REPUBLIC BANK LIMITED

24

ManagingDirector’sDiscussionandAnalysis

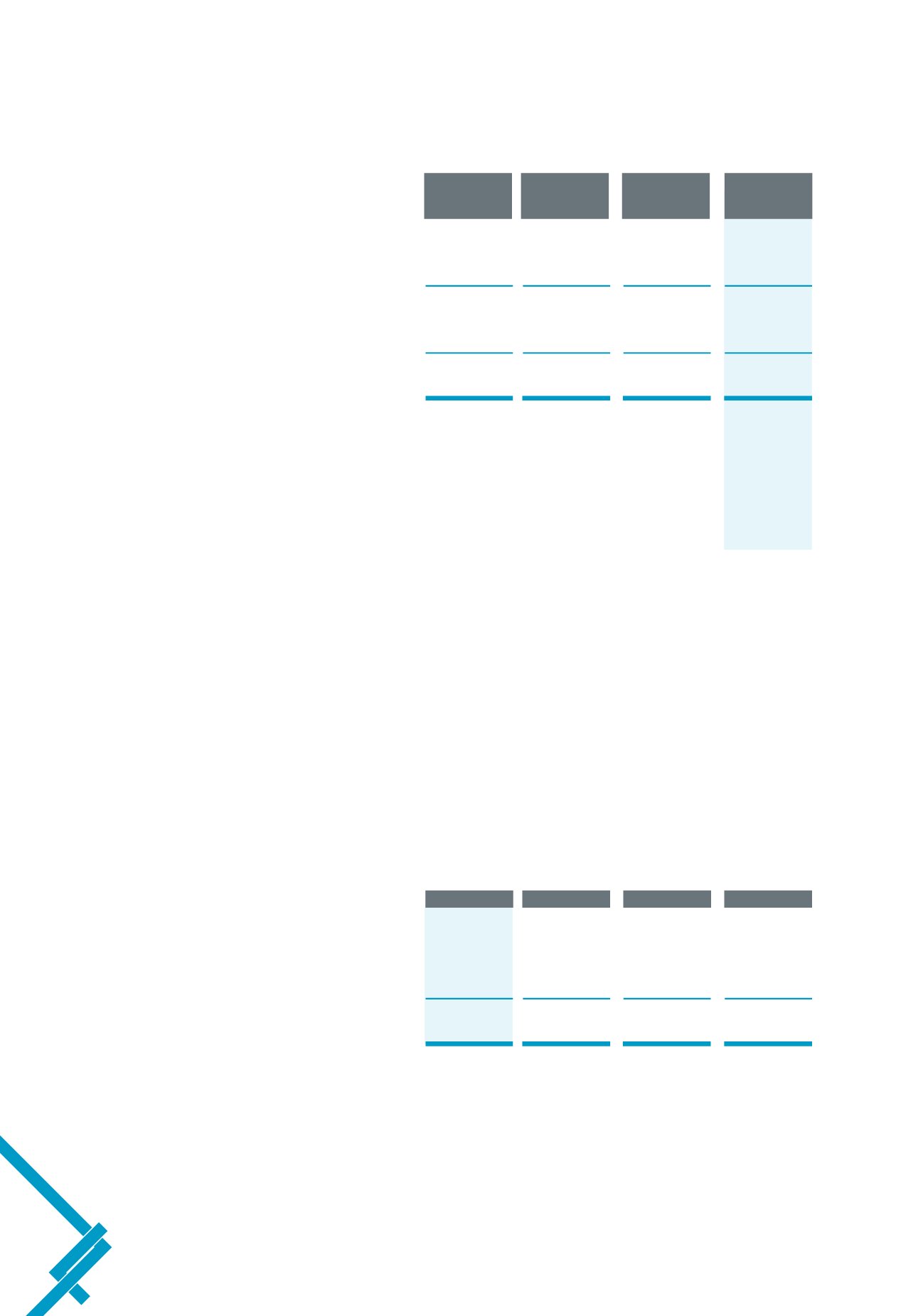

The improvement in the Group’s NPL to Gross Loans ratio,

from 3.7% in 2013 to 3.5% in 2014 is driven by an improved ratio

in Trinidad and Tobago (from 1.4% in 2013 to 1.2% in 2014) and

Barbados (from11.7% in2013 to10.5% in2014).Thiswas negated

somewhat by an increased ratio in the Cayman/Guyana/Eastern

Caribbean region, where the NPL ratio increased from 4.7% in

2013 to 7.4% in 2014, fuelled by provisions for the sugar industry

in Guyana and exposure to defaulted debts in Grenada.

The lower level of provision as a percentage of NPL’s in the

subsidiaries is due to the high levels of collateral held, which

reduced the loan provision required.

