71

2014 ANNUAL REPORT

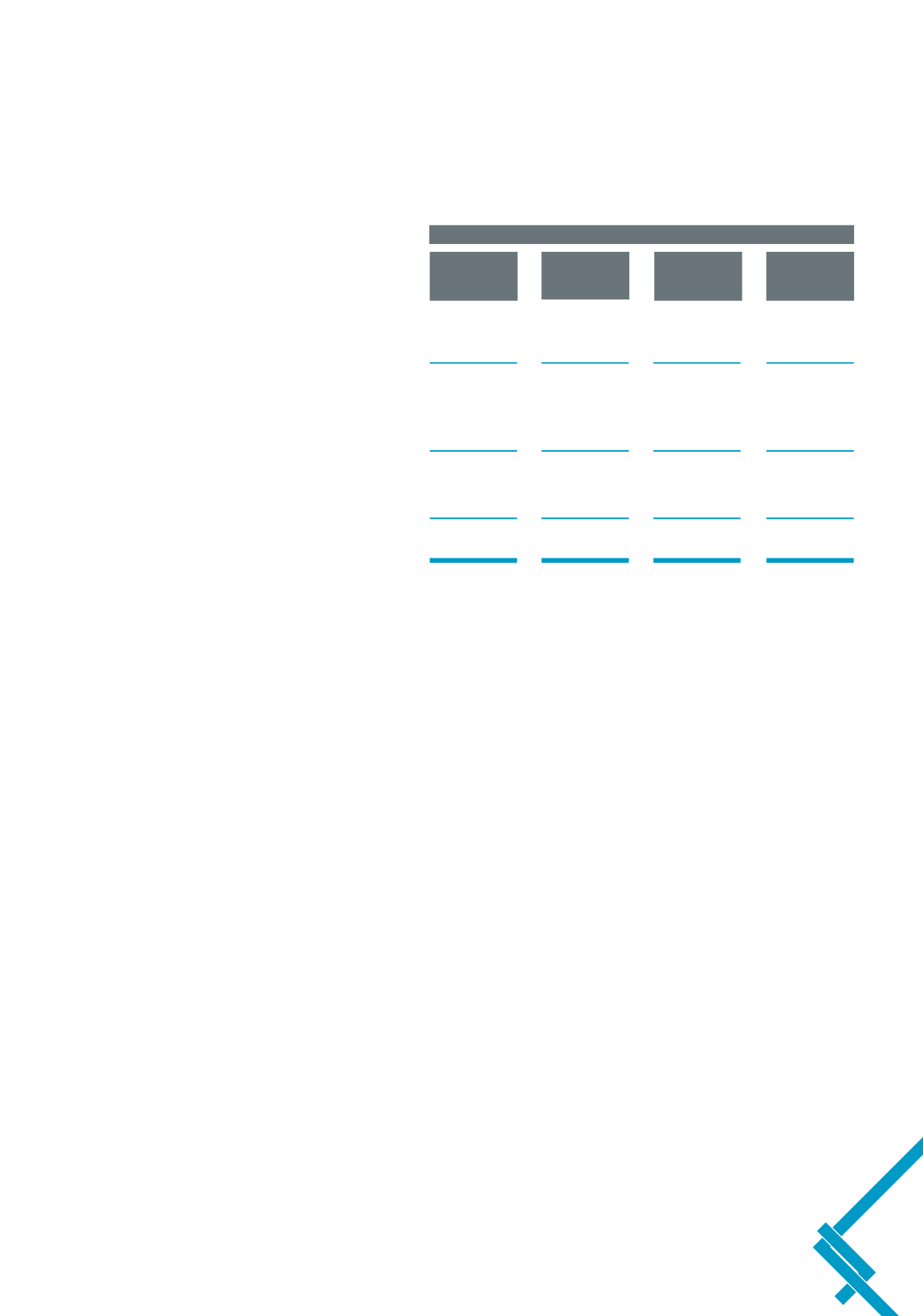

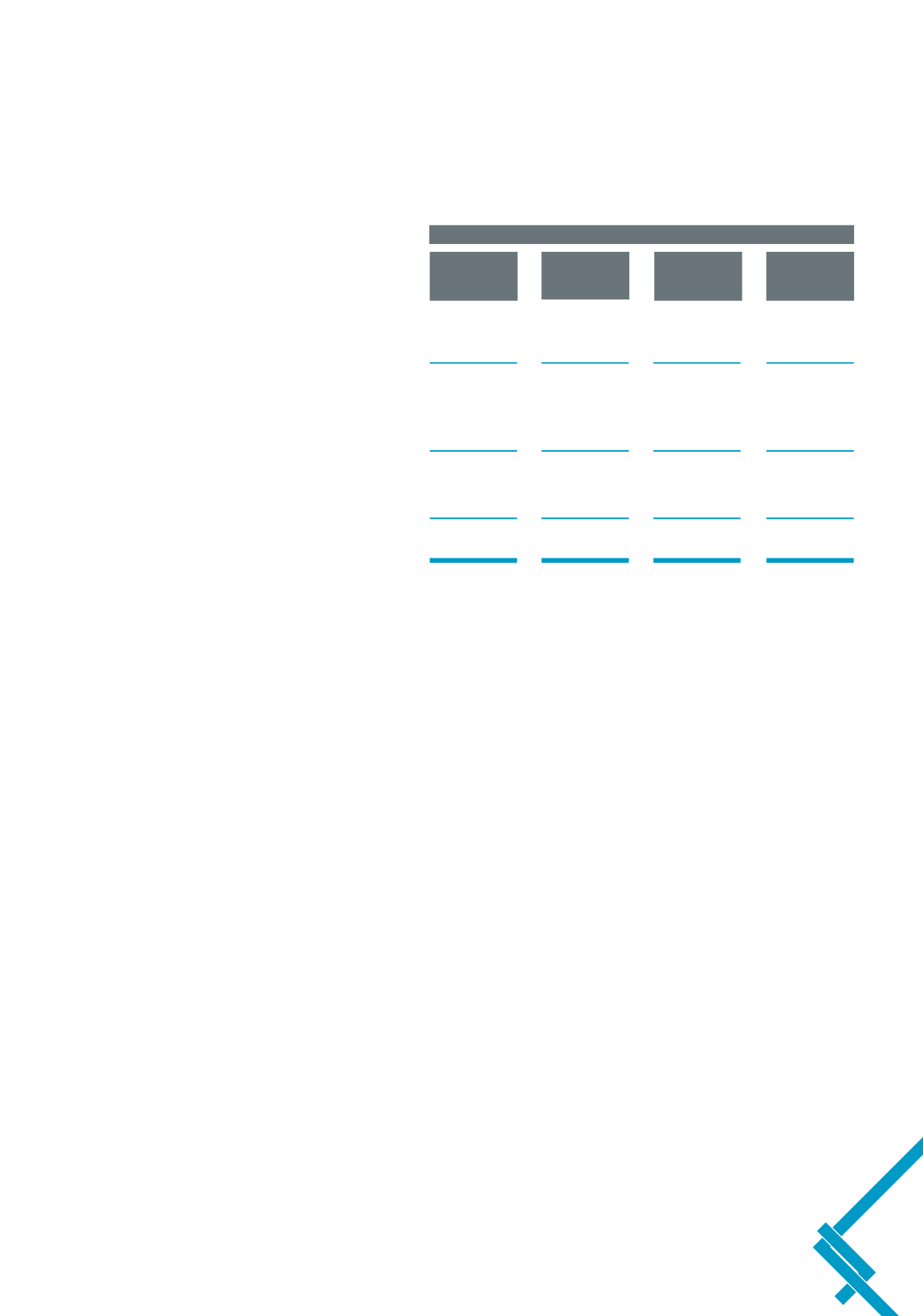

4 Advances

(continued)

a) Advances

(continued)

2013

Retail

Commercial

Mortgages

Total

Lending and Corporate

Lending

Performing advances

4,657,838

10,687,882

9,352,129

24,697,849

Non-performing advances

98,375

593,299

256,772

948,446

4,756,213

11,281,181

9,608,901

25,646,295

Unearned interest/finance charge

(51,267)

(130,223)

–

(181,490)

Accrued interest

23,508

71,097

29,205

123,810

4,728,454

11,222,055

9,638,106

25,588,615

Allowance for impairment losses

(66,530)

(211,320)

(75,248)

(353,098)

Net advances

4,661,924

11,010,735

9,562,858

25,235,517

b) Allowance for impairment losses

i) Impairment assessment

The main considerations for the loan impairment assessment include whether any payments of principal or interest are overdue by more

than 90 days or there are any known difficulties in the cash flows of counterparties, credit rating downgrades, or infringement of the

original terms of the contract. The Group addresses impairment assessment in two areas: individually assessed allowances and collectively

assessed allowances.

Individually assessed allowances

The Group determines the allowances appropriate for each individually significant loan or advance on an individual basis. Items

considered when determining allowance amounts include the sustainability of the counterparty’s business plan, its ability to improve

performance once a financial difficulty has arisen, projected receipts and the expected dividend payout should bankruptcy ensue, the

availability of other financial support and the realisable value of collateral, and the timing of the expected cash flows. The impairment

losses are evaluated at each reporting date, unless unforeseen circumstances require more immediate attention.

Collectively assessed allowances

Allowances are assessed collectively for losses on loans and advances that are not individually significant (including credit cards, residential

mortgages and unsecured consumer lending) and for individually significant loans and advances where there is not yet objective

evidence of individual impairment.

Allowances are evaluated on each reporting date with each portfolio receiving a separate review. The collective assessment takes

account of impairment that is likely to be present in the portfolio even though there is not yet objective evidence of the impairment in

an individual assessment. Impairment losses are estimated by taking into consideration the following information: historical losses on

the portfolio, current economic conditions, the approximate delay between the time a loss is likely to have been incurred and the time it

will be identified as requiring an individually assessed impairment allowance, and expected receipts and recoveries once impaired. The

impairment allowance is then reviewed by credit management to ensure alignment with the Group’s overall policy.