REPUBLIC BANK LIMITED

20

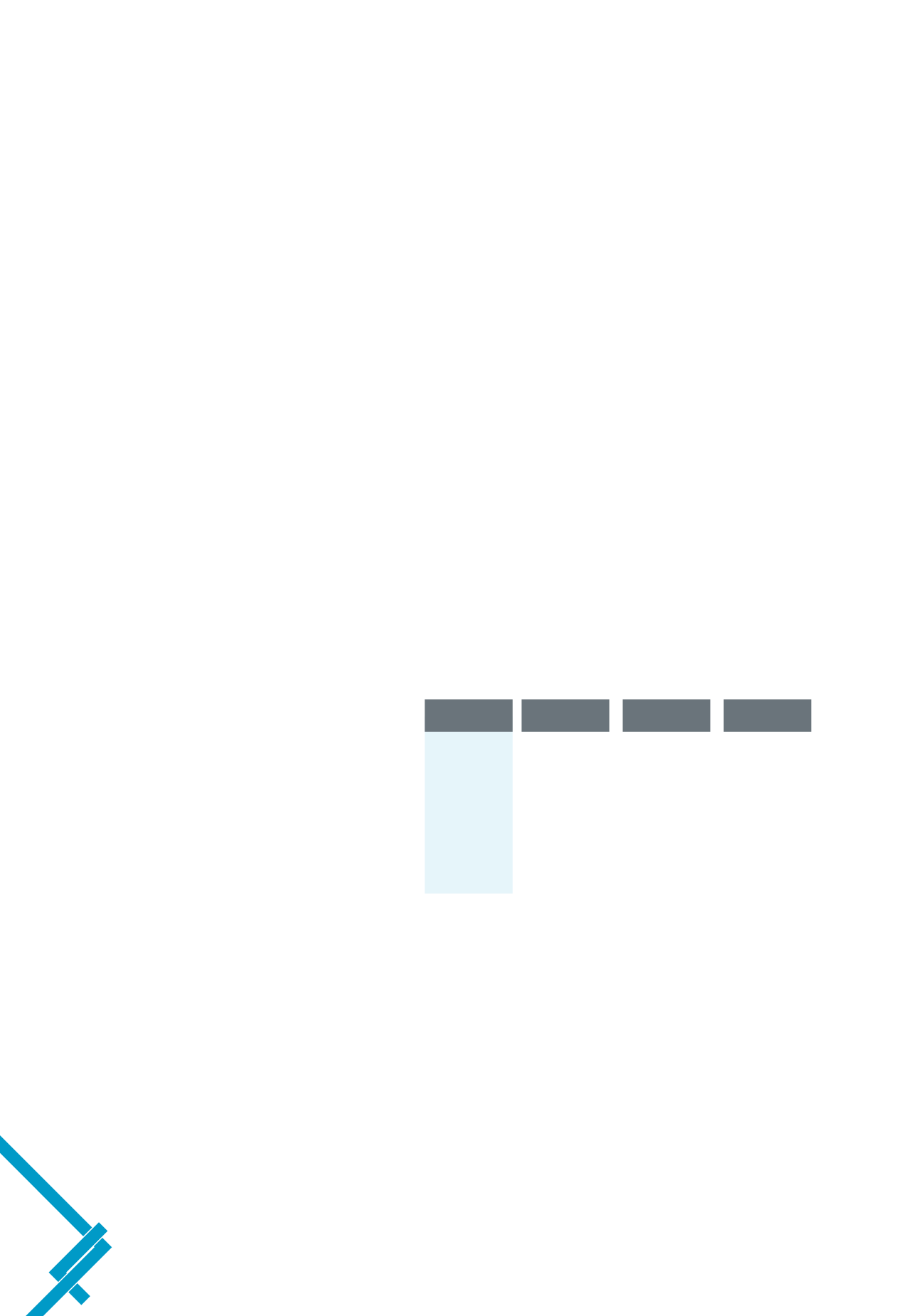

Resultsof Operations: Highlights

All figures are in TT$ Millions

2014

2013

Change

% Change

Restated

Financial Position

Total assets

59,371.5

57,612.4

1,759.1

3.1%

Total advances

27,095.4

25,235.5

1,859.9

7.4%

Total investments

8,260.4

8,131.0

129.3

1.6%

Total deposits

43,770.8

42,098.3

1,672.4

4.0%

Total equity

8,746.3

8,516.0

230.3

2.7%

of $20.5 million - due to a reduction in the investment

impairment expense, which had negatively impacted profits in

2013. The profitability in Barbados reflects a one-off adjustment

at the consolidated level in 2014 which resulted in a decline of

$20 million or 36% from the amount reported in 2013.

The Board of Directors has declared a final dividend of $3.00

per share for the year ended September 30, 2014. When added

to the interim dividend of $1.25 per share, this brings the total

dividend for the year to $4.25 per share. At a closing share price

of $121.61 per share, this equates to a dividend yield of 3.49%,

which together with capital appreciation of $11.57 during the

fiscal, represents a total return of 14.38% to our shareholders.

The Bank continues to maintain a strong capital base,

reflected in a tier I and II capital adequacy ratio of 25.77%, well

in excess of the 8% minimum requirement. This excess capital

will allow us to continue to explore our expansion strategy in

the Caribbean and in selected countries in Africa that meet our

risk profile.

The following is a detailed discussion and analysis of the

financial results of Republic Bank Limited. This should be read

in conjunction with the audited financial statements, contained

on pages 49 to 115 of this report. All amounts are stated in

Trinidad and Tobago dollars.

Financial Position

The Group’s total asset base grew from $57.6 billion in 2013 to

$59.4 billion at September 30, 2014, an increase of $1.8 billion

or 3.1%. This growth in assets was largely driven by an increase

of $1.9 billion or 7.4% in advances and an increase of $129.3

million or 1.6% in investments.

While deposits continue to grow this year, by 4% over

the prior period, the rate of growth has decelerated when

compared to the 14% deposit growth experienced in 2013.

Throughout the year, we utilised our excess cash reserves to

finance the growth in interest earning assets which resulted in a

$891.9 million decline in balances Due from Banks.

Total equity increased by $230.3 million to $8.7 billion at

September 30, 2014 as the Group continued to build capital

resources to support future expansion.

Loans and advances

The non-performing loans (NPL’s) to gross loans ratio, at 3.5%

reflects a decline of 20 basis points from the 3.7% recorded

in 2013. This is reflective of the improved quality of the loan

portfolio in Trinidad and Tobago. Total loan provision is 40.2%

of total NPL’s, up from 37.2% in 2013. In order to achieve at least

100% provision for non-performing loans, the policy of the

Group is to provide for these loans by specific and inherent risk

ManagingDirector’sDiscussionandAnalysis