REPUBLIC BANK LIMITED

88

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

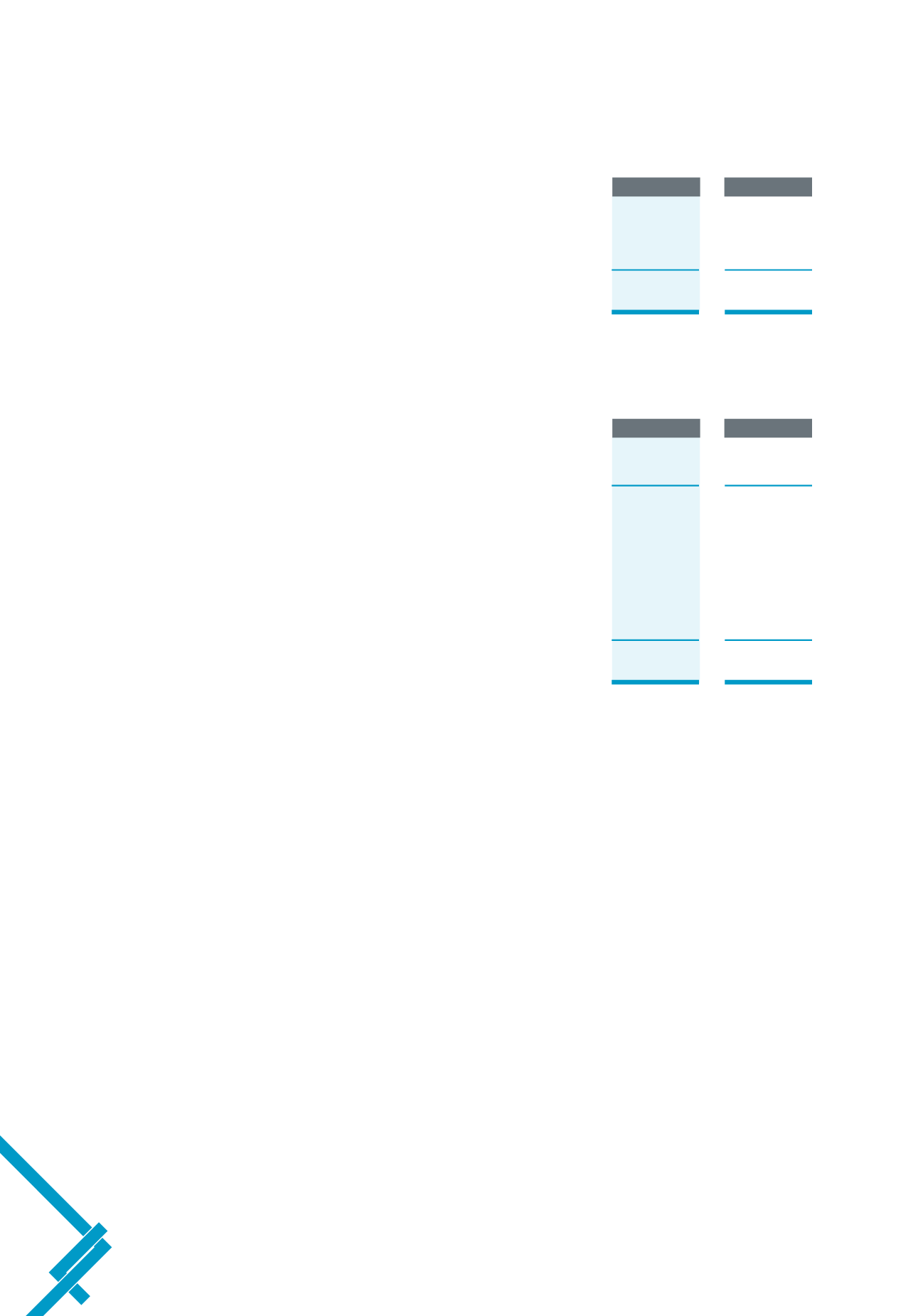

19 Taxation expense

2014

2013

Corporation tax

354,375

384,344

Deferred tax

(15,395)

(7,269)

