REPUBLIC BANK LIMITED

70

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

3 Significant accounting judgements and estimates in applying the Group’s accounting policies

Net pension asset/liability (Note 9)

In conducting valuation exercises to measure the effect of all employee benefit plans throughout the Group, the Banks’independent actuaries use

judgement and assumptions in determining discount rates, salary increases, NIS ceiling increases, pension increases and the rate of return on the

assets of the Plans.

Goodwill (Note 8)

The Group financial statements include goodwill arising from acquisitions. In accordance with IFRS 3, goodwill was reviewed for impairment as at

September 30, 2014 by determining the recoverable amount, which is the higher of fair value less cost to dispose or value in use. The value in use

method requires the use of estimates for determination of future cash flows expected to arise from each cash-generating unit and an appropriate

perpetuity discount rate to calculate present value.

Deferred taxes (Note 10)

In calculating the provision for deferred taxation, management uses judgement to determine the probability that future taxable profits will be

available to facilitate utilisation of temporary tax differences which may arise.

Premises and equipment (Note 7)

Management exercises judgement in determining whether costs incurred can accrue sufficient future economic benefits to the Group to enable

the value to be treated as a capital expense. Further judgement is used upon annual review of the residual values and useful lives of all capital items

to determine any necessary adjustments to carrying value.

Assessment of control

Management uses judgement in performing a control assessment review on all mutual funds and retirement plans sponsored by Republic Bank

Limited (RBL) and its subsidiaries. This assessment revealed that RBL is unable to exercise power over the activities of the funds and is therefore not

deemed to be in control of any of the mutual funds and retirement plans.

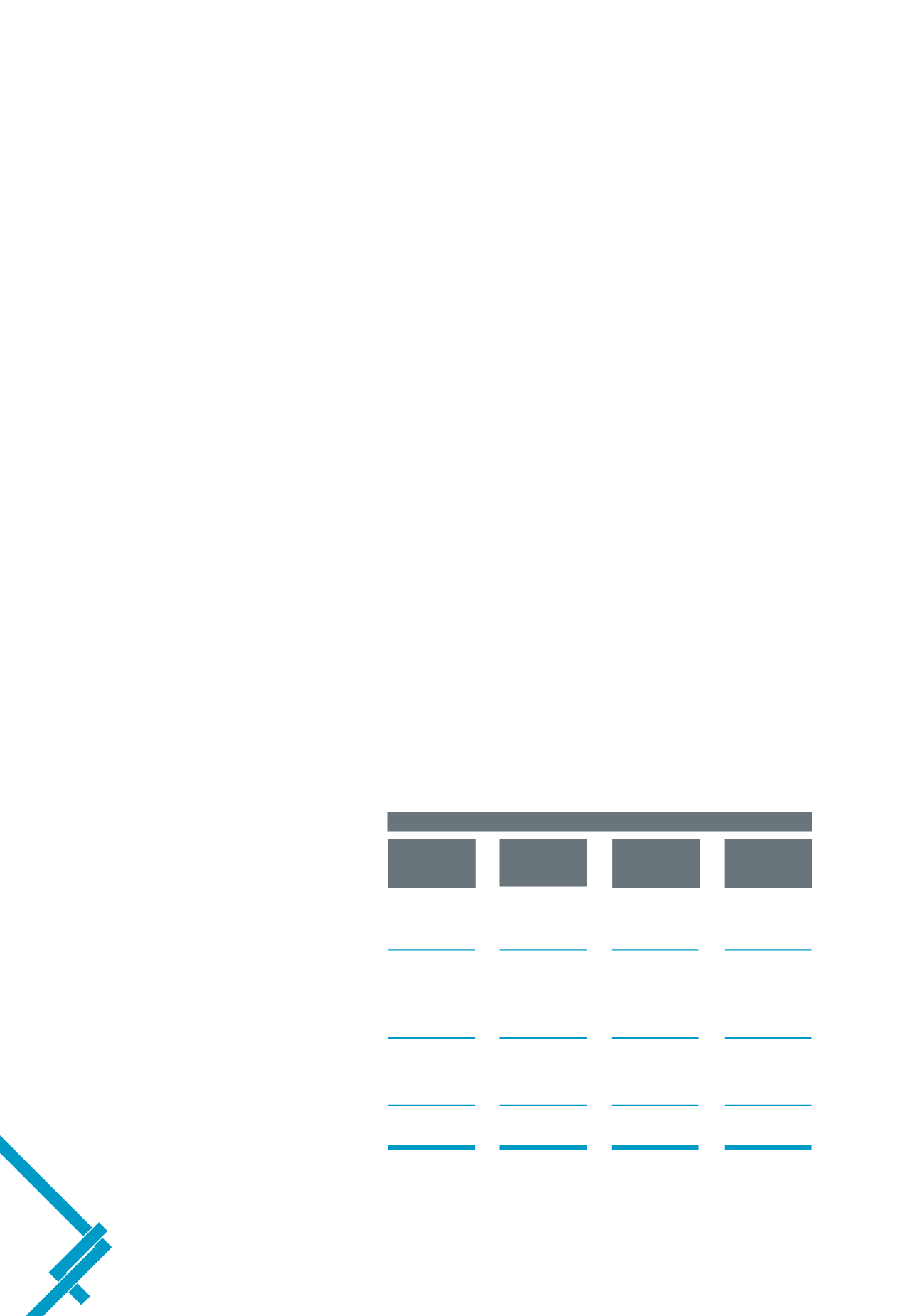

4 Advances

a) Advances

2014

Retail

Commercial

Mortgages

Total

Lending and Corporate

Lending

Performing advances

5,200,539

10,892,477

10,453,975

26,546,991

Non-performing advances

111,145

539,633

322,833

973,611

5,311,684

11,432,110

10,776,808

27,520,602

Unearned interest/finance charge

(46,692)

(64,976)

–

(111,668)

Accrued interest

8,324

47,054

22,500

77,878

5,273,316

11,414,188

10,799,308

27,486,812

Allowance for impairment losses - Note 4 (b)

(73,831)

(240,841)

(76,733)

(391,405)

Net advances

5,199,485

11,173,347

10,722,575

27,095,407