REPUBLIC BANK LIMITED

80

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

9 Employee benefits

(continued)

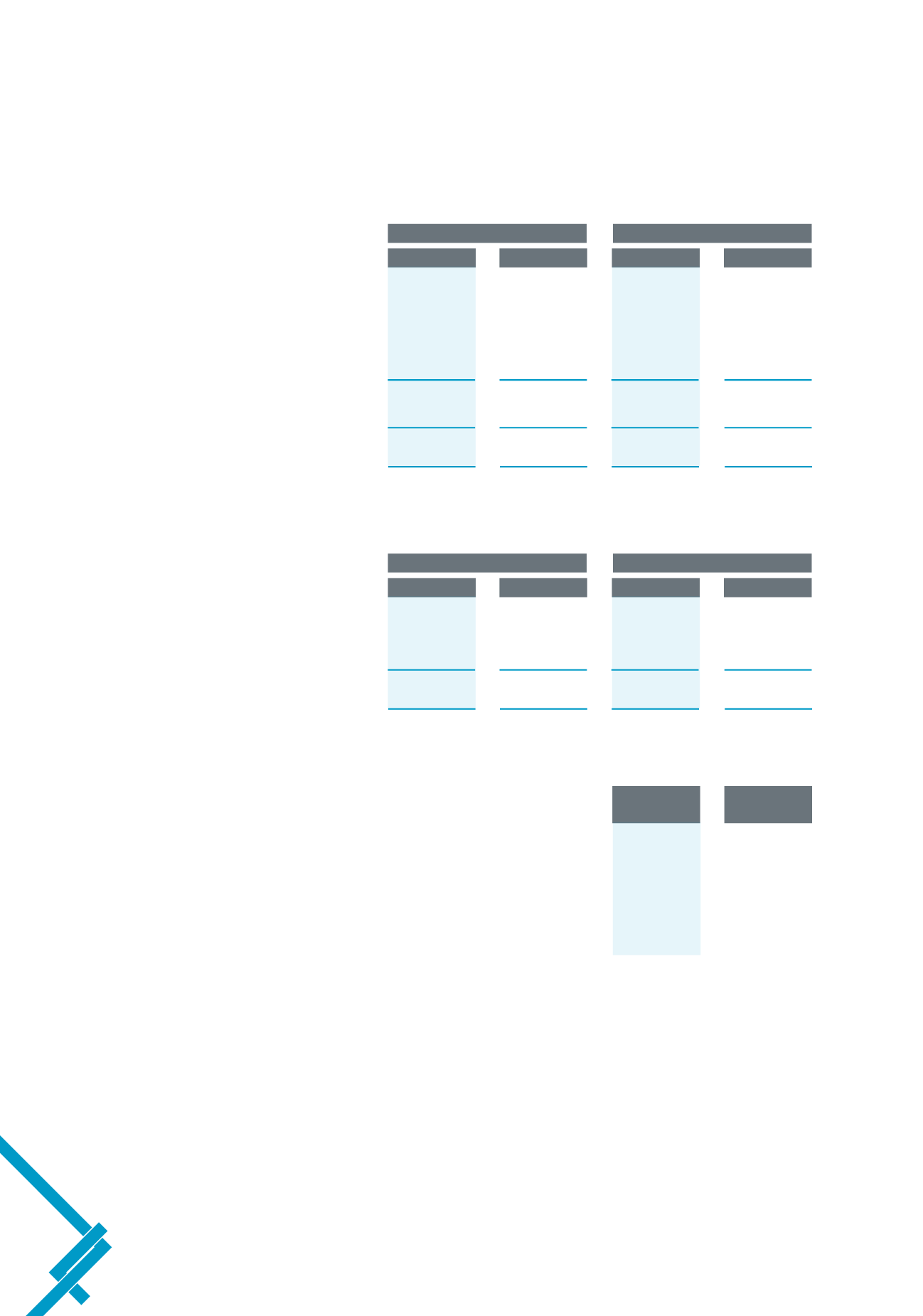

g) The amounts recognised in the consolidated statement of income are as follows:

Defined benefit pension plans

Post-retirement medical benefits

2014

2013

2014

2013

Current service cost

107,811

92,997

14,652

10,538

Interest on defined benefit obligation

(65,309)

(69,696)

15,221

12,136

Past service cost

(8,473)

(9,343)

