republic onboarding

Internet Banking

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

For youths between the ages 13 to 19 years

Shape your future

Helps you to build your nest egg

Saves you time and money

The wise investment instrument

Earn more on your Foreign Accounts

Chequing Accounts

Bank FREE, easy and convenient

A world of convenience and flexibity

Invest and enjoy the best of both worlds

A value package designed for persons 60 +

Life Stage Packages

Banking on your terms

Getting married?

Tools & Guides

Make an informed decision using our calculators

Help choose the account that’s right for you

All Our Cheques Have A New Look!

-

-

Electronic Banking

-

EBS Products

Open a deposit account online

Pay bills and manage your accounts easily

Banking on the Go!

Welcome to the Cashless Experience

Top up your phone/friend’s phone or pay utility bills for FREE!

EBS Products

Make secure deposits and bill payments

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

Access cash and manage your money

Where your change adds up

-

-

Credit cards

-

Credit Cards

Credit Cards

Additional Information

-

-

Prepaid Cards

-

Pre-paid Cards

-

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy to acquire financial assistance for tertiary education through the Higher Education Loan Programme

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business’ potential borrowing repayments

Republic Bank's Group Life Insurance will provide relief to your family by repaying your outstanding mortgage, retail or credit card balance in the event of death or disablement.

-

-

Mortgages

-

Mortgage Centre

Republic Bank Limited can make your dream of a new home a quick and affordable reality

New Customers

Block for MM- new user mortgage process

There are three stages you must complete before owning your first home

Tools & Guides

block for MM - personal - mortgages

-

-

Investments

-

Investment Products

-

Compliant Cheques FAQs

You are here

Home / Compliant Cheques FAQsA compliant cheque refers to any printed cheque that follows the Canadian Payments Association (CPA) standard 006 and is compatible with the TT Electronic Cheque Clearing System (ECCS).

- Specific dimensions / measurements for cheque sizes, and placement of data fields to ensure accurate reading on the software.

- Date format standardised to read as DD/MM/YYYY.

- Cheque paper, which would change from ‘bond’ to ‘security grade’ paper (similar to Manager’s cheques).

- Light pastel coloured ink will be required on background screening / images.

- Date and amount fields should be within a blank white box.

- Teller’s stamp box on the reverse of cheques.

- Endorsement line on the reverse of cheques.

- The MICR encoding area should be 5/8” and band remains clear of background screening.

- Borders are not permitted within the 1.59cm (5/8") clear MICR band.

The implementation of the Electronic Cheque Clearing System (ECCS) will introduce automation within the cheque clearing processing. The current process of the manual exchange and settlement of physical cheques will be replaced with the electronic submission and settlement of truncated, imaged local TTD denominated cheques between Participant Banks in Trinidad and Tobago. This is an initiative supported by the Bankers Association of Trinidad and Tobago (BATT) and the Central Bank of Trinidad and Tobago (CBTT).

The manual and paper-based process is being automated to create a more efficient cheque clearing process. The real time electronic exchange of cheque images and related transactional data between all commercial Banks is more efficient, without the next-day requirement of a physical exchange of cheques. The processing of these transactions and corresponding credits or debits to personal and corporate customer accounts would be supported by an Electronic Funds Transfer solution.

Yes, it is mandatory as all commercial Banks will be required to electronically exchange cheque images with standardised cheques.

New orders for cheques should be done immediately by contacting your branch or Account Manager.

Once your existing retail cheque book was received after May 2020 and your Commercial cheque book was received after January 2021; more than likely you already have the compliant cheque book in hand. Please verify with the compliant cheque design on our website or contact your branch.

a. Improved monitoring by Central Bank of Trinidad and Tobago.

b. Enhanced fraud mitigation capabilities.

c. More secure processing via the Electronic Cheque Clearing System and enhanced cheque security features.

Based on the updated industry-wide cheque standard, effective May 5th, 2023, we will no longer accept cheques over the counter, via the ABM and Nightsafe that do not comply with the newly implemented Electronic Cheque Clearing System, including those from other local Banks. You will need to request updated cheque books from your branch or Account Manager.

Regular Cheque Books:

2x25 - $29.00

4X25-$42.00

Duplicate cheque Books:

2X25-$42.00

4X25-$59.00

Commercial Cheque Books:

2X50 - $43.00

1X100-$43.00

4X50-$72.00

** Printeries will advise special cheque customers if there is an increase in the cost of printing the revised special cheques.

This is an industry wide change mandated by Central Bank of Trinidad & Tobago for cheques to be accepted by the Electronic Cheque Clearing (ECC) system. Cheques not accepted by the ECC system will have to be physically exchanged and this extended acceptance of non-compliant cheques will cease on May 5, 2023.

If you do not replace your cheques, the old-format cheques will not be accepted by any Bank in Trinidad and Tobago. As such, you will be required to transact from your chequing account via other means, for example: branch, ATM or online banking services – RepublicOnline and RepublicMobile App.

Republic Bank Manager’s Cheques with the old format will still be accepted until further notice.

