republic onboarding

Internet Banking

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

For youths between the ages 13 to 19 years

Shape your future

Helps you to build your nest egg

Saves you time and money

The wise investment instrument

Earn more on your Foreign Accounts

Chequing Accounts

Bank FREE, easy and convenient

A world of convenience and flexibity

Invest and enjoy the best of both worlds

A value package designed for persons 60 +

Life Stage Packages

Banking on your terms

Getting married?

Tools & Guides

Make an informed decision using our calculators

Help choose the account that’s right for you

All Our Cheques Have A New Look!

-

-

Electronic Banking

-

EBS Products

Open a deposit account online

Pay bills and manage your accounts easily

Banking on the Go!

Welcome to the Cashless Experience

Top up your phone/friend’s phone or pay utility bills for FREE!

EBS Products

Make secure deposits and bill payments

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

Access cash and manage your money

Where your change adds up

-

-

Credit cards

-

Credit Cards

Credit Cards

Additional Information

-

-

Prepaid Cards

-

Pre-paid Cards

-

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy to acquire financial assistance for tertiary education through the Higher Education Loan Programme

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business’ potential borrowing repayments

Republic Bank's Group Life Insurance will provide relief to your family by repaying your outstanding mortgage, retail or credit card balance in the event of death or disablement.

-

-

Mortgages

-

Mortgage Centre

Republic Bank Limited can make your dream of a new home a quick and affordable reality

New Customers

Block for MM- new user mortgage process

There are three stages you must complete before owning your first home

Tools & Guides

block for MM - personal - mortgages

-

-

Investments

-

Investment Products

-

Electronic Cheque Clearing System (ECCS)

