Annual Report 2015

119

21 RISK MANAGEMENT

(continued)

21.2 Credit risk

(continued)

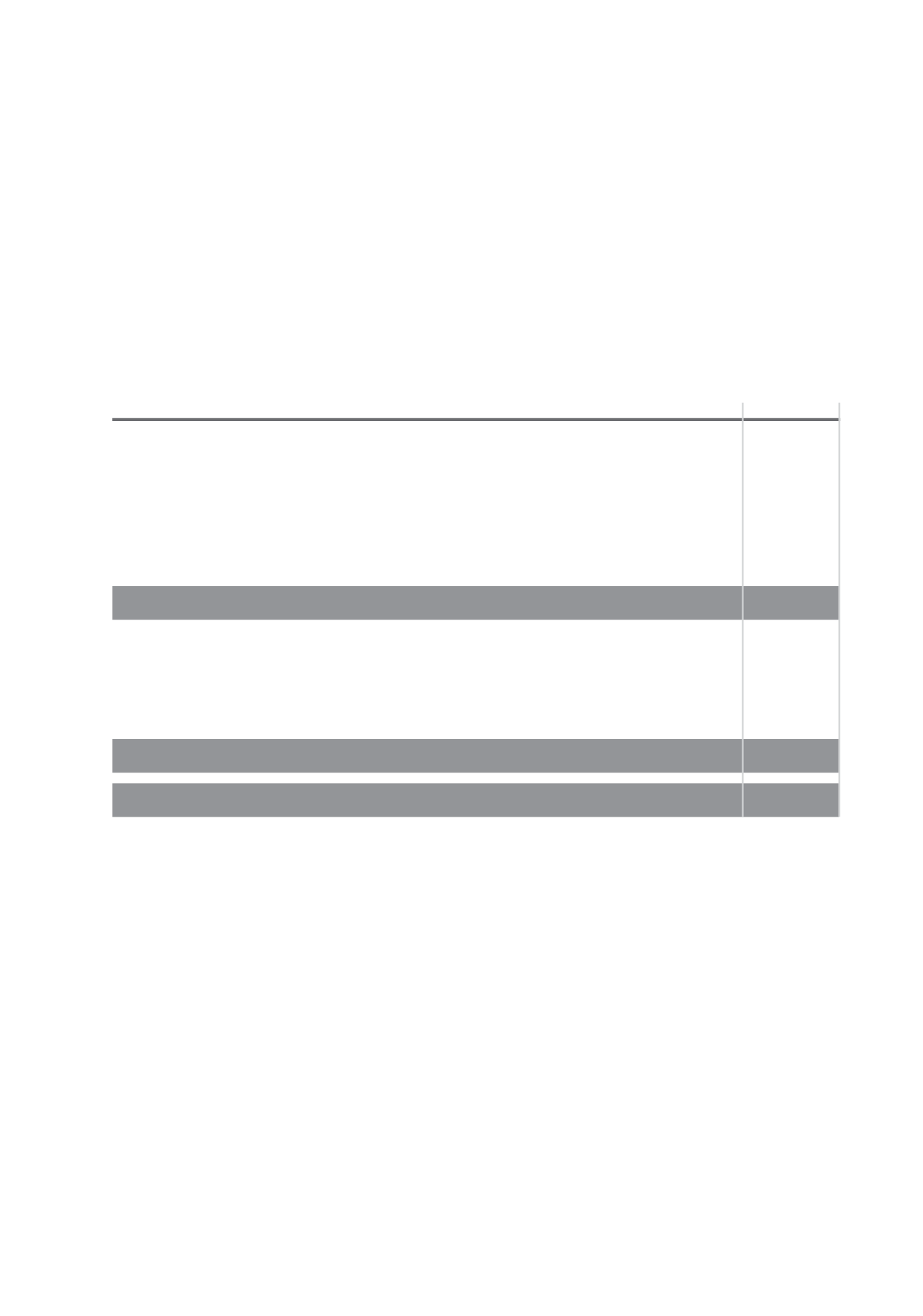

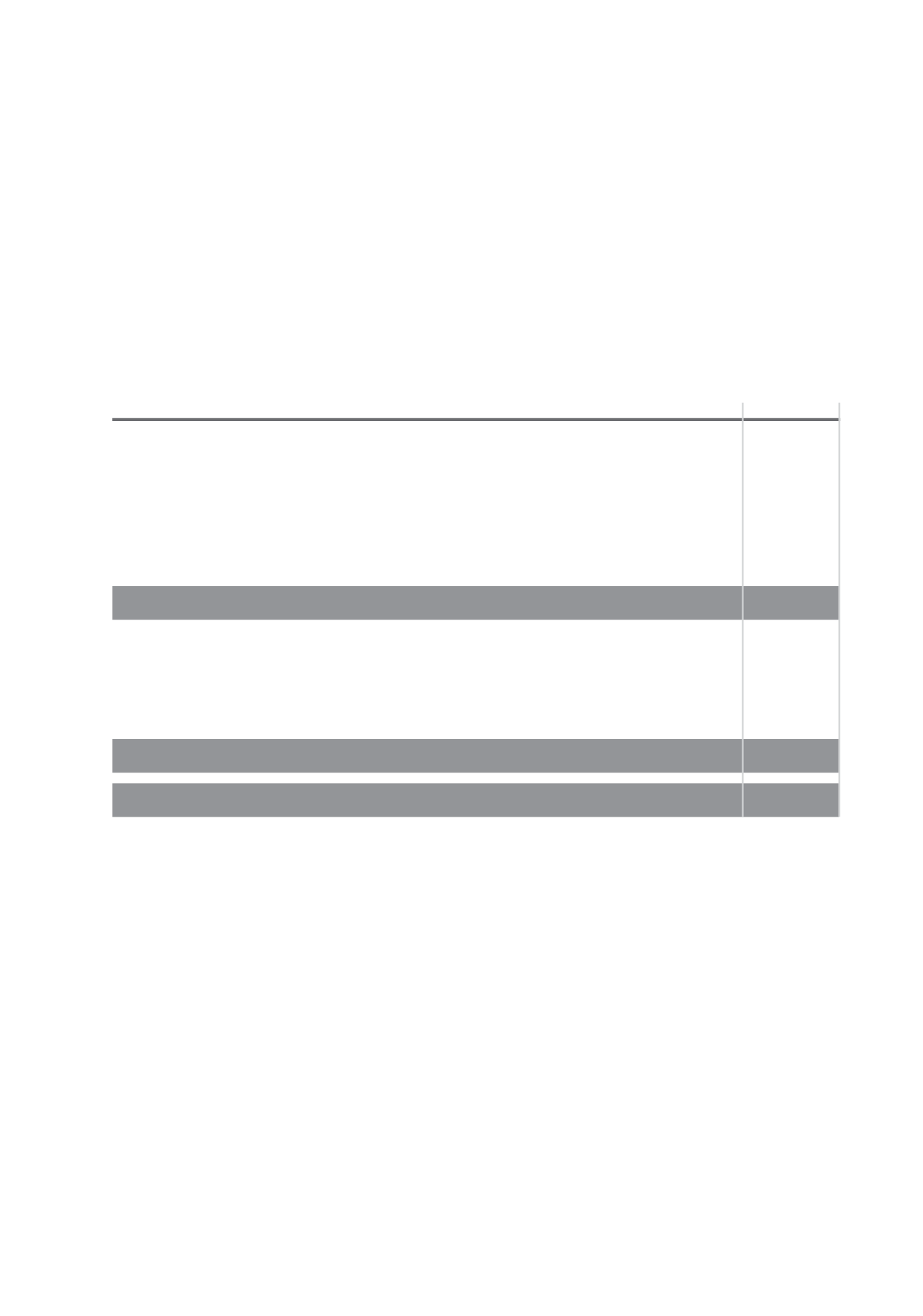

21.2.1 Maximum exposure to credit risk without taking account of any collateral and other credit enhancements

The table below shows the Group’s maximum exposure to credit risk:

Gross maximum exposure

2015

2014

Statutory deposits with Central Banks

5,627,292

4,834,456

Due from banks

7,542,995

8,345,146

Treasury Bills

6,162,162

5,905,053

Investment interest receivable

74,400

72,136

Advances

33,007,998

27,095,407

Investment securities

8,003,640

8,203,270

Total

60,418,487

54,455,468

Undrawn commitments

5,138,615

4,697,372

Acceptances

1,108,666

742,087

Guarantees and indemnities

301,161

106,898

Letters of credit

309,110

117,716

Total

6,857,552

5,664,073

Total credit risk exposure

67,276,039

60,119,541

Where financial instruments are recorded at fair value, the amounts shown represent the current credit risk exposure

but not the maximum risk exposure that could arise in the future as a result of changes in values.

Collateral and other credit enhancements

The Group maintains credit risk exposure within acceptable parameters through the use of collateral as a risk-mitigation

tool. The amount and type of collateral required depends on an assessment of the credit risk of the counterparty.

Guidelines are implemented regarding the acceptability of types of collateral and valuation parameters.

The main types of collateral obtained are cash or securities, charges over real estate properties, inventory and trade

receivables and mortgages over residential properties and chattels. The Group also obtains guarantees from parent

companies for loans to their subsidiaries.

Management monitors the market value of collateral, requests additional collateral in accordance with the underlying

agreement, and monitors the market value of collateral obtained during its review of the adequacy of the allowance for

impairment losses.