Republic Bank Limited

30

ManagingDirector’sDiscussionandAnalysis

2

Executive

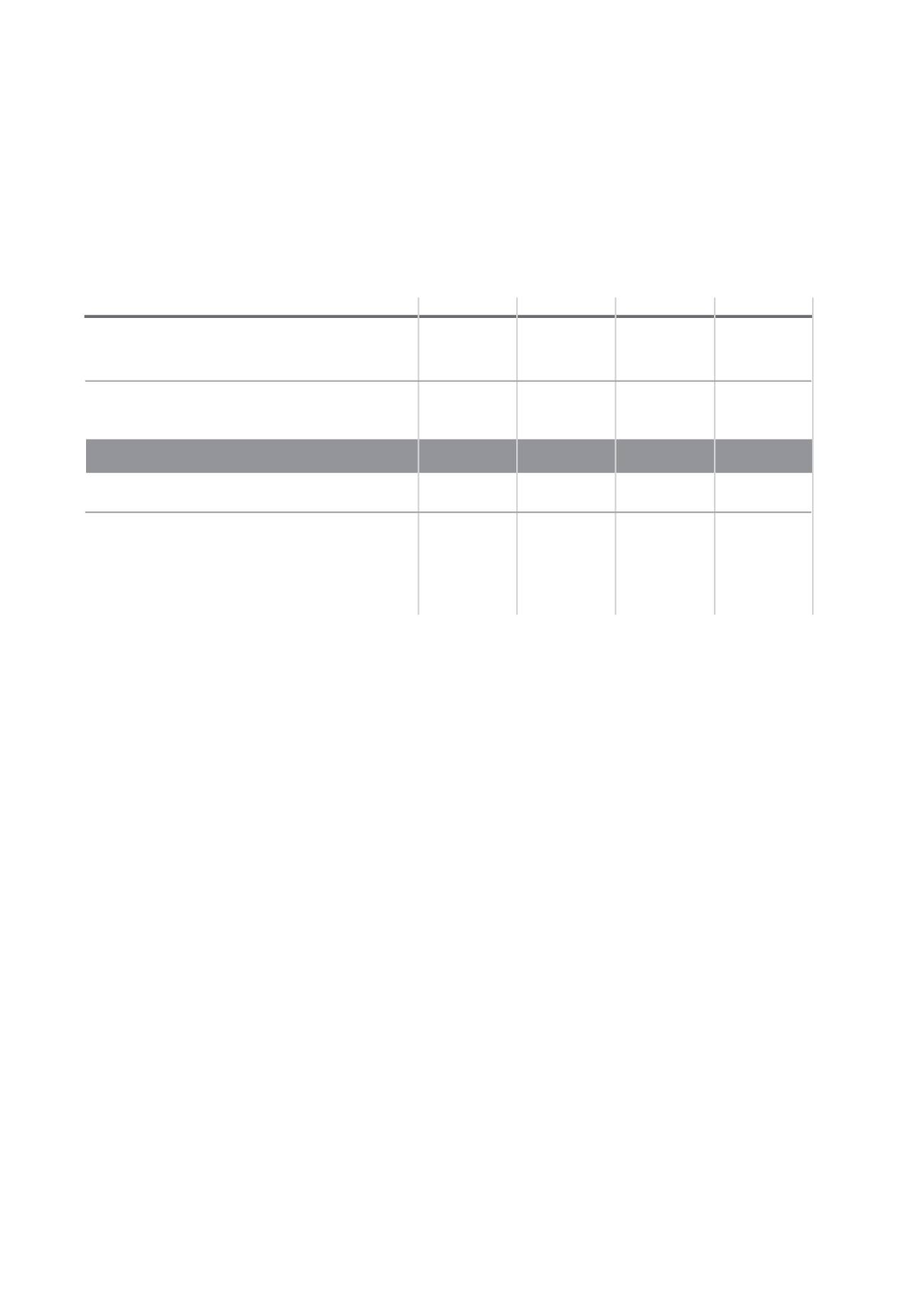

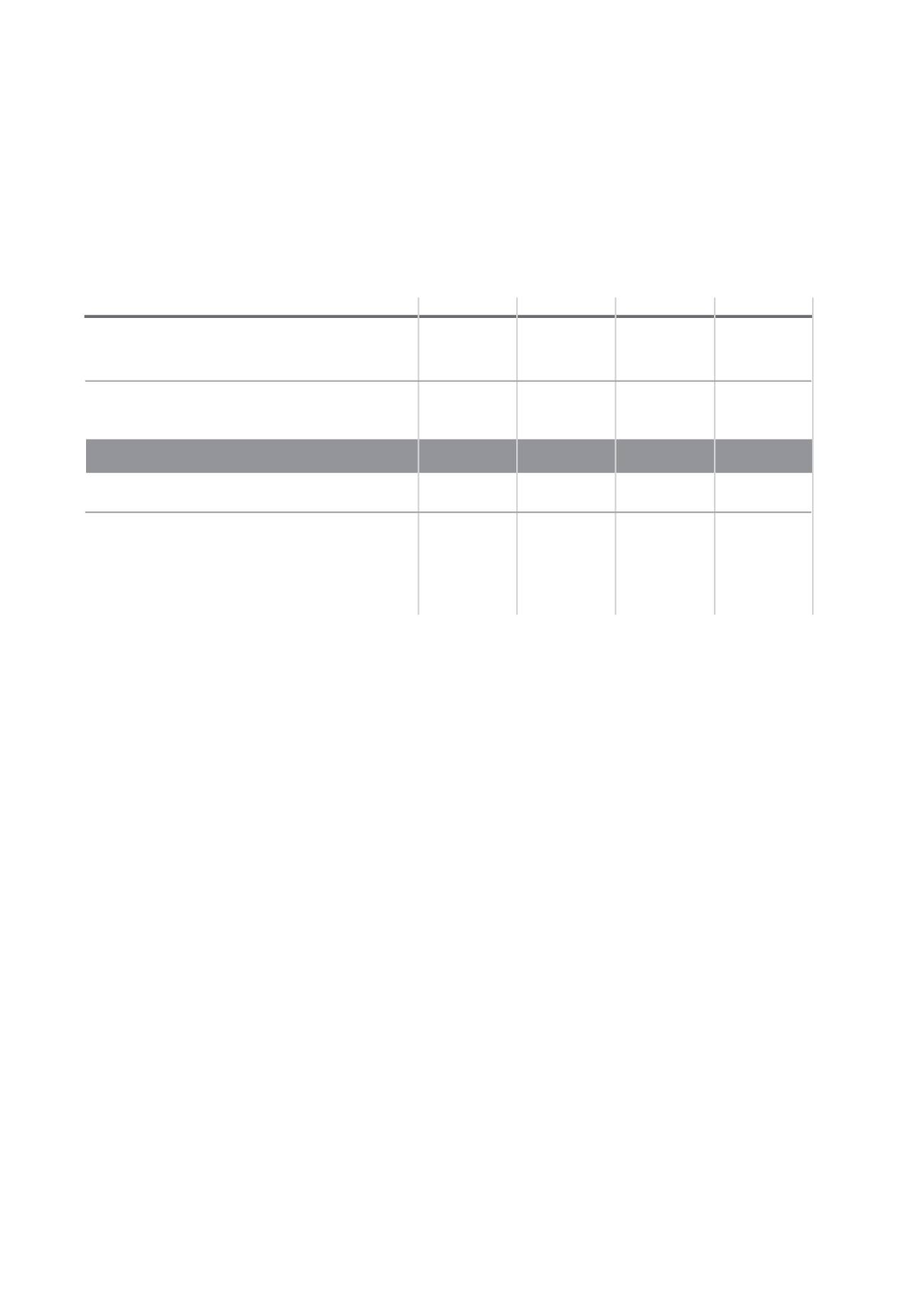

LoansandAdvances

All figures are in TT$ Millions

2011

2012

2013

2014

2015

Performing Loans

21,477

22,928

24,640

26,513

32,370

Non-performing Loans (NPL’s)

732

778

948

974

1,250

Gross loans

22,209

23,707

25,589

27,487

33,619

Loan Provision

(343)

(390)

(353)

(391)

(611)

Net Loans

21,866

23,317

25,236

27,095

33,008

Contingency Reserve

455

453

654

642

642

Non-performing Loans to Gross Loans

3.3%

3.3%

3.7%

3.5%

3.7%

Loan provision as a % of NPL’s

46.8%

50.0% 37.2%

40.2%

48.9%

Provision and Contingency Reserves

as a % of NPL’s

109.0% 108.2% 106.2% 106.1%

100.3%

TOTAL LIABILITIES

50,625,193

49,096,331

43,115,940

Loansandadvances

Through sound risk management practices, we were able to keep

the non-performing loans (NPL’s) to gross loans ratio at 3.7% at

September 30, 2015 – a slight increase of 20 basis points over the

3.5% recorded in 2014. This deterioration was primarily due to

our subsidiary in Ghana for which we increased the level of NPL’s

after acquisition to bring in line with the Group’s stricter policy for

recognition of NPL’s. Ghana’s NPL’s/ Gross loans stood at 14.3% at

September 30, 2015 – up from the 10.43% at December 31, 2014.

The Group’s loan provisions coverage ratio increased to 48.9%, up

from the 40.2% reported in 2014, reflecting the higher levels of

loan provisions being booked.

The Group seeks to achieve at least 100% provision for non-

performing loans through specific and inherent risk provisions,