338,980

377,075

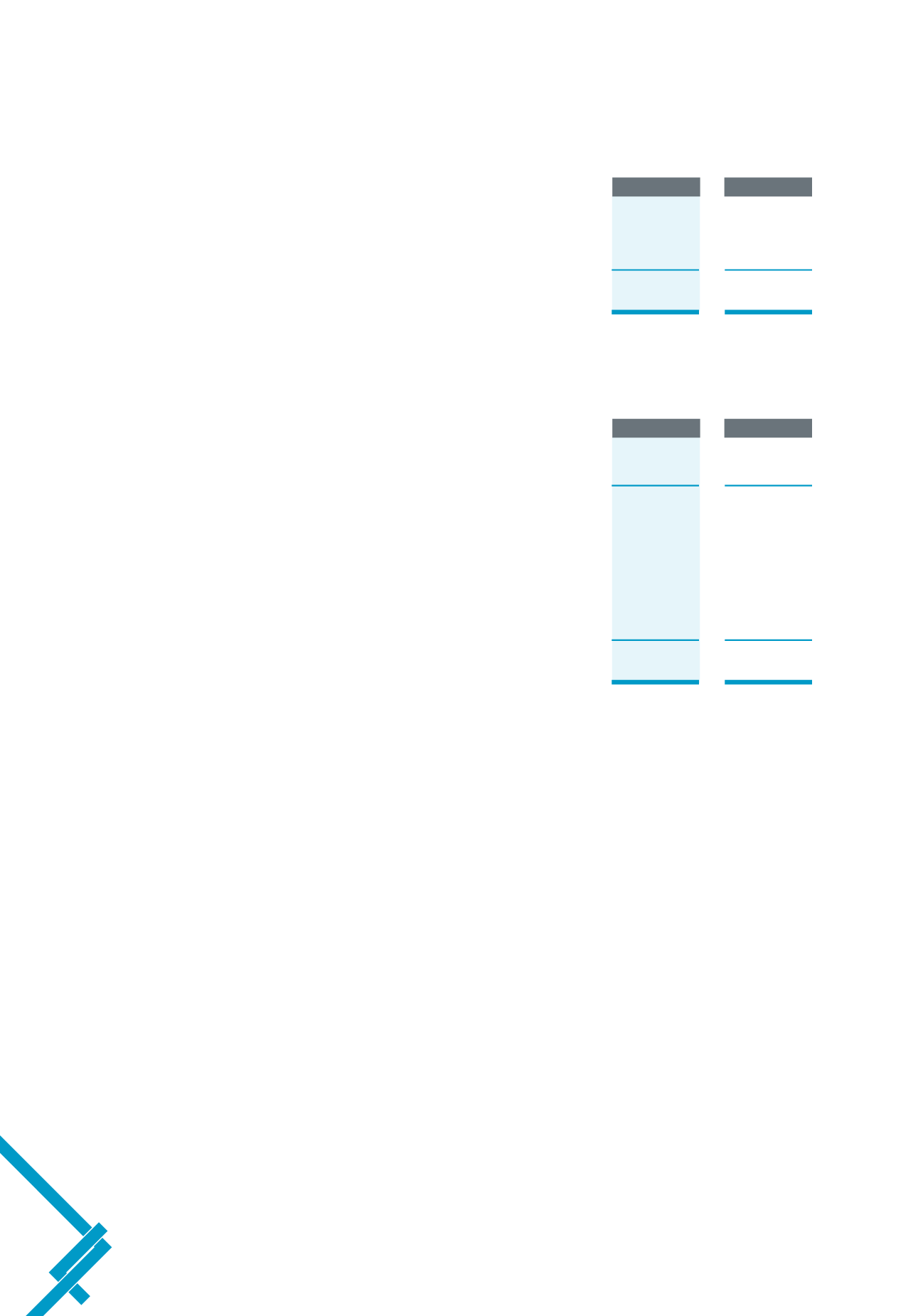

Reconciliation between taxation expense and accounting profit

Income taxes in the consolidated statement of income vary from amounts that would be computed by applying the statutory tax rate for the

following reasons:

2014

2013

Accounting profit

1,568,696

1,554,942

Tax at applicable statutory tax rates

418,594

407,063

Tax effect of items that are adjustable in determining taxable profit:

Tax exempt income

(82,136)

(61,809)

Non-deductible expenses

27,529

57,840

Allowable deductions

(15,395)

(22,435)

Provision for Green Fund Levy and other taxes

(9,612)

(3,584)

338,980

377,075

The Group has tax losses in two of its subsidiaries amounting to $158.4 million (2013: $274.6 million). In one of these subsidiaries, no deferred

tax asset has been recognised for these tax losses in the financial statements since it is not anticipated that there will be sufficient future taxable

profits to offset these losses.

20 Related parties

Parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party in

making financial or operating decisions. A number of banking transactions are entered into with related parties in the normal course of business.

These transactions are both secured and unsecured and were carried out on commercial terms and conditions and at market rates.