REPUBLIC BANK LIMITED

82

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

10 Deferred tax assets and liabilities

Components of deferred tax assets and liabilities

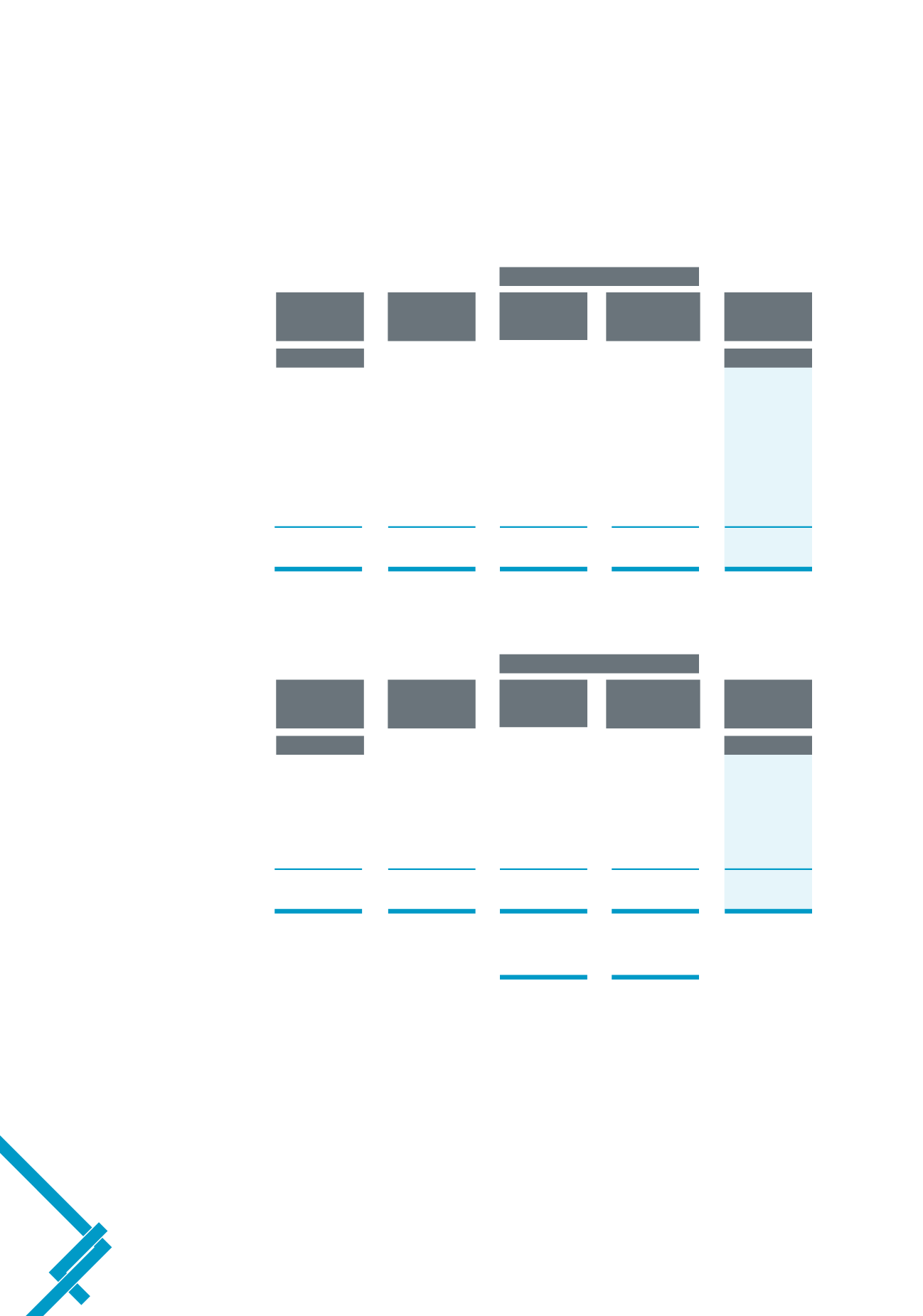

a) Deferred tax assets

(Credit)/Charge

Opening

Exchange

Consolidated

Other

Closing

Balance

and Other

Statement

Comprehensive

Balance

Restated

Adjustments

of Income

Income

2013

2013

2014

Post-retirement medical

benefits

91,325

(80)

4,181

28,291

123,717

Leased assets

24,024

–

472

–

24,496

Unrealised reserve

1,856

(3)

(395)

3,472

4,930

Unearned loan origination fees

25,156

(168)

4,779

–

29,767

Other

612

–

632

–

1,244

142,973

(251)

9,669

31,763

184,154

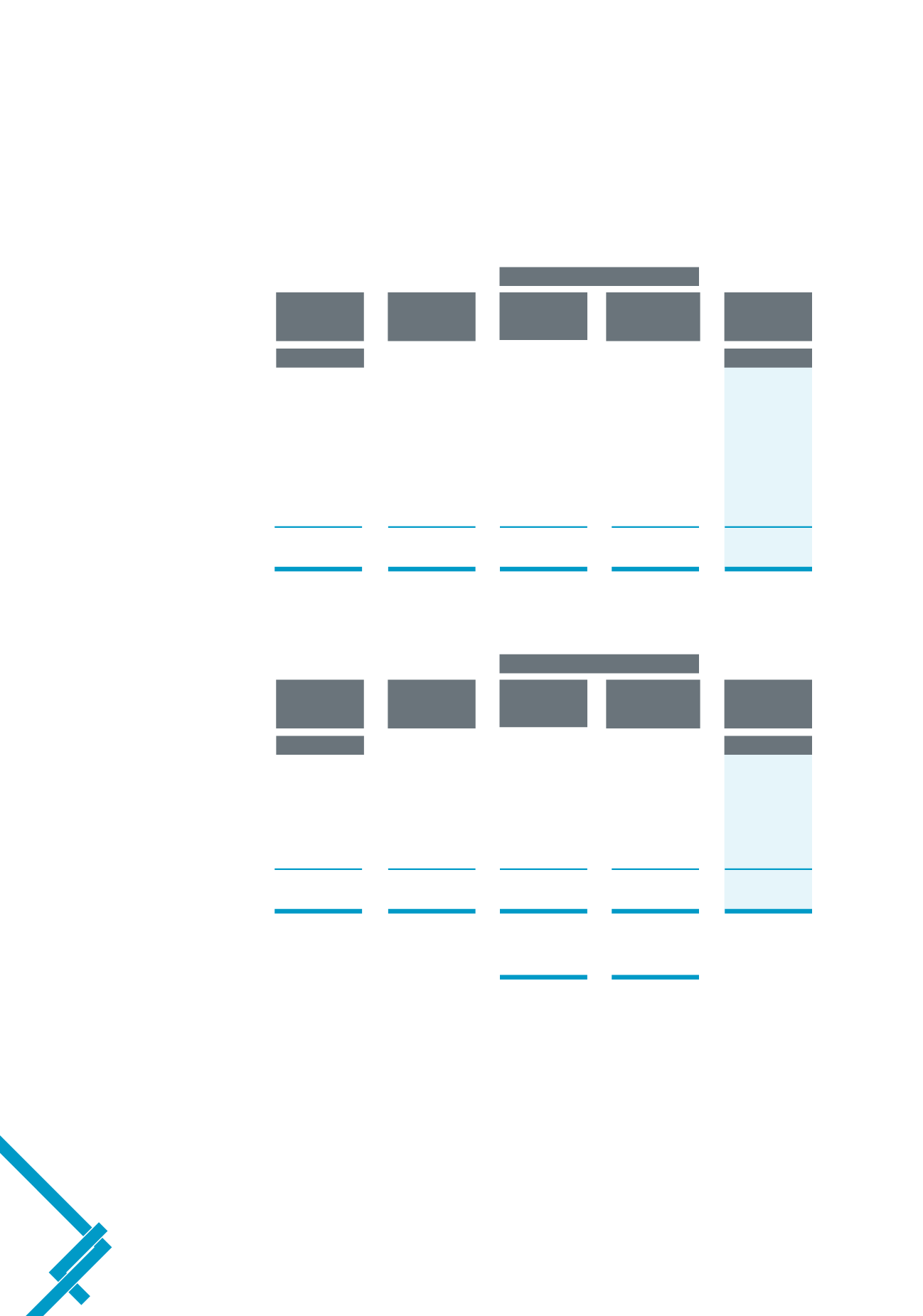

b) Deferred tax liabilities

Charge/(Credit)

Opening

Exchange

Consolidated

Other

Closing

Balance

and Other

Statement

Comprehensive

Balance

Restated

Adjustments

of Income

Income

2013

2014

Pension asset

324,862

–

(11,942)

10,403

323,323

Leased assets

34,080

–

(1,776)

–

32,304

Premises and equipment

63,052

(189)

7,992

–

70,855

Unrealised reserve

70,266

–

–

(28,712)

41,554

492,260

(189)

(5,726)

(18,309)

468,036

Non-controlling interest share of charge to OCI

742

Net credit to consolidated statement of income/OCI

15,395

50,814