Net Interest Income

(TT$ Millions)

Trinidad

Barbados Cayman/Guyana

Total

and Tobago

Eastern

Caribbean

Performing Loans

19,280

4,233

3,001

26,513

Non-performing Loans (NPL’s)

239

496

239

974

Gross loans

19,519

4,728

3,239

27,487

Loan Provision

(183)

(150)

(59)

(391)

Net Loans

19,336

4,578

3,181

27,095

Contingency Reserve

194

367

81

642

Non-performing Loans to Gross Loans

1.2%

10.5%

7.4%

3.5%

Loan provision as a % of NPL’s

76.4%

30.3%

24.5%

40.2%

Provision and Contingency Reserves as a %

of Non-performing loans

157.5%

104.3%

58.3%

106.1%

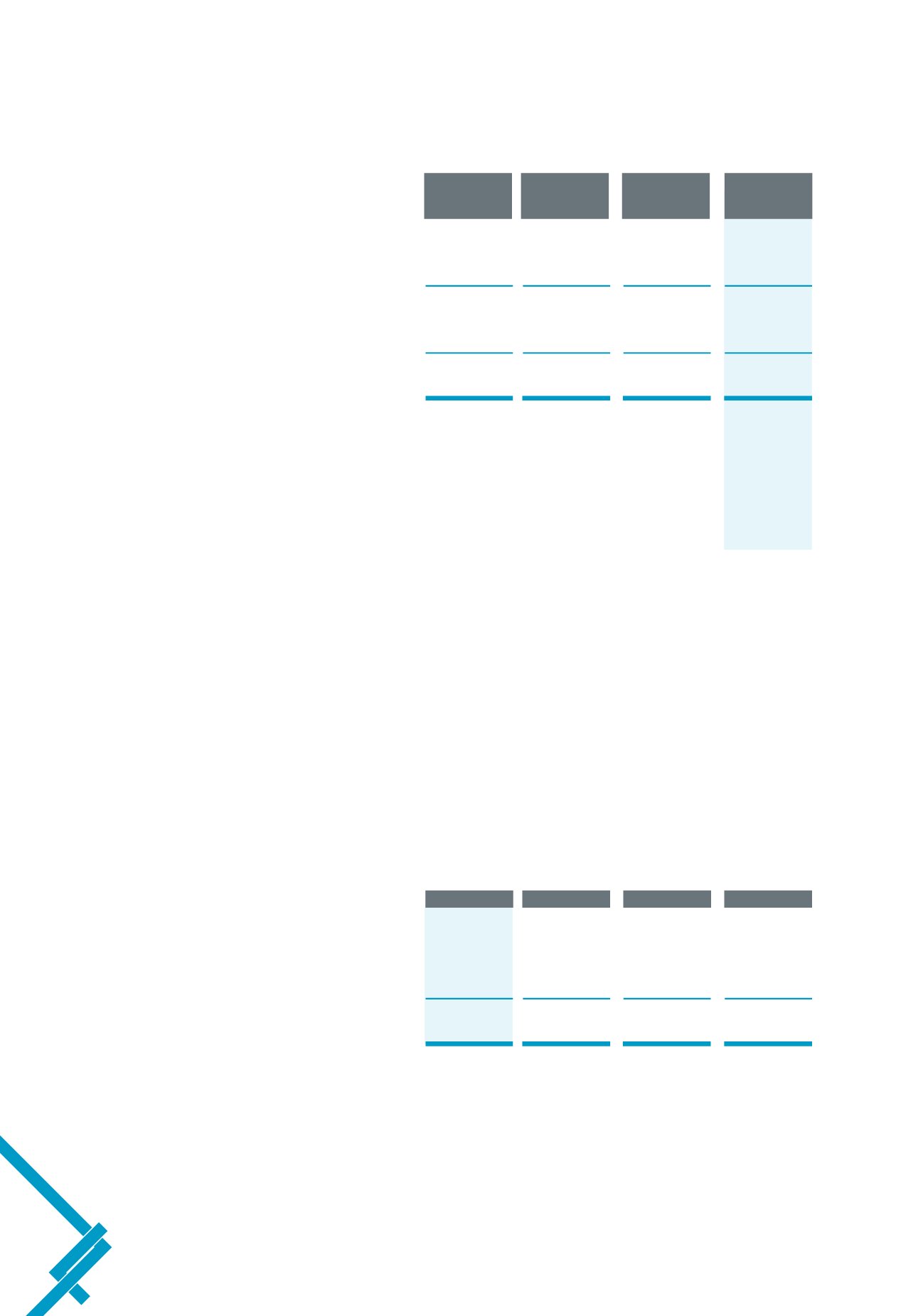

Country (TT$ Millions)

2014

2013

Change

% Change

Trinidad and Tobago

1,571

1,502

69

4.6%

Barbados

300

347

(47)

-13.6%

Cayman/Guyana/Eastern Caribbean

347

332

13

4.0%

Total

2,218

2,181

35

1.6%

LoansandAdvances 2014

Net interest income increased by $35 million or 1.6% in 2014.

This was led by Trinidad and Tobago, where 70.9% of the Group’s

net interest income was earned despite sliding interest rates,

mainly due to increases in the loans and investments portfolios.

Net interest income in Barbados declined by $47 million or

13.6% due to a one-off adjustment, while the Cayman/Guyana/

Eastern Caribbean region experienced growth of 4.0%, driven

by the improved performance in Guyana.

Effective management of interest rate spreads will continue

to be a key focus for the Group in the upcoming financial year as

Central Banks worldwidemay start to relax their accommodative

monetary policies.