Internet Banking

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

For youths between the ages 13 to 19 years

Shape your future

Helps you to build your nest egg

Saves you time and money

The wise investment instrument

Earn more on your Foreign Accounts

Chequing Accounts

Bank FREE, easy and convenient

A world of convenience and flexibity

Invest and enjoy the best of both worlds

A value package designed for persons 60 +

Life Stage Packages

Banking on your terms

Getting married?

Tools & Guides

Make an informed decision using our calculators

Help choose the account that’s right for you

All Our Cheques Have A New Look!

-

-

Electronic Banking

-

EBS Products

Open a deposit account online

Pay bills and manage your accounts easily

Banking on the Go!

Welcome to the Cashless Experience

Top up your phone/friend’s phone or pay utility bills for FREE!

EBS Products

Make secure deposits and bill payments

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

Access cash and manage your money

Where your change adds up

-

-

Credit cards

-

Credit Cards

Credit Cards

Additional Information

-

-

Prepaid Cards

-

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy to acquire financial assistance for tertiary education through the Higher Education Loan Programme

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business’ potential borrowing repayments

Republic Bank's Group Life Insurance will provide relief to your family by repaying your outstanding mortgage, retail or credit card balance in the event of death or disablement.

-

-

Mortgages

-

Mortgage Centre

Republic Bank Limited can make your dream of a new home a quick and affordable reality

New Customers

Block for MM- new user mortgage process

There are three stages you must complete before owning your first home

Tools & Guides

block for MM - personal - mortgages

-

-

Investments

-

Investment Products

-

Coronavirus to determine short term prospects

You are here

Home / Coronavirus to determine short term prospects

TRINIDAD AND TOBAGO KEY ECONOMIC INDICATORS

| INDICATOR | 2018 | 2018.4 | 2019.4 p/e |

|---|---|---|---|

| Real GDP (% change) | -0.2 | -0.1* | -1 |

| Retail Prices (% change) | 1.0 | 0.7 | 0.01 |

| Unemployment Rate (%) | 3.9 | 4.0 | 5.5 |

| Fiscal Surplus/Deficit ($M) | -5,696.8 | 942.8 | -386.8 |

| Bank Deposits (% change) | 3.1 | 3.9 | 3.1 |

| Private Sector Bank Credit (% change) | 4.8 | 1.5 | 2.9 |

| Net Foreign Reserves (US$M) | 10,348.3 | 10,348.3 | 9,619.3 |

| Exchange Rate (TT$/US$) | 6.73/6.78 | 6.74/6.78 | 6.73/6.78 |

| Stock Market Comp. Price Index | 1,302.48 | 1,302.48 | 1,468.41 |

| Oil Price (WTI) (US$ per barrel) | 65.06 | 59.59 | 56.86 |

| Gas Price (Henry Hub) (US$ per mmbtu) | 3.15 | 3.80 | 2.40 |

Source: - Central Bank of Trinidad and Tobago, TTSE, Energy Information Administration

p - Provisional data

e -Republic Bank Limited estimate

* - Estimate based on CBTT’s Index of Economic Activity

Coronavirus to Determine Short-term Prospects

Overview

Pandemics are always bad and there is never a good time to have to deal with one. However, few would disagree that the spread of COVID-19 is occurring at an inopportune time for the global economy, considering the severe challenges with which it is already saddled. As for Trinidad and Tobago, the timing couldn’t be more terrible. Available data from fourth quarter 2019 suggests that the domestic economy continues to be stymied by weak activity in both the energy and non-energy sectors. The rapid spread of the virus has caused these difficulties to intensify, as related anxieties have resulted in a plunge in oil and gas prices, in addition to disruptions in several non-energy sectors.

In the fourth quarter of 2019, the overall output of the energy sector is estimated to have been negative, notwithstanding a 1.8 percent increase in oil production. The sector was beset by continued weak prices. In the non-energy sector, indications are that construction sector activity cooled appreciably during the period, when compared to the third quarter, while there was a pick-up in activity in the trade and repairs sector. Republic Bank estimates that the domestic economy experienced a 1 percent fall in economic activity during the fourth quarter of 2019, compared to the third. Nevertheless, activity on the domestic stock market remained positive, increasing by 4.8 percent, compared to a marginal rise of 0.5 percent in the third quarter.