221

222

Administration expenses

1,407

1,417

–

–

Total included in staff costs

35,436

15,375

30,094

22,896

Net benefit cost under the previous IAS 19 rules

16,542

20,193

34,400

23,812

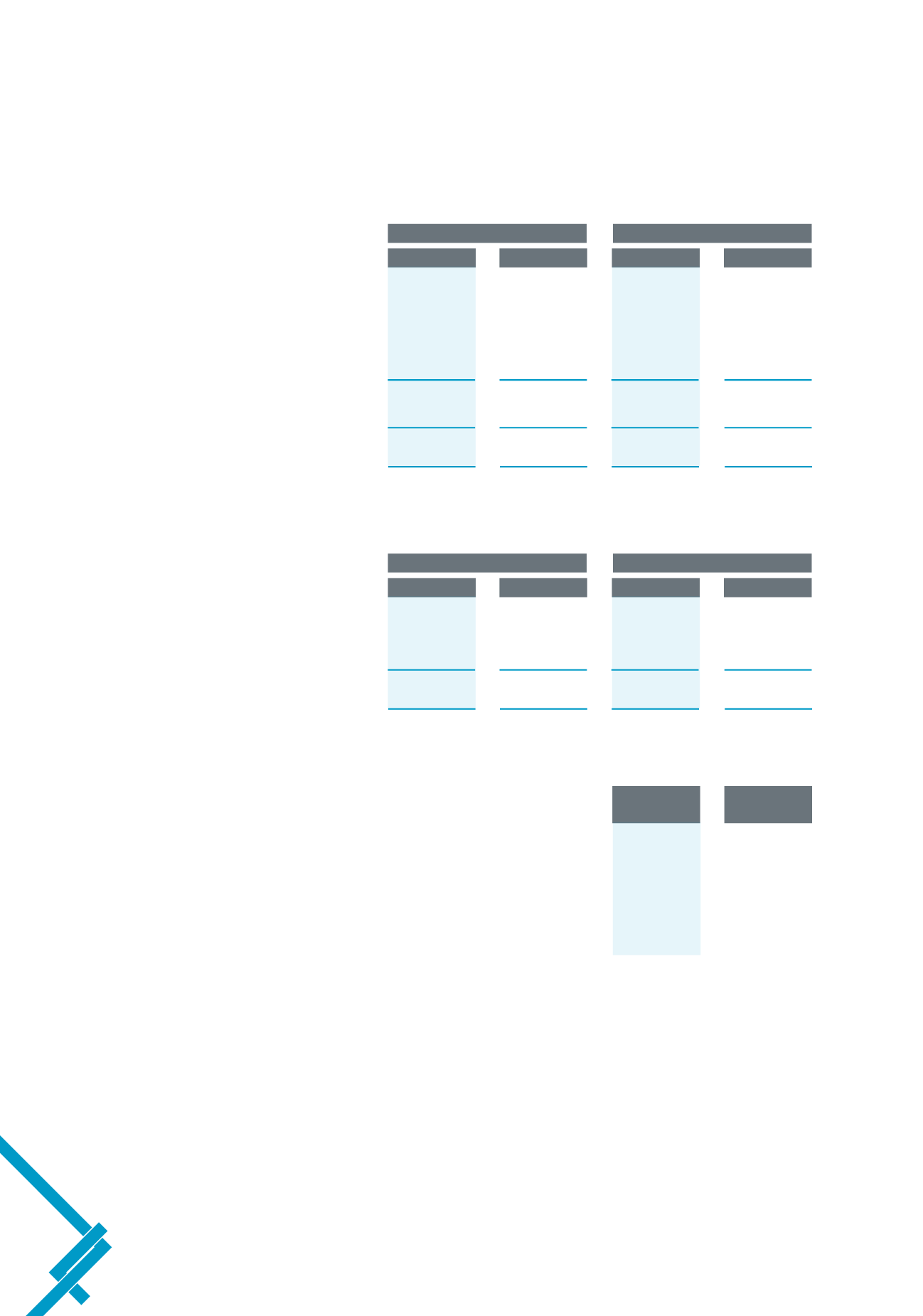

h) Re-measurements recognised in other comprehensive income

Defined benefit pension plans

Post-retirement medical benefits

2014

2013

2014

2013

Experience (gains)/losses

(22,958)

(39,959)

91,511

62,306

Effect of asset ceiling

122

1,454

–

–

Total included in other comprehensive income

(22,836)

(38,505)

91,511

62,306

i) Summary of principal actuarial assumptions as at September 30

2014

2013

%

%

Discount rate

5.00 - 7.75

5.00 - 7.75

Rate of salary increase

2.50 - 5.50

2.50 - 5.50

Pension increases

0.00 - 2.40

0.00 - 2.40

Medical cost trend rates

5.75 - 6.00

7.00 - 7.75

NIS ceiling rates

3.00 - 5.00

3.00 - 5.00

Assumptions regarding future mortality are based on published mortality rates. The life expectancies underlying the value of the defined

benefit obligation as at September 30 are as follows: