REPUBLIC BANK LIMITED

84

Notes to theConsolidatedFinancial Statements

For the year ended September 30, 2014. Expressed in thousands of Trinidad and Tobago dollars ($’000), except where otherwise stated

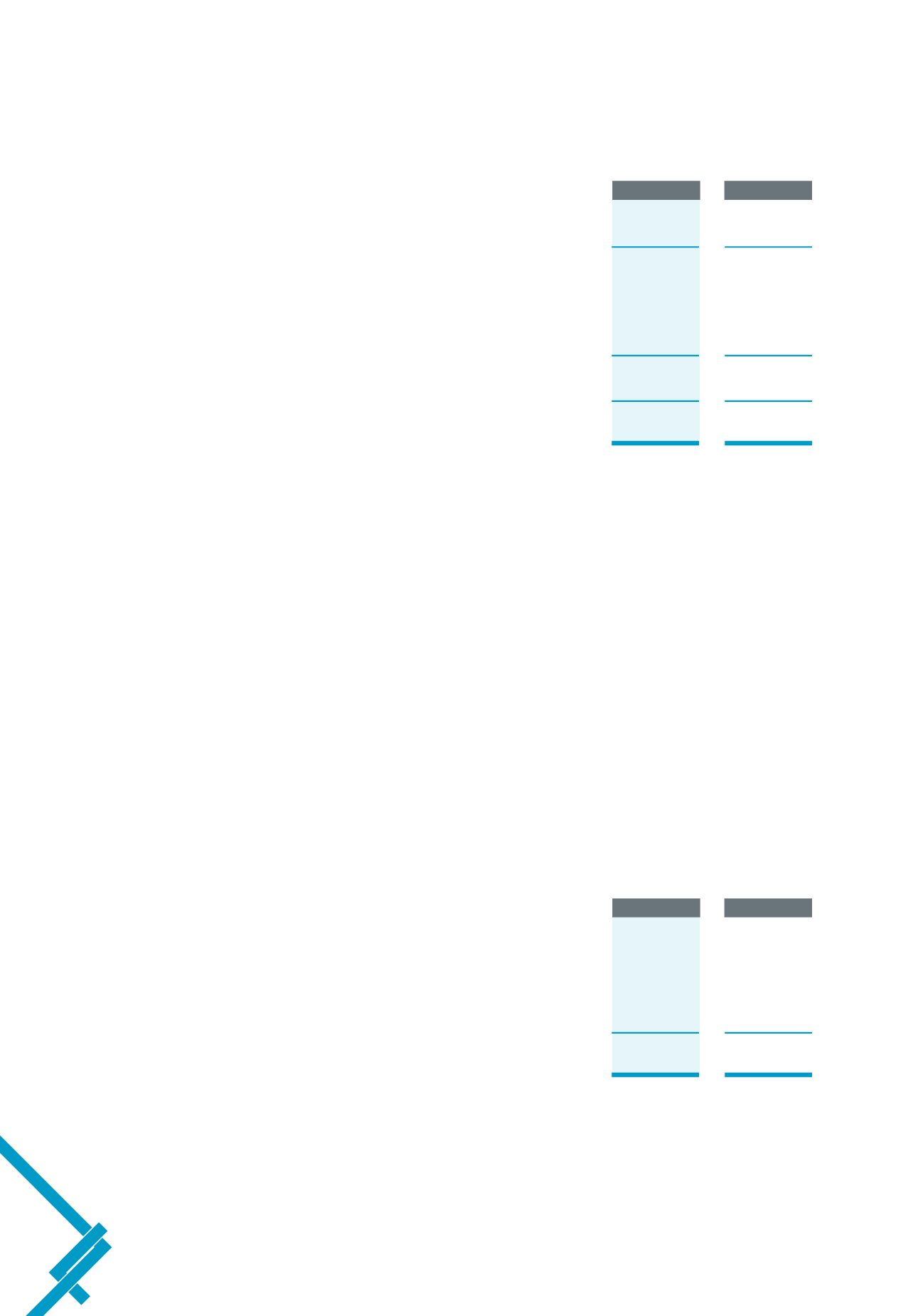

14 Debt securities in issue

2014

2013

Unsecured

a) Fixed rate bonds

799,260

798,930

Secured

a) Floating rate bonds

250,582

409,493

b) Fixed rate bonds

16,852

19,989

c) Mortgage pass-through certificates

108

646

267,542

430,128

Total debt securities in issue

1,066,802

1,229,058

Unsecured obligations

a) Fixed rate bonds are denominated in Trinidad and Tobago dollars and includes an unsubordinated bond issued by the Parent Company,

Republic Bank Limited in 2008 for a term of ten years at a fixed rate of interest of 8.55%.