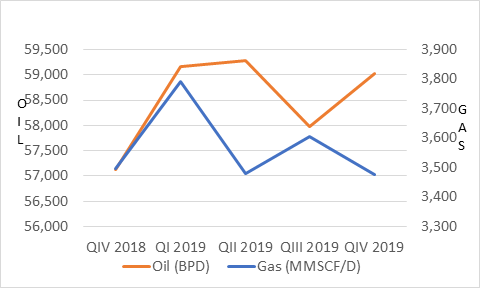

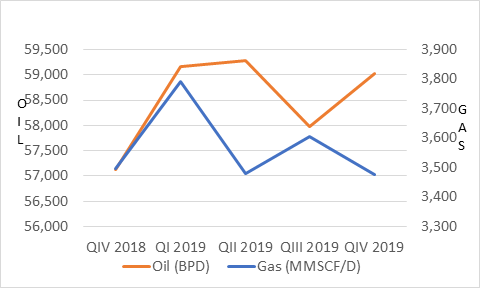

Energy

Between October and December 2019, oil production increased by 1.8 percent over the previous quarter to average 59,029.8 barrels per day (Figure 1) and was accompanied by a marginal increase in prices. The average West Texas Intermediate (WTI) oil price increased to US$56.86 per barrel from US$56.35 in the third quarter. On the other hand, Henry Hub gas prices went up by a negligible 2 cents to US$2.40 per million British thermal units (MMBTU), while gas production fell by 3.5 percent to 3.5 billion cubic feet per day (bcf/d) during the period. Beside low prices, the downstream sub-sector continues to be impeded by production challenges. During the fourth quarter of 2019, there were declines in ammonia (13.2 percent), methanol (4.5 percent) and LNG (2 percent) output. There were also declines in the barometers of exploration activity, with rig days decreasing by 6.1 percent and depth drilled down 9.6 percent.

The short-term prospects for the energy sector took a significant hit during the first quarter of 2020. As COVID-19 fears pushed global energy demand down, a price war ignited between Saudi Arabia and Russia, causing prices to plummet further. The price war was sparked by a failure of OPEC and Russia to reach a production cut agreement, which was the intended response to mitigate the impact of the virus. This was followed by the closure of another downstream plant, as Methanex, a Canadian-based methanol producer, indefinitely closed its Trinidad-based Titan plant in March, citing unfavourable market conditions. On the positive side, in December 2019, Touchstone Exploration announced a significant crude oil find in its onshore Cascadura field in Ortoire. This is an encouraging sign for the long-term outlook for the sector and follows the company’s gas discovery, which was declared three months earlier.

Figure 1: Energy Production

Source: Ministry of Energy and Energy Industries

Non-energy

Although construction activity expanded on a year-on-year (y-o-y) basis in the fourth quarter of 2019, available information on cement sales suggests that there was some cooling in comparison to third quarter 2019. Domestic cement sales, which are a good gauge of the strength of the sector, expanded by 1.3 percent (y-o-y) but was 7.8 percent below the levels of the previous quarter. For all of 2019, cement sales rose by 0.6 percent. This was the first increase since 2014. Before the Central Statistical Office reclassified domestic industries to be consistent with the International Standard Industrial Classification (ISIC) for the purposes of calculating GDP, the sale of new motor vehicles, was used as a proxy for activity in the distribution sector. However, it is now captured in the trade and repairs sector. Between October and December 2019, new motor vehicle sales were 7.2 percent higher than what was recorded in the previous quarter, but down 1.8 percent y-o-y. As COVID-19 related panic became pervasive, some domestic retailers, including pharmacies benefitted from a boost in sales during the first quarter of 2020. Concurrently, some of the measures adopted to control the spread of the disease have negatively affected air travel, certain areas in retail, the tourism and entertainment industries, to name a few. The net effect on the non-energy sector is likely to be negative.

