Annual Report 2015

29

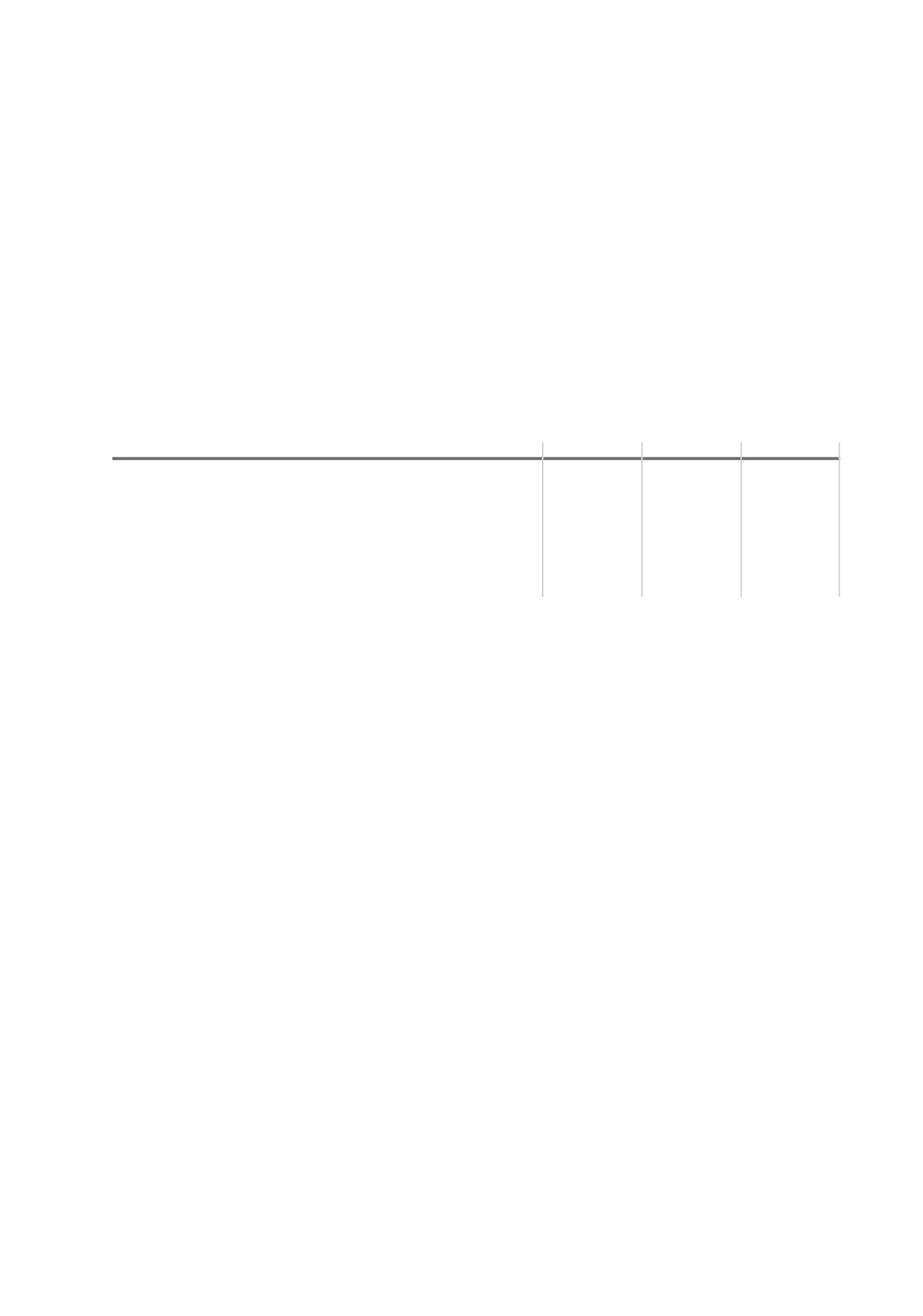

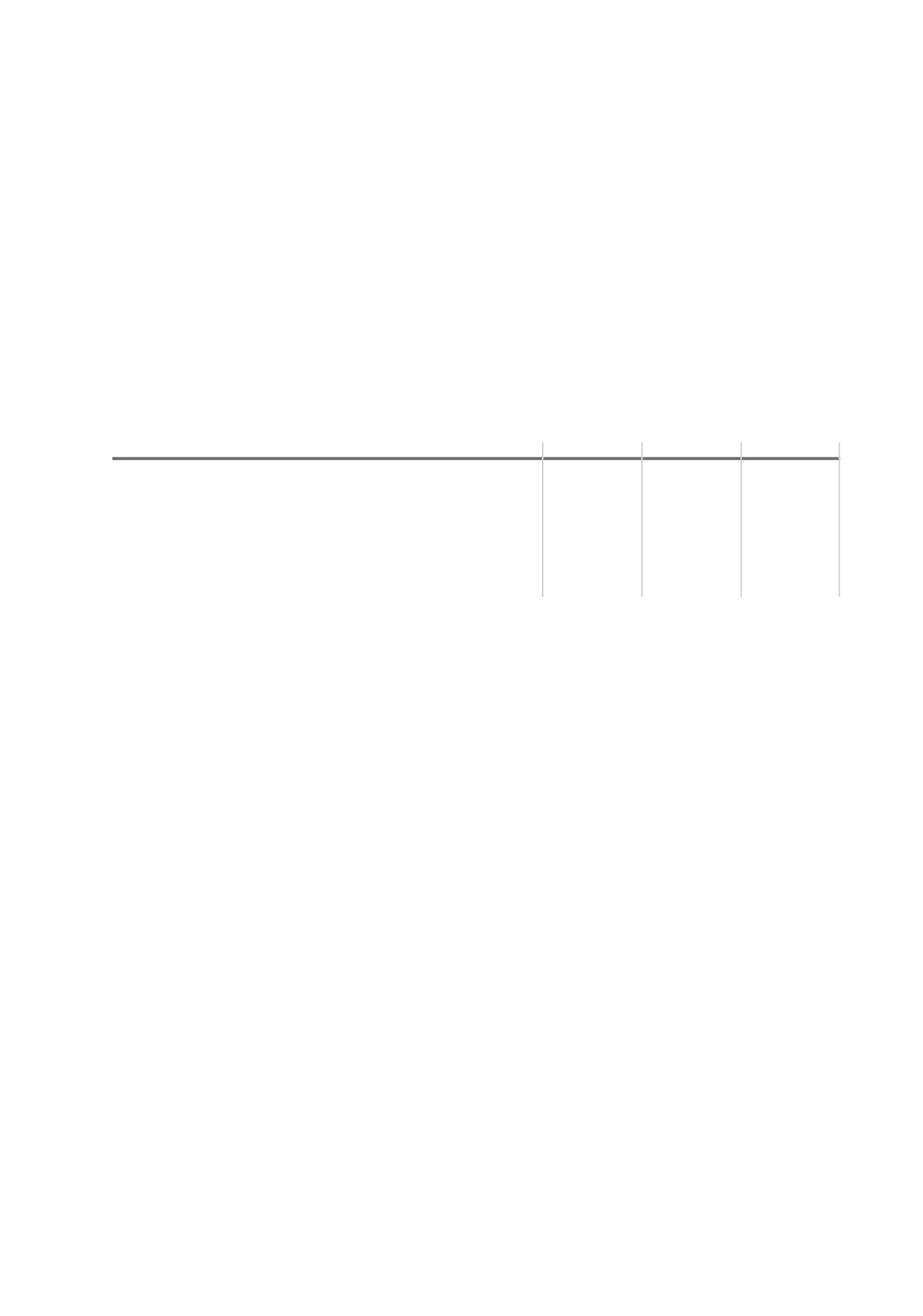

RESULTSOFOPERATIONS:HIGHLIGHTS

All figures are in TT$ Millions

2015

2014

Change

% Change

Financial Position

Total assets

65,992.2

59,371.5

6,620.7

11.2%

Total advances

33,008.0

27,095.4

5,912.6

21.8%

Total investments

8,094.4

8,260.4

(166.0)

-2.0%

Total deposits

49,495.7

43,770.8

5,724.9

13.1%

Total equity

9,410.6

8,746.3

664.3

7.6%

The following is a detailed discussion and analysis of the financial

results of Republic Bank Limited. This should be read in conjunction

with the audited financial statements, contained on pages 68 to

149 of this report. All amounts are stated in Trinidad and Tobago

dollars.

Financial Position

Total assets for the Group increased by $6.6 billion or 11.2%, from

$59.4 billion in 2014 to $66 billion at September 30, 2015. The

growth in assets was largely driven by an increase of $5.9 billion

or 21.8% in loans and advances, $3.1 billion of which originated

from our Trinidad and Tobago operations. Ghana and Suriname

contributed $1.4 billion to the growth as they are now being

consolidated into the Group’s results.

The Group’s deposit base grew by $5.7 billion or 13.1%, mainly

due to the addition of a $2.8 billion portfolio from Suriname and a

$1.2 billion portfolio from Ghana. Moderated liquidity in Trinidad

and Tobago resulted in lower growth in the deposits portfolio of $1

billion, compared to a $2.5 billion or 8% growth in 2014. With the

growth in loans, we were better able to deploy low earning liquid

assets into higher yielding loans. This led to a $2 billion decrease

in liquid assets in Trinidad and Tobago and a decline in the Group

liquid assets ratio to 30.7% in 2015, down from 33.1% in 2014.

Total investments fell by $166 million or 2%, from $8.3 billion in

2014 to $8.1 billion in 2015 as a result of scheduled repayments.

These amounts are now held in liquid assets due to the lack of

suitable medium to long-term investment opportunities.

Total equity increased by $664.3 million to $9.4 billion at September

30, 2015. This increased capital base will allow the Group to

continue with its acquisition strategy while maintaining sufficient

capital levels to fulfil impending increased capital regulations. At

September 30, 2015, the Group capital adequacy ratio is 24.73%.