REPUBLIC BANK LIMITED

78

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

9 Employee benefits

(continued)

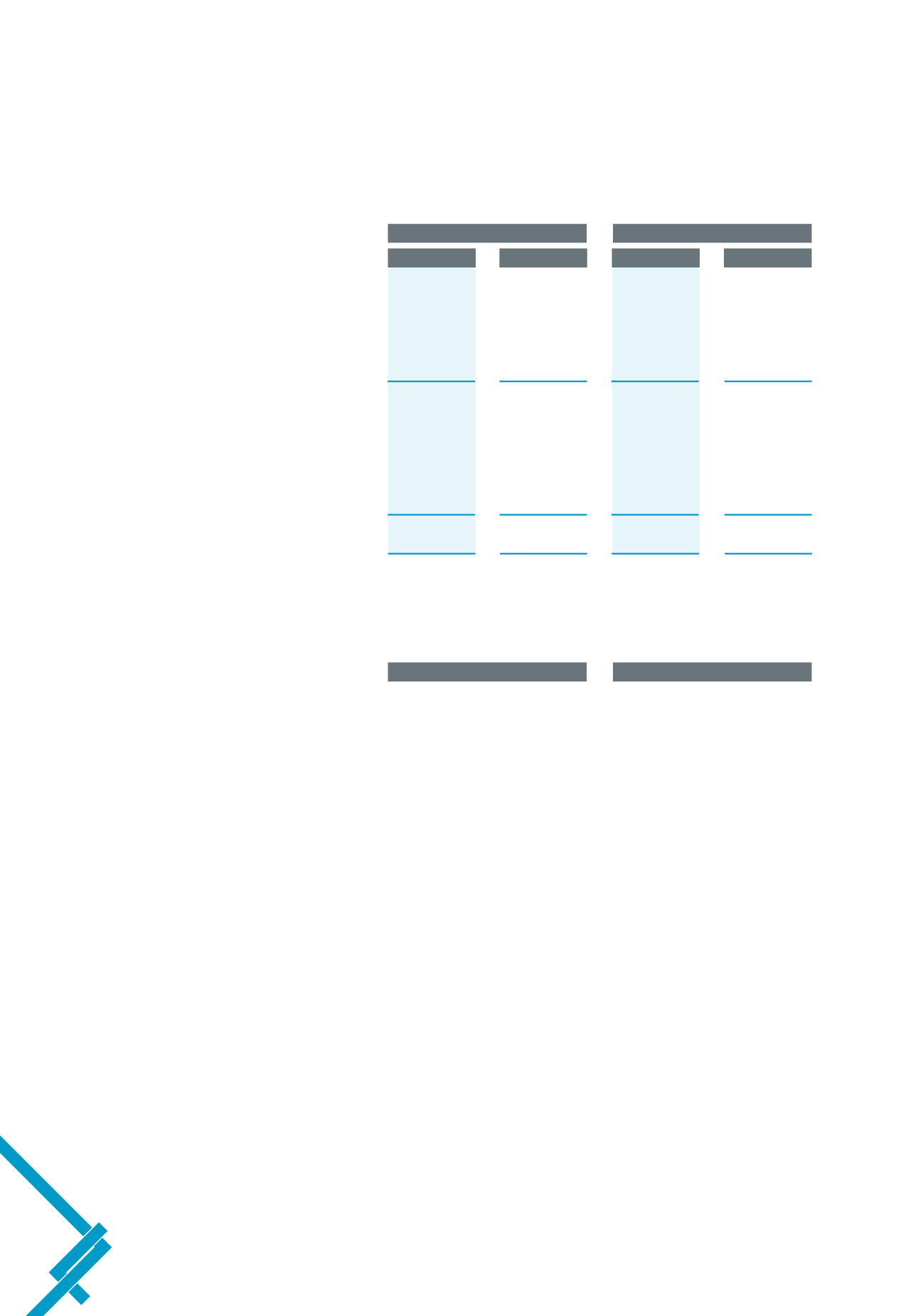

c) Reconciliation of opening and closing statement of financial position entries:

Defined benefit pension plans

Post-retirement medical benefits

2014

2013

2014

2013

Defined benefit obligation at prior year end

1,242,651

1,193,527

304,850

182,773

Exchange adjustments

297

–

(64)

–

Unrecognised gain/(loss) charged to

retained earnings

–

14,980

–

39,344

Opening defined benefit obligation

1,242,948

1,208,507

304,786

222,117

Net pension cost

(40,517)

(22,121)

30,094

22,896

Re-measurements recognised in other

comprehensive income

22,836

38,505

91,511

62,306

Premiums paid by the Group

17,183

17,760

(2,889)

