republic onboarding

Internet Banking

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

For youths between the ages 13 to 19 years

Shape your future

Helps you to build your nest egg

Saves you time and money

The wise investment instrument

Earn more on your Foreign Accounts

Chequing Accounts

Bank FREE, easy and convenient

A world of convenience and flexibity

Invest and enjoy the best of both worlds

A value package designed for persons 60 +

Life Stage Packages

Banking on your terms

Getting married?

Tools & Guides

Make an informed decision using our calculators

Help choose the account that’s right for you

All Our Cheques Have A New Look!

-

-

Electronic Banking

-

EBS Products

Open a deposit account online

Pay bills and manage your accounts easily

Banking on the Go!

Welcome to the Cashless Experience

Top up your phone/friend’s phone or pay utility bills for FREE!

EBS Products

Make secure deposits and bill payments

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

Access cash and manage your money

Where your change adds up

-

-

Credit cards

-

Credit Cards

Credit Cards

Additional Information

-

-

Prepaid Cards

-

Pre-paid Cards

-

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy to acquire financial assistance for tertiary education through the Higher Education Loan Programme

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business’ potential borrowing repayments

Republic Bank's Group Life Insurance will provide relief to your family by repaying your outstanding mortgage, retail or credit card balance in the event of death or disablement.

-

-

Mortgages

-

Mortgage Centre

Republic Bank Limited can make your dream of a new home a quick and affordable reality

New Customers

Block for MM- new user mortgage process

There are three stages you must complete before owning your first home

Tools & Guides

block for MM - personal - mortgages

-

-

Investments

-

Investment Products

-

All Eyes on the Fed

You are here

Home / All Eyes on the Fed

Before cutting its benchmark rates to the 4 – 4.25 percent range in September 2025, the US Federal Reserve’s (Fed) previous policy rate reduction was in December 2024. In the period between the two decreases, the Fed opted to leave the rates unchanged at 4.25 – 4.5 percent, primarily due to high global economic uncertainty and stubborn inflationary pressures. The country’s decision to implement widespread tariffs in April 2025 contributed substantially to the uncertainty. In June, Chairman of the Fed, Jerome Powell, asserted that