Fiscal

Trinidad and Tobago registered a fiscal deficit of $386.8 million in the fourth quarter, which was a reversal of the $942.8 million surplus recorded during the same period in 2018. This outturn was the result of a 11.9 percent fall in central government revenue to $9,989.9 million, which significantly outweighed the 0.2 percent fall in expenditure to $10,376.8 million. Current expenditure accounted for 97.4 percent of total spending during the period. In response to the fall in energy prices related to the COVID-19 outbreak and the ongoing oil-price war, in March 2020 government reduced its budgeted prices for gas from US$3.00 per MMBtu to US$1.80 and oil from US$60.00 per barrel to US$40. The Minister of Finance revealed that the fall in energy prices is expected to result in at least a $4.5 billion in lost revenue for the 2019/2020 fiscal year. Considering this alone, the fiscal deficit could potentially exceed $9.5 billion, instead of the $5.3 billion initially envisaged. However, when the costs associated with the array of social and fiscal measures designed to mitigate the impact of COVID-19 on the economy and the most vulnerable citizens are included, a double-digit deficit and a substantial rise in public debt is likely to be realised. This may occur, notwithstanding government’s plan to withdraw US$1.1 billion from the Heritage and Stabilisation Fund. The social initiatives are expected to cost $1 billion in the first instance and include a $1,500 salary grant for displaced workers and temporary increases under the food card programme. Government also plans to accelerate $1 billion of its $6.2 billion in outstanding VAT refund payments, as well as $400 million in tax returns. It should be noted, that the longer it takes to control the spread of the virus, the greater the impact will be on the country’s fiscal accounts. Public debt ended 2019 at 65.5 percent of GDP.

Monetary

The general rise of prices remained well within manageable levels in the fourth quarter, with headline inflation averaging 0.4 percent, while core prices increased by an average of 0.6 percent. On the other hand, food prices fell by 0.5 percent. Given the still negative short-term interest rate spread between TT and US treasury securities, the slowing global economy and the severe challenges facing the domestic economy, the Central Bank’s Monetary Policy Committee (MPC) maintained the ‘Repo’ rate at 5 percent during its December 2019 monetary policy announcement. However, in March 2020, with decreases in US policy rates turning the TT-US spread positive, the MPC cut the ‘Repo’ by 150 basis points to 3.5 percent and reduced the commercial banks’ primary reserve requirement to 14 percent from 17 percent. The decision was also significantly influenced by mounting economic challenges related to COVID-19. Earlier in the month, the US Federal Reserve cut its policy rates to zero-0.25 percent, to counteract the deleterious economic impact of the virus. The Fed also announced a bond purchase programme to pump cash into the financial system and encourage banks to lend more.

As the commercial banks’ average prime lending rate remained unchanged at 9.26 percent, the demand for credit encouragingly grew at healthy rates during the last three months of 2019. For instance, commercial banks’ loans to businesses expanded by 2.9 percent over the levels recorded in the third quarter and 5.6 percent y-o-y, while consumer credit grew by 3.5 percent compared to the previous quarter and 8.4 percent y-o-y. Similarly, mortgage loans increased by 12 percent on a y-o-y basis and 2.6 percent in comparison to the previous quarter (Figure 2).

Figure 2: Credit Growth (% Change)

Source: CBTT

Reserves

The country’s stock of foreign exchange represented by the net foreign position, continued to trend down reaching US$9,489.7 million or 7.6 months of import cover (MIC) in December 2019, from US$9,839.7 million or 7.7 MIC, three months earlier. This is not surprising given low energy sector revenue and the enduring strong demand for foreign exchange. Nevertheless, between October and December 2019, the net sale of foreign currency decreased by 11.8 percent from the previous quarter to US$397 million, a figure that was 19.6 percent below fourth quarter 2018 levels. The TT/US exchange rate remained at TT$6.78 per US$1.

Outlook

The COVID-19 virus is expected to remain a disruptive force heading into the second quarter of 2020. Its continued spread is expected to constrain the demand for fossil fuel in the second quarter and as such keep prices low. With no meaningful increase in domestic production expected for some time, the performance of the energy sector is projected to remain negative for the first half of 2020. With factories in China having been shut for an extended period to control the virus’ spread, our retailers and manufactures could experience some challenges replenishing their stock. In tourism, the initiatives adopted by many governments to halt the advance of COVID-19 are expected to subdue activity in the global tourism sector. This represents a serious challenge to the domestic manufacturing sector, since its largest export market, CARICOM, is heavily reliant on tourism. In the financial sector, growth will be stymied by moves by banks and other institutions to offer loan moratoria and reduced credit card interest rates, among other things to customers negatively impacted by the virus. Overall, economic activity is likely to shrink significantly in the first half of 2020.

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2024 Republic Bank Limited. All Rights reserved.

Republic Bank

Republic Bank