REPUBLIC BANK LIMITED

22

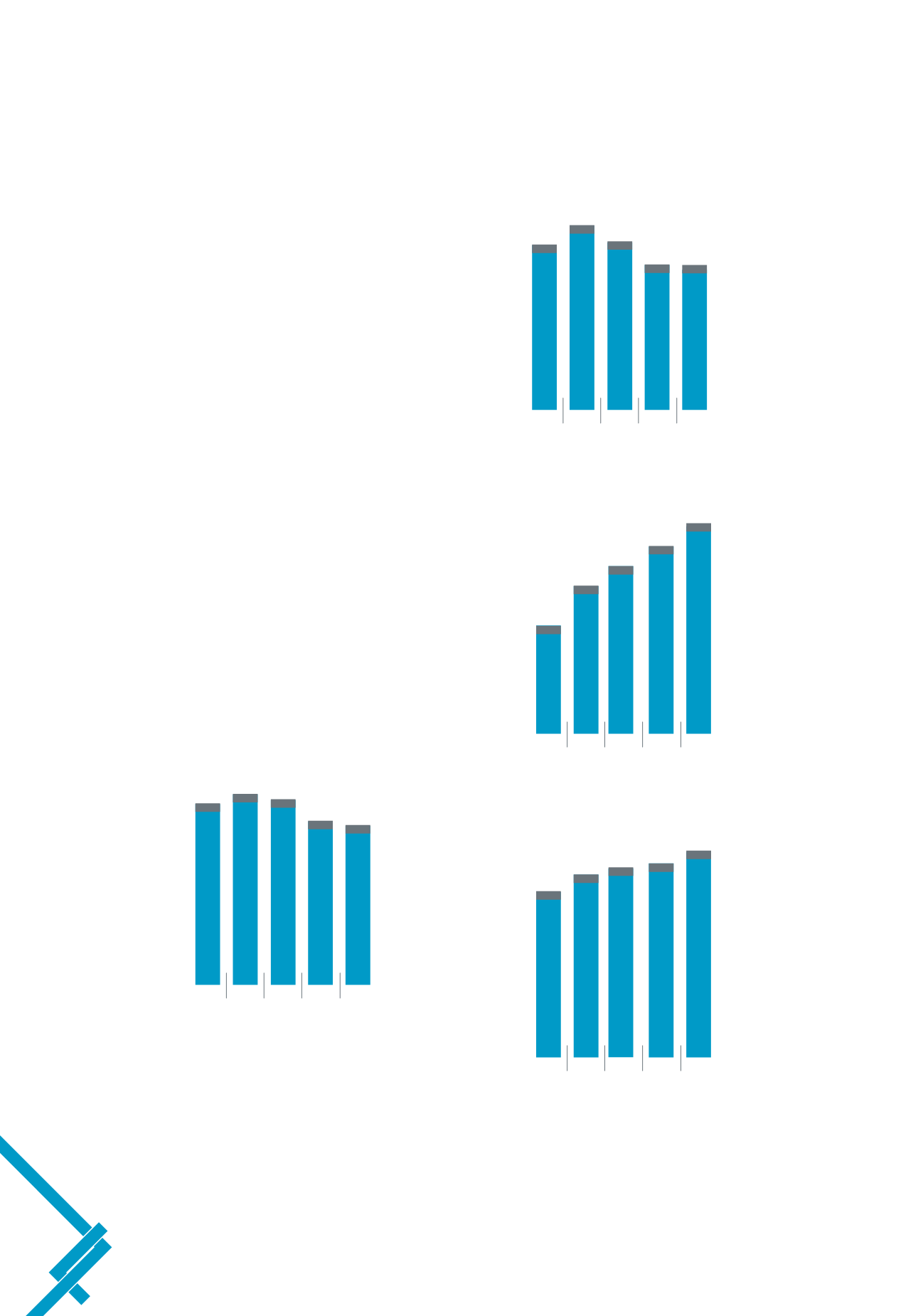

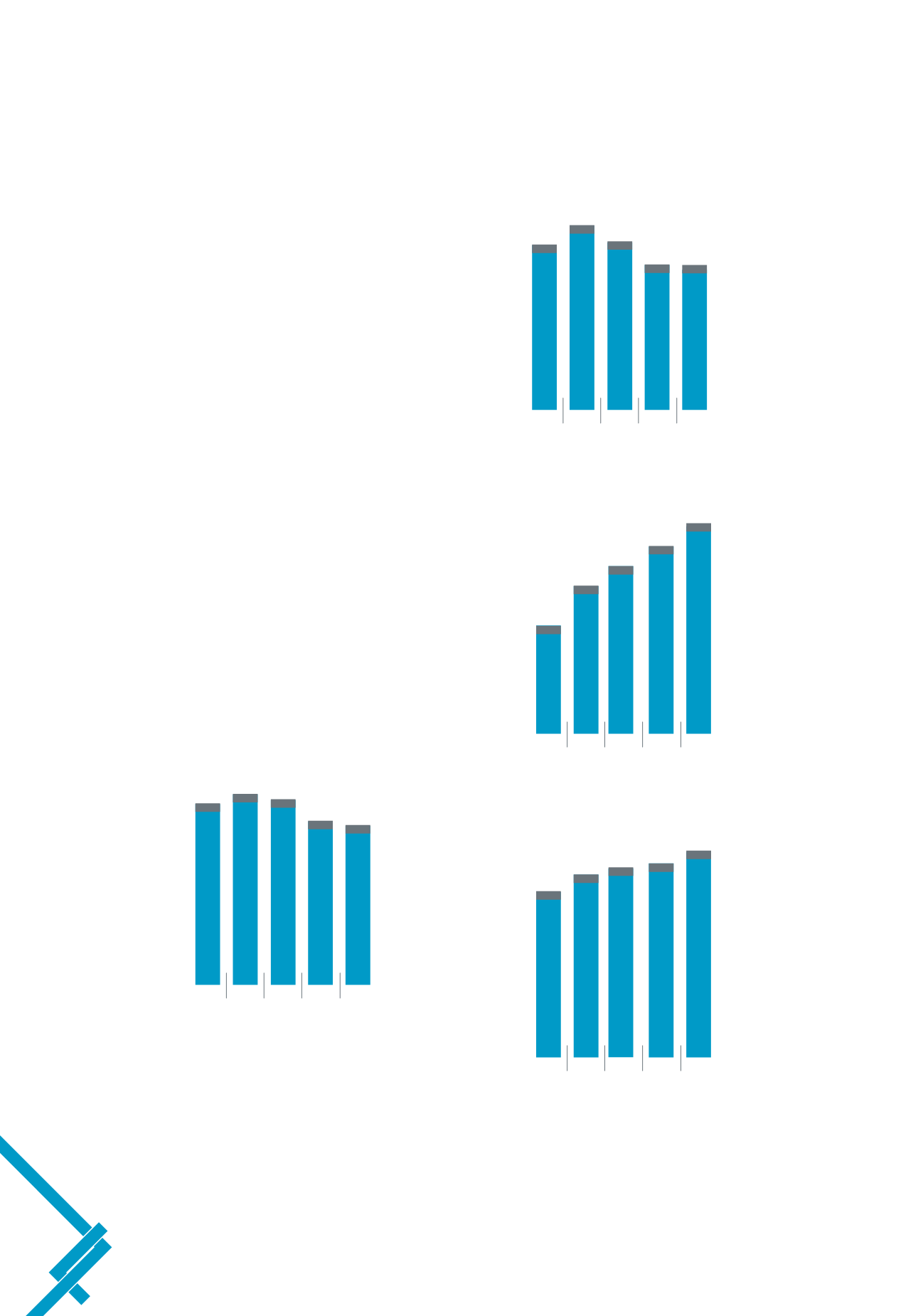

ReturnonEquity (%)

ReturnonAssets (%)

SharePrice ($)

Price/EarningsRatio

18.00

16.00

14.00

12.00

10.00

0

3.00

2.50

2.00

1.50

1.00

0.50

0

130.00

110.00

90.00

70.00

50.00

30.00

0

18.00

16.00

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0

2010 2011 2012 2013

2014

2010 2011 2012 2013

2014

2010 2011 2012 2013

2014

2010 2011 2012 2013

2014

2.43

2.52

2.48

2.16

2.10

15.30

16.17

15.48

14.33

72.99

13.3

93.09

14.6

105.51

15.1

110.04

15.3

ManagingDirector’sDiscussionandAnalysis

Income Statement

The Group’s profitability for 2014 increased by $42.4 million or

3.7% over the restated profit for 2013. The growth in average

assets and average equity however outpaced/matched this

growth in profits, resulting in a decrease in the Return on Assets

(ROA) from 2.16% in 2013 to 2.10% in 2014 though the Return

on Equity (ROE) remained constant at 14.33%.

Despite the declining interest rate environment, driven by

increased liquidity and competition in the financial services

industry, net interest income increased by $37.4 million or 1.7%

in 2014, mainly due to increases in the loans and investments

portfolios. The net interest margin declined from 4% to 3.79%.

This marginmay rebound in the coming year as the Central Bank

of Trinidad & Tobago seeks to curb inflationary and exchange

rate pressures by increasing the ‘Repo’ rate from 2.75% to 3% in

September 2014, the first increase since September 2012.

Other income for the Group was $1.49 billion, an increase

of $230.4 million or 18.3%, all due to gains from the sale of

available for sale investments. Our investment in HFC Bank

(Ghana) Limited continues to reap benefits, contributing $43.3

million to Group’s profits.

Core operating expenses increased by $137.3 million or 8.2%

over the prior year, resulting in a deterioration in the efficiency

ratio, from 53.7% in 2013 to 55% in 2014.

14.33

121.61

16.4