79

2014 ANNUAL REPORT

9 Employee benefits

(continued)

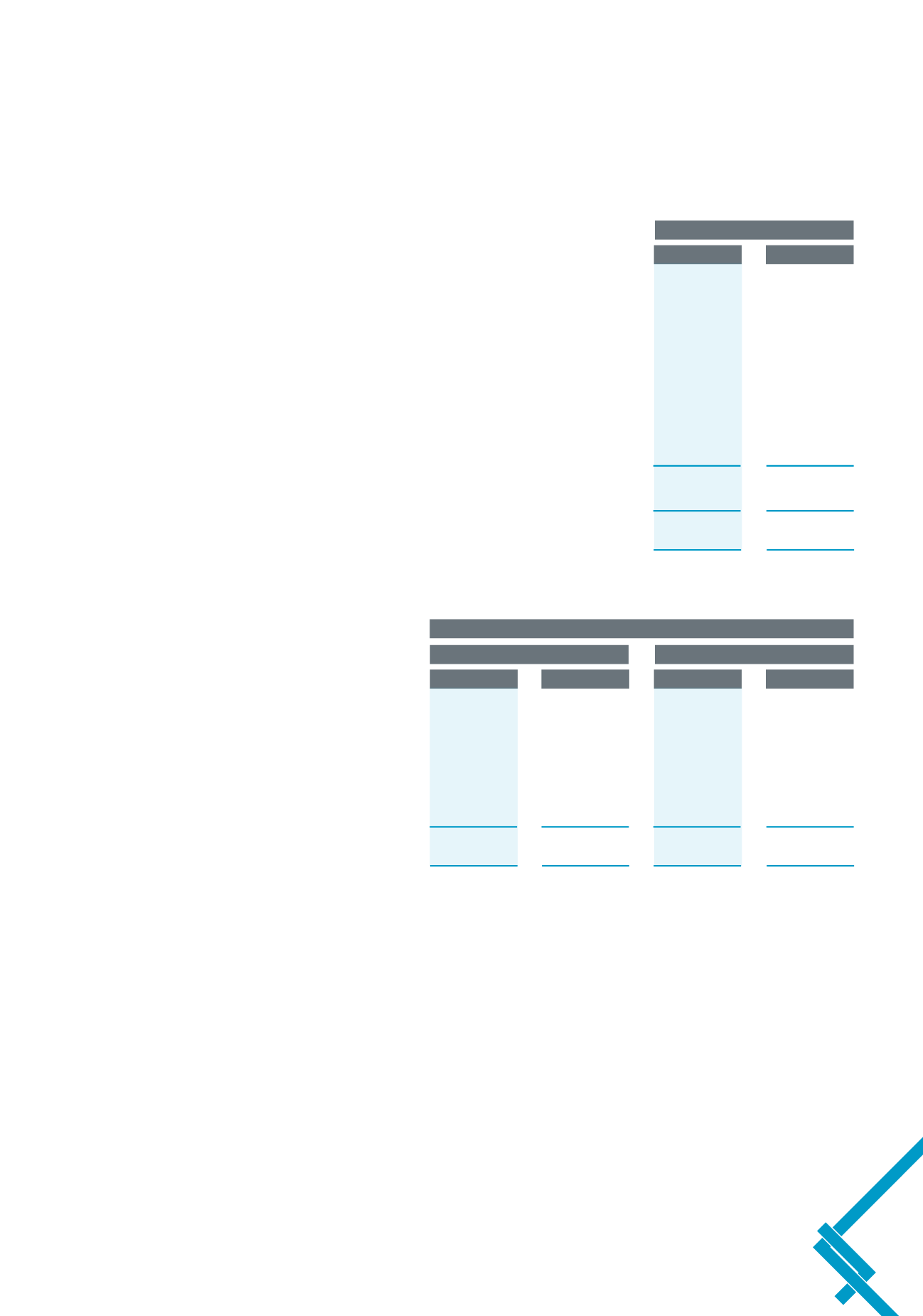

e) Changes in the fair value of plan assets are as follows:

Defined benefit pension plans

2014

2013

Opening fair value of plan assets

4,120,688

3,744,144

Exchange adjustments

(2,549)

–

Interest income

194,595

193,342

Return on plan assets, excluding interest income

25,309

250,552

Contributions by employer

17,184

17,761

Members’contributions

1,029

1,012

Benefits paid

(89,230)

(84,597)

Expense allowance

(1,522)

(1,526)