You are here

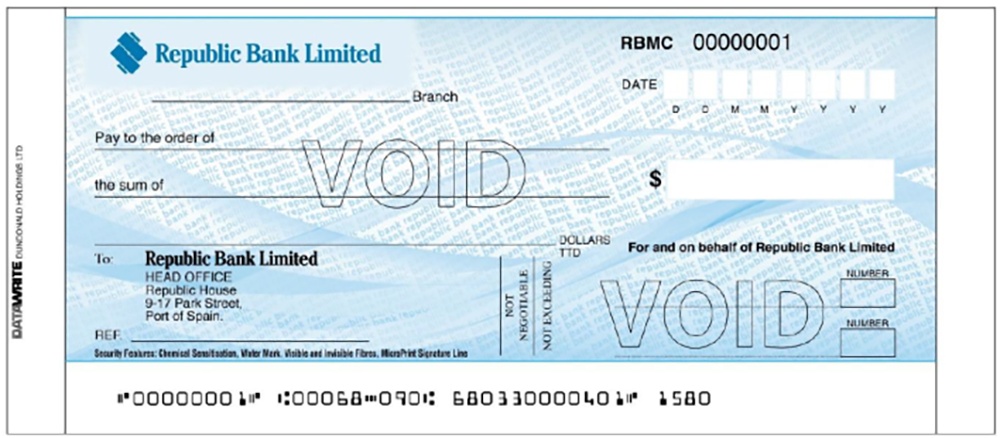

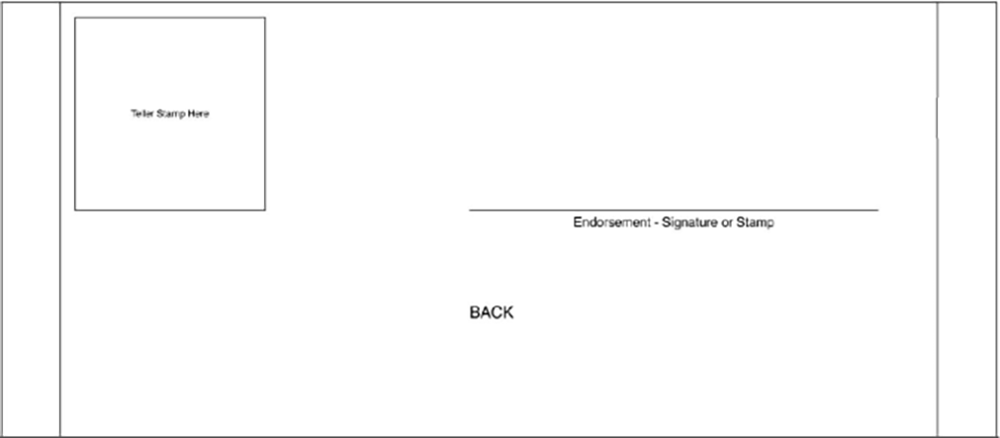

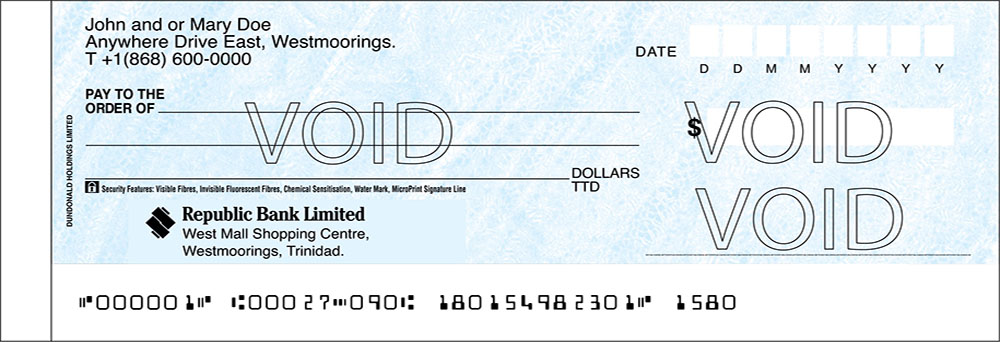

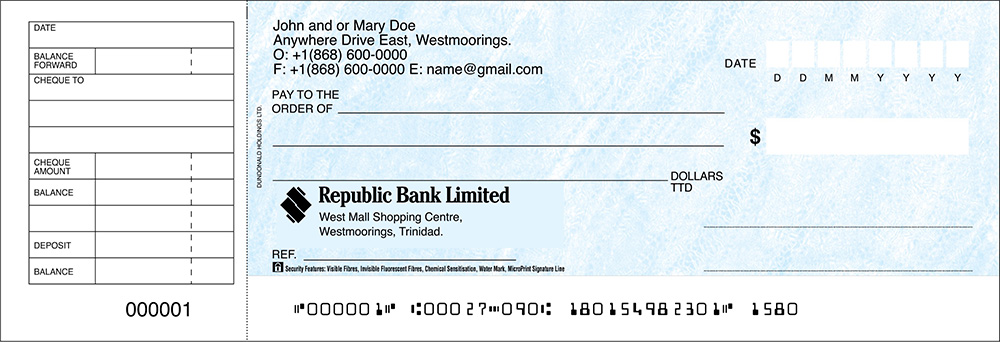

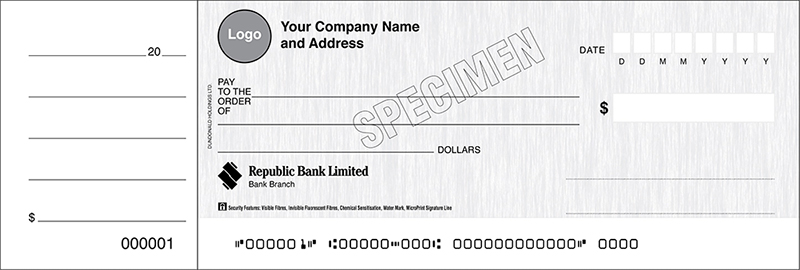

Home / Electronic Cheque Clearing System (ECCS)The new Electronic Cheque Clearing system requires all Banks to update their cheques to comply with the Canadian Payments Association (CPA) standards. This ensures that all cheques are standardized for better, more efficient processing, to better serve you.

Since the launch of the ECC system on February 6, 2023, all Banks continued accepting cheques in the old format to facilitate customers who hadn’t updated their cheques. However, based on the updated industry-wide cheque standard, effective May 5, 2023, we advise that we will no longer accept cheques that do not comply with the newly implemented ECC System, including those from other local Banks..

Not sure if you have updated cheques? Please see samples of our updated cheques below:

Manager’s Cheques

Personal and Commercial Cheques

Personal Cheque

Commercial Cheque

Special Cheques

Specially Designed Business Cheques:

Sample cheques with the revised design must be submitted to your Account Manager or Corporate Manager for approval before issuance.

Alternative Options

Personal customers: you can avail of our online banking services – RepublicOnline and RepublicMobile App, to make your everyday banking easy.

Click here to sign up for online banking today.

Businesses can avail of:

- Corporate Online Banking services for more efficient management of your company’s finances, sending and receiving payments quickly and easily.

- RepublicACH platform, that allows for direct deposits which include payments for salaries, service providers, suppliers and much more.

If you have any questions about this change, please email us at email@rfhl.com or view our Frequently Asked Questions here.

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2026 Republic Bank Limited. All Rights reserved.