which are booked through the statement of income and through

a general contingency reserve, which is booked directly through

equity. As at September 30, 2015, the combination of specific and

general provisions represents 100.3% of NPL’s, slightly above the

target of 100%.

IncomeStatement

The 2.5% growth in profits was driven by a $235 million or 10.6%

increase in net interest income, arising from a $5.9 billion or 21.8%

growth in the loan portfolio and the recovery of $123.4 million after

tax on a non-performing facility. This was offset by an increase in

operating expenses of $212.4 million and impairment expenses of

$108.8 million. The increase in operating expenses is attributable

mainly to the consolidation of HFC Bank (Ghana) Limited (HFC) and

Republic Bank (Suriname) N.V. which amounted to $89.4 million.

Impairment expenses of $52.1 million (net of minority interest)

was recorded by HFC to bring its loan provisions in line with Group

policy and $56.7 million was booked by Republic Bank (Cayman)

Limited relating to loans and goodwill impairment.

While profits grew by 2.5%, average assets grew at a faster rate

of 7.2%, resulting in a decline in the Return on Assets (ROA) from

2.10% in 2014 to 1.97% in 2015. Total assets of $5.5 billion were

added from the acquisition of subsidiaries in Ghana and Suriname,

but the full extent of the profitability of these entities is not reflected

in the Group’s results as they were done close to the end of the

fiscal.

Likewise, a 4.3% growth in average equity also outpaced growth

in profits, resulting in a decrease in the Return on Equity (ROE) from

14.33% in 2014 to 14.09% in 2015.