Closing fair value of plan assets

4,265,504

4,120,688

Actual return on plan assets

206,579

434,807

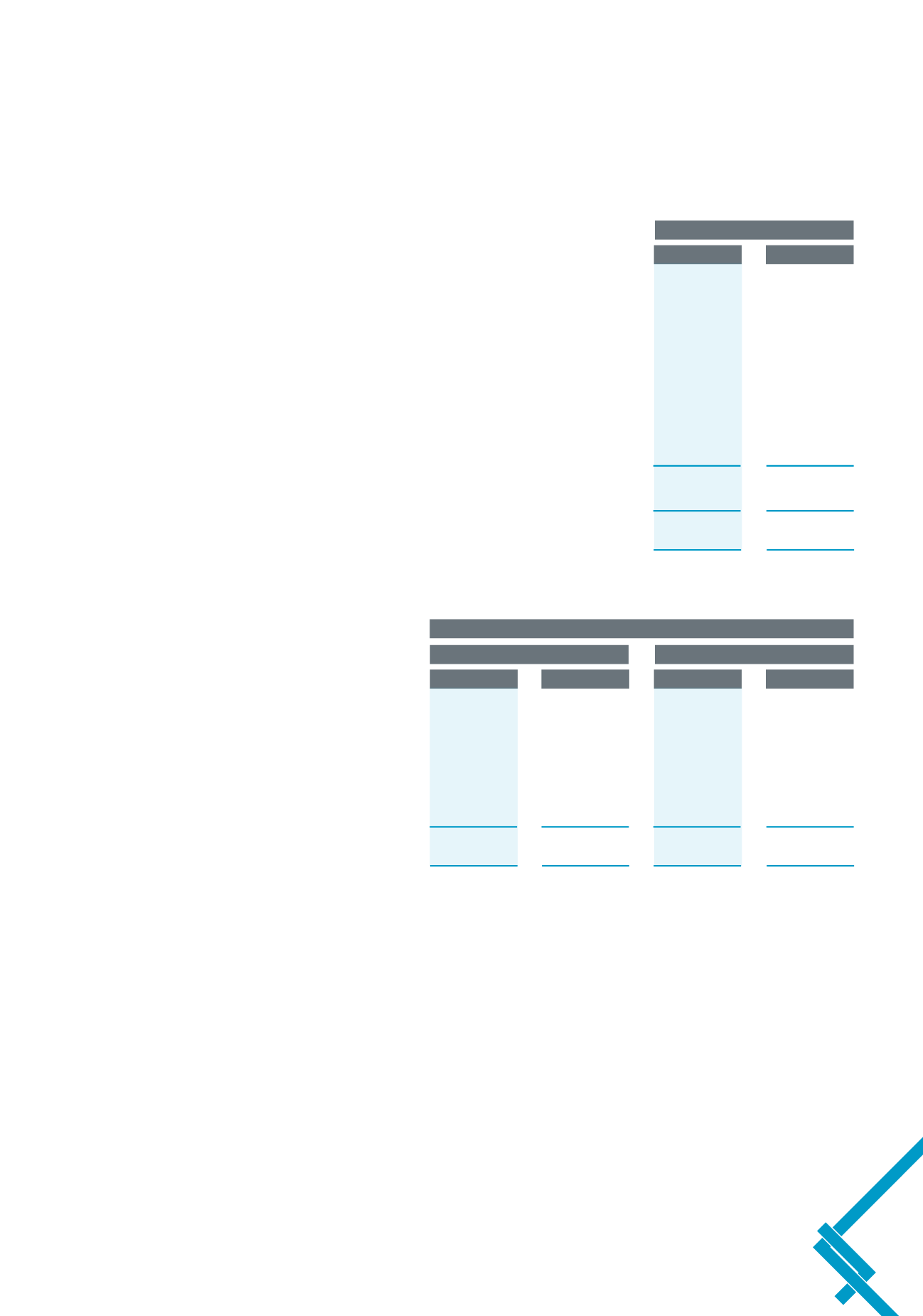

f) Plan asset allocation as at September 30

Defined benefit pension plans

Fair value

% Allocation

2014

2013

2014

2013

Equity securities

1,975,432

1,882,649

46.31

45.69

Debt securities

1,786,142

1,639,583

41.87

39.79

Property

31,524

32,056

0.74

0.78

Mortgages

1,132

1,855

0.03

0.05

Money market instruments/cash

471,274

564,545

11.05

13.70

Total fair value of plan assets

4,265,504

4,120,688

100.0

100.0