Secured obligations

a) For Republic Bank Limited, the floating rate bonds are denominated in Trinidad and Tobago dollars and are unconditional secured obligations

of the Bank. The Bank has pledged a portfolio of liquid debt securities issued or guaranteed by the Government of Trinidad and Tobago

together with high-grade corporate bonds and debentures in an aggregate amount equal to the bonds issued as collateral security for the

bondholders. Other floating rate bonds are also denominated in Trinidad and Tobago dollars and are secured by property and equipment

under investments in leased assets.

b) Fixed rate bonds for one of the subsidiaries are denominated in Trinidad and Tobago dollars and are secured by property and equipment

under investments in leased assets.

c) Mortgage pass-through certificates are secured on a portfolio of mortgage loans, net of the related loan loss provisions to the extent that the

Bank has recourse to the note holders.

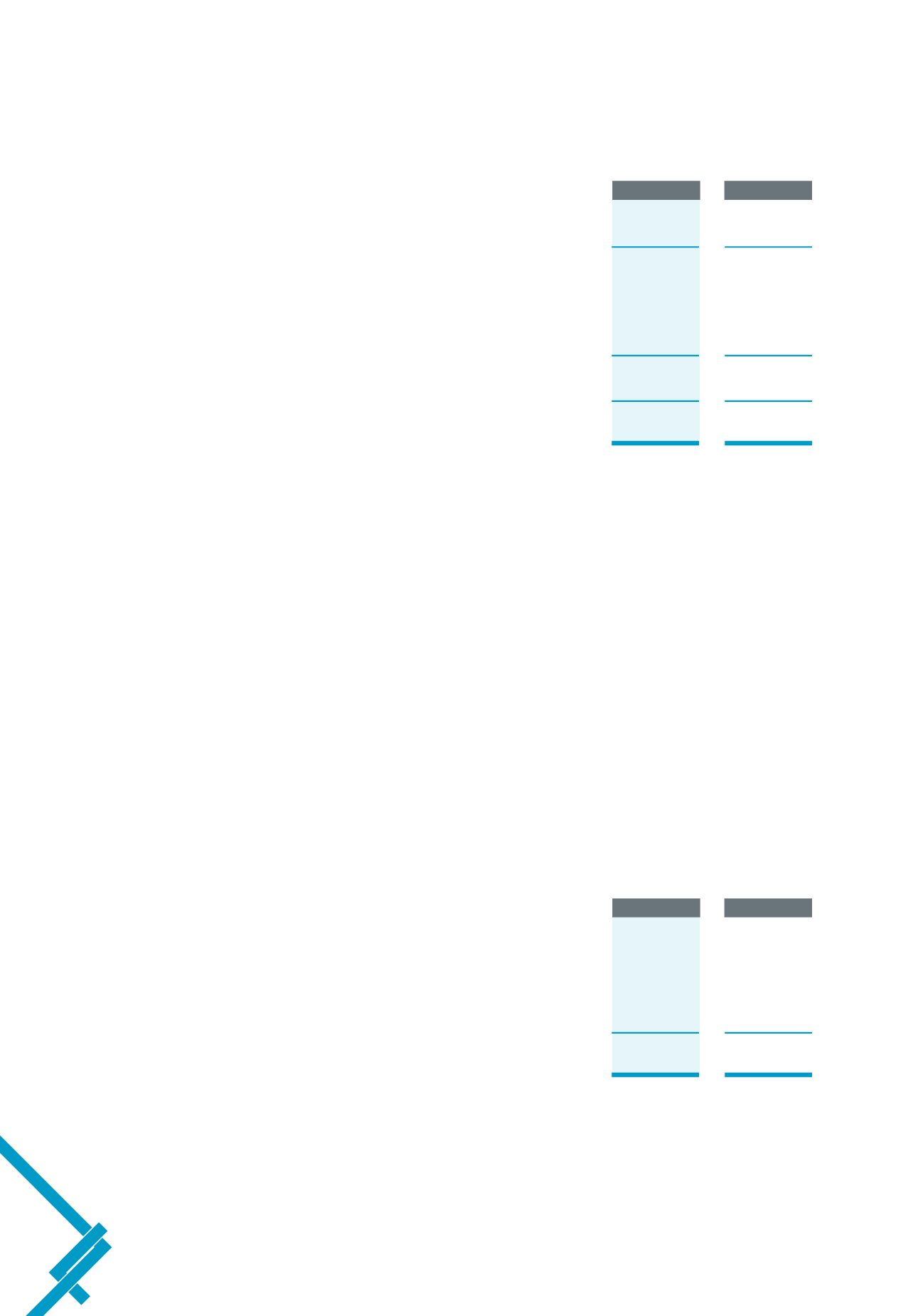

15 Other liabilities

2014

2013

Accounts payable and accruals

1,083,307

1,044,366

Unearned loan origination fees

130,729

110,267

Deferred income

1,413

5,251

Other

81,945

70,352

1,297,394

1,230,236