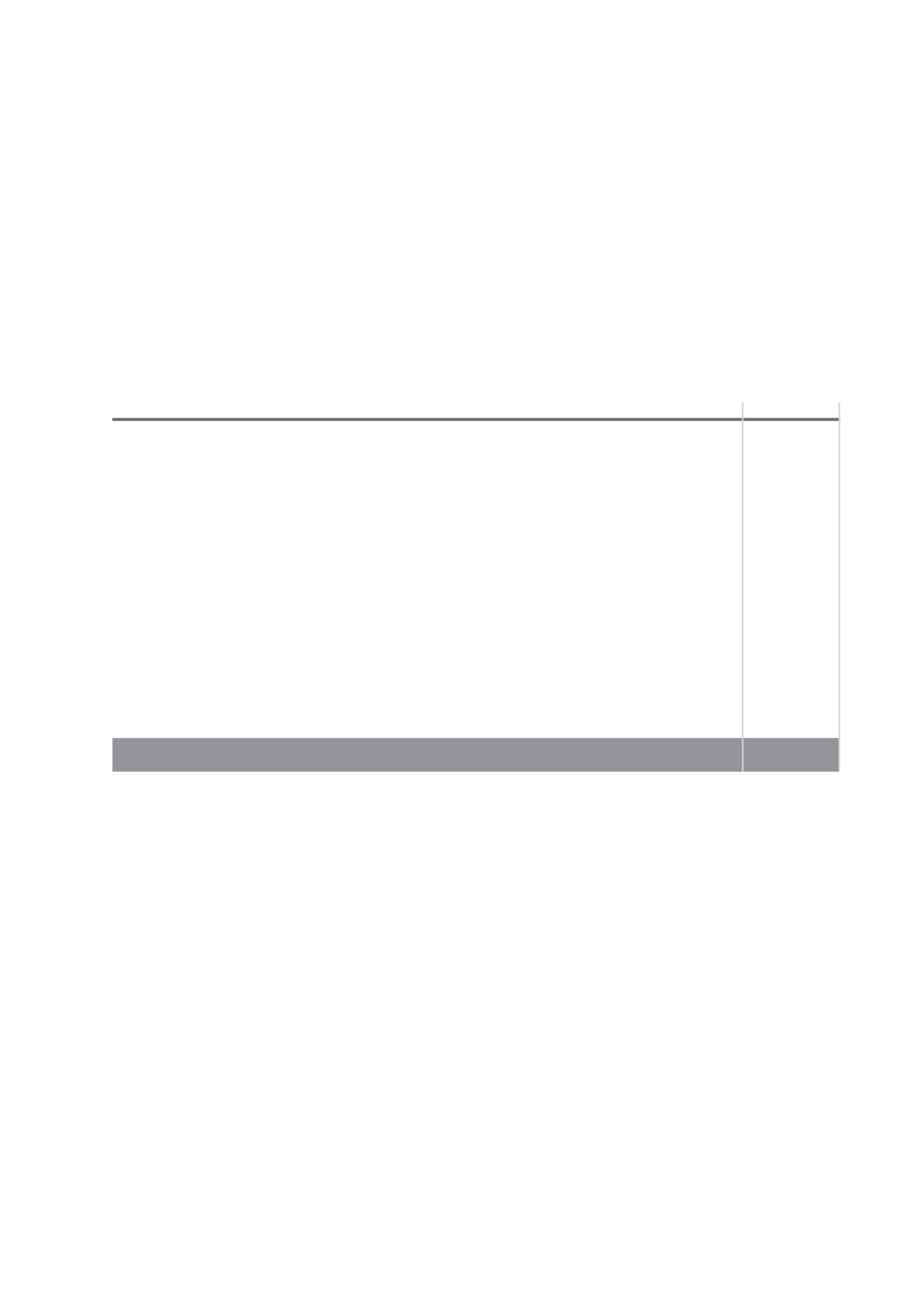

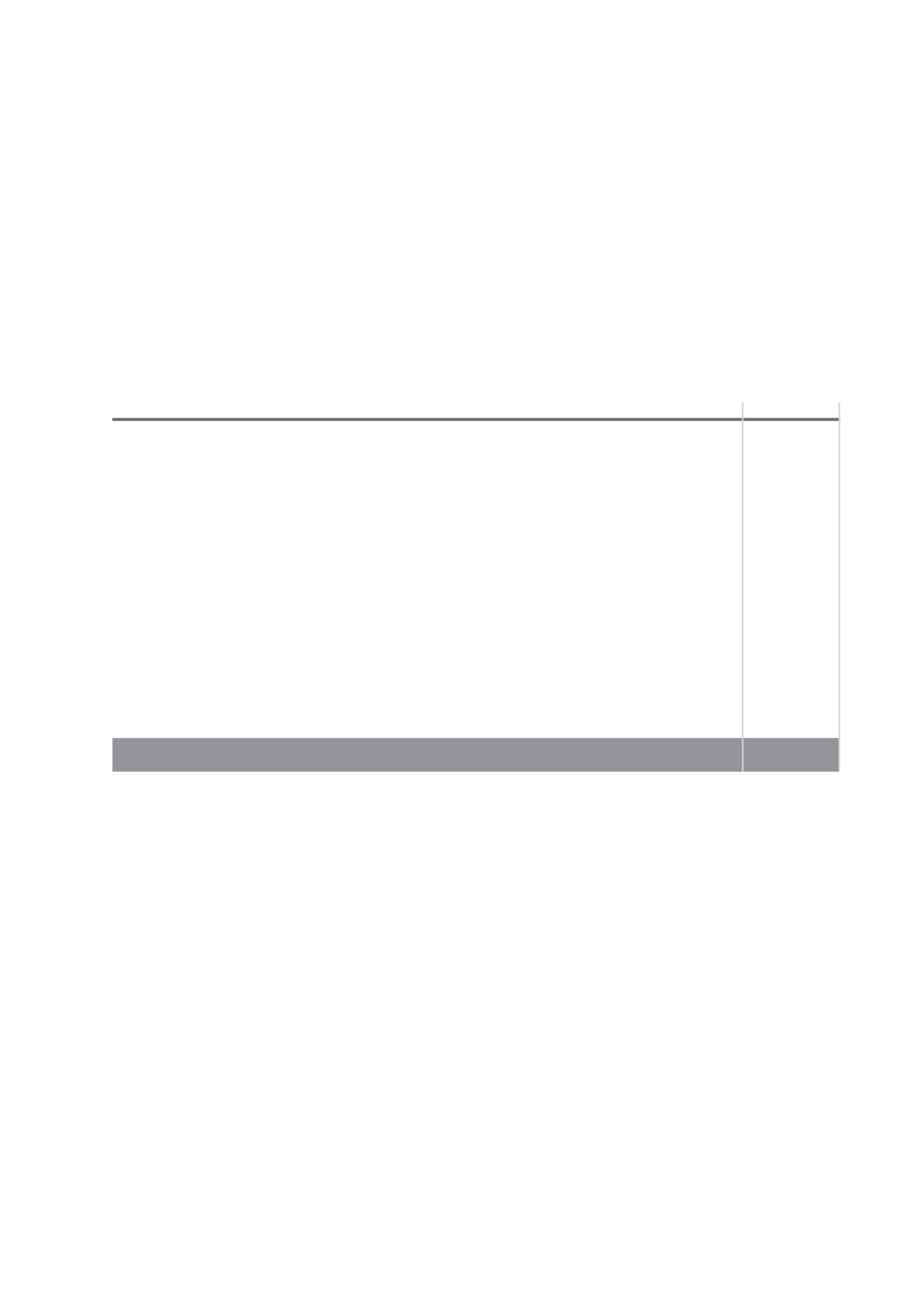

21.2.2 Risk concentrations of the maximum exposure to credit risk

(continued)

b)

Industry sectors

The following table breaks down the Group’s maximum credit exposure as categorised by the industry sectors of

its counterparties:

2015

2014

Government and Central Government Bodies

21,031,567

18,062,055

Financial sector

9,161,190

9,959,108

Energy and mining

1,640,811

485,363

Agriculture

296,051

288,360

Electricity and water

433,797

438,235

Transport, storage and communication

673,403

496,898

Distribution

3,896,355

3,420,787

Real estate

3,706,672

2,916,169

Manufacturing

1,973,901

1,961,724

Construction

1,971,464

1,942,023

Hotel and restaurant

1,392,342

1,125,375

Personal

15,145,163

13,923,841

Other services

5,953,323

5,099,603

67,276,039

60,119,541

Credit exposure with state-owned bodies have been categorised according to the service offered by the

organisation rather than within ‘Government and Central Government Bodies’.

21.2.3 Credit quality per category of financial assets

The Group has determined that credit risk exposure arises from the following consolidated statement of financial

position lines:

-

Treasury Bills and Statutory deposits with Central Banks

-

Balances due from banks

-

Advances

-

Financial investment securities

Treasury Bills and Statutory deposits with Central Banks

These funds are placed with Central Banks in the countries where the Group is engaged in the full range of banking

and financial activities and management therefore considers the risk of default to be very low. These financial assets

have therefore been rated as ‘Superior’.