You can request new cheque books via the following:

a. via the cheque book requisition form in your existing cheque book. Simply, fill out this form and submit it to the nearest branch of Republic Bank to place the order.

b. via the Service Request menu on RepublicOnline.

c. by placing an order through Account Manager or Corporate Manager for Commercial cheques.

Yes. The bank waived the charge for exchange and replacement of cheque books up to April 29th, 2022. The normal fee now applies.

Yes. At the point of ordering your new cheque books, you can specify which branch you would like to collect the order.

Cheque books can only be collected at our branches.

Cheque books are usually received from the printers within 2-3 weeks.

No, the new cheque book would start from the next cheque range e.g.: if the last cheque used in the old cheque book was #268 the new cheque book will start from cheque #300.

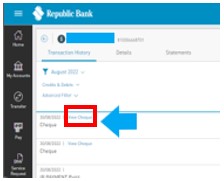

Images of your paid cheques are available via Republic Online. Retail customers can access up to 500 images and Corporate customers up to 1000 images.

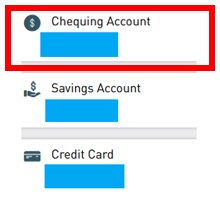

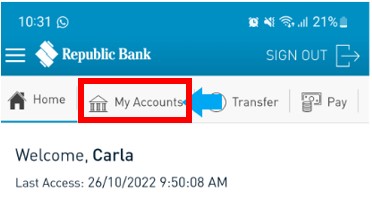

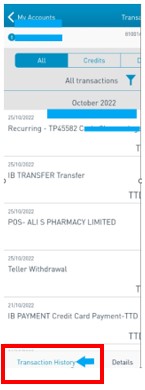

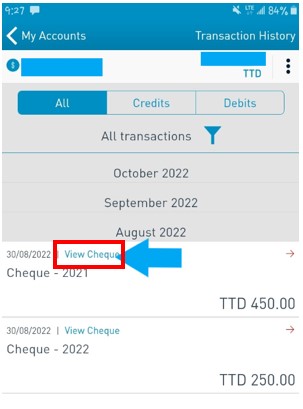

ii. Select “My Accounts”

iii. Go to the account that is linked to your cheque book

iv. Select “Transaction History”

v. Select “View Cheque”

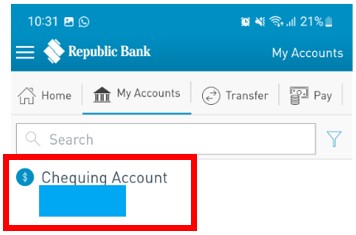

ii. Select account that is linked to cheque book

iii. Go to “Transaction History”

iv. Select “View Cheque”

Customers will no longer be receiving physical returned cheques. Cheques returned for various discrepancies e.g. words & figures differ insufficient funds or stale-dated will now be retained by the bank accepting the deposit. The customer will only receive a copy of the item for their further action. The timelines for contacting customers for any cheque related discrepancy is reduced.

Four working days excluding the date of deposit.