(2,469)

Closing net pension asset/liability

1,242,450

1,242,651

423,502

304,850

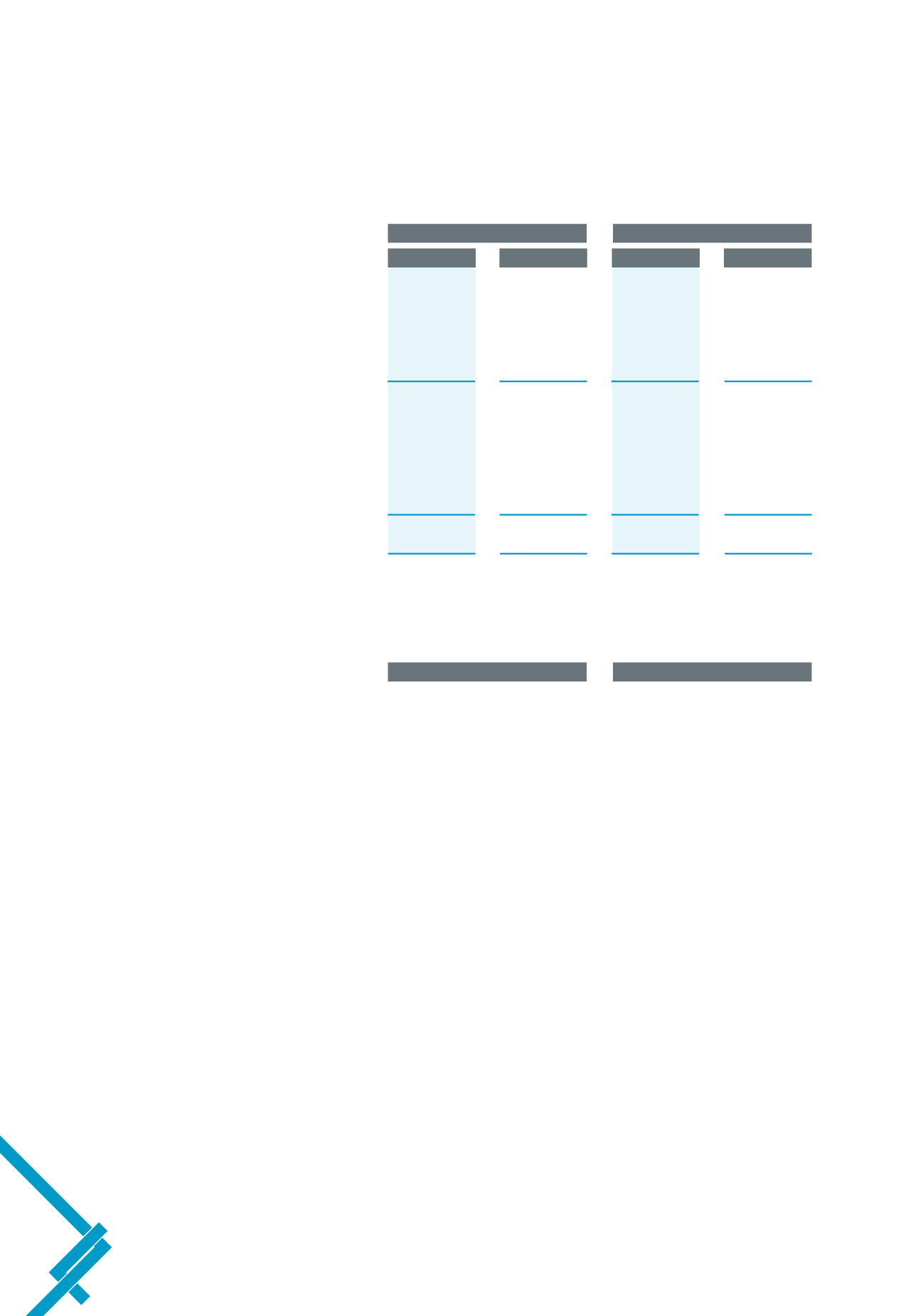

d) Liability profile

The defined benefit obligation is allocated between the Plan’s members as follows:

Defined benefit pension plans

Post-retirement medical benefits

- Active members

63% to 80%

76% to 87%

- Deferred members

3% to 8%

N/A

- Pensioners

15% to 30%

13% to 24%

The weighted duration of the defined benefit obligation ranged from 16.9 to 24 years.

31% to 46% of the defined benefit obligation for active members was conditional on future salary increases.

29% to 98% of the benefits for active members were vested.