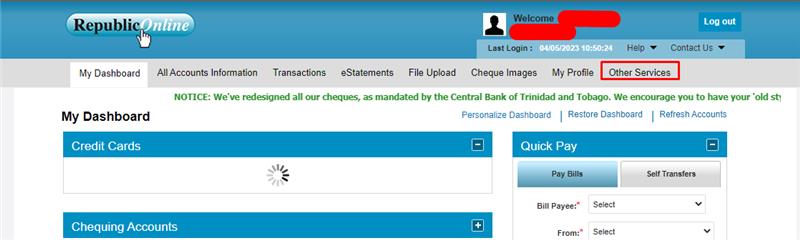

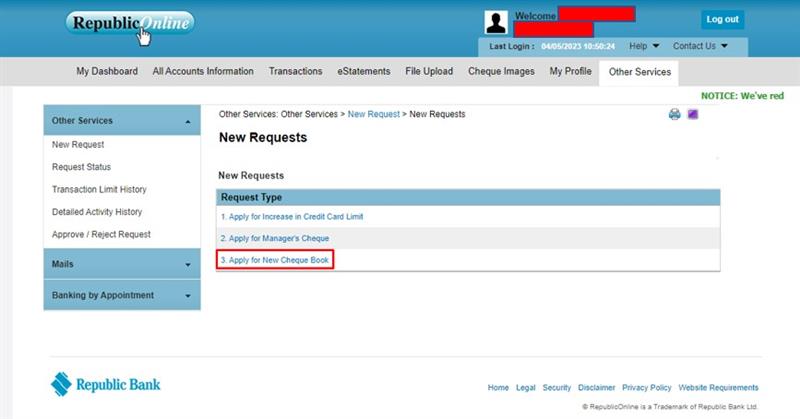

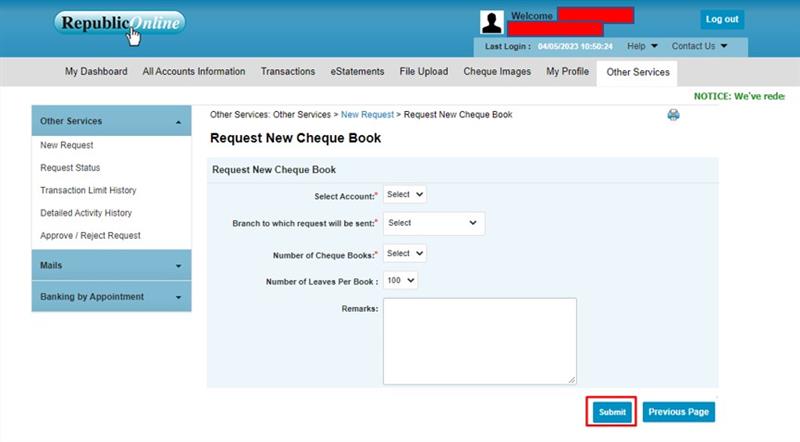

Login and then from dashboard, select “Other Services”

Select “New Request”

Click on “3. Apply for New Cheque Book”

Enter the particulars of the request then select “Submit”

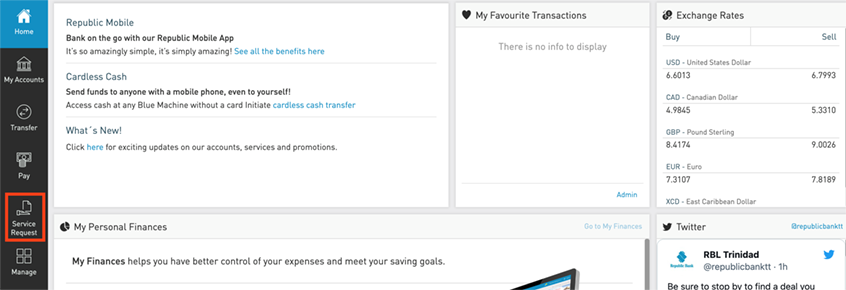

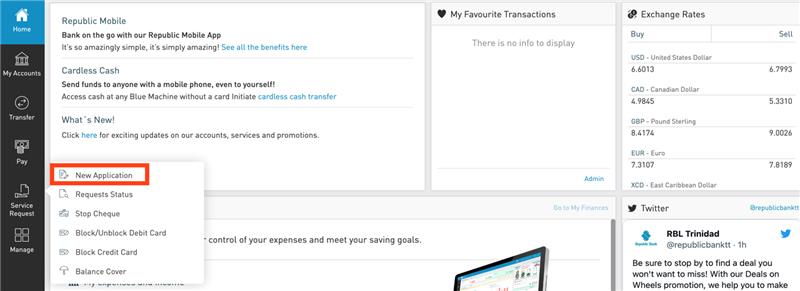

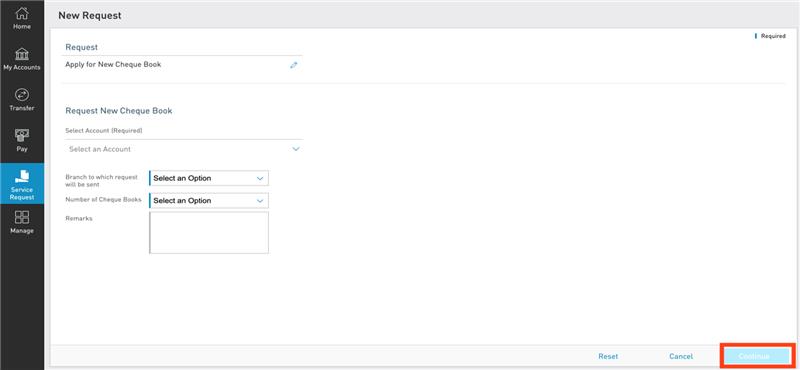

Login and then select “Service Request”

Select “New Application”

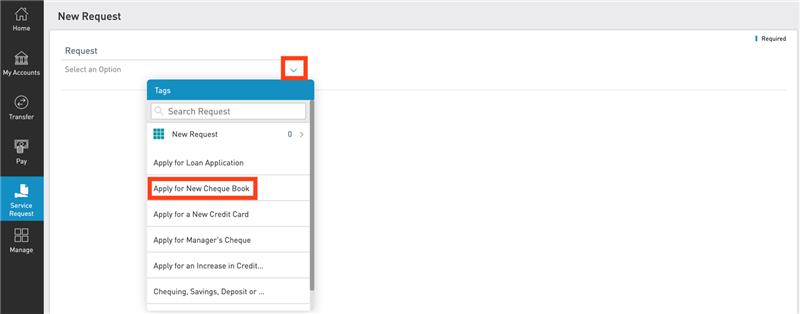

Click the drop-down arrow and select “Apply for New Cheque Book”

Enter the particulars of the request then select “Continue”

Review order and then select “Confirm”

Foreign currency cheques in the old cheque format will continue to be accepted. Only TTD cheques are processed via the Electronic Cheque Clearing System and therefore need to be compliant.

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2026 Republic Bank Limited. All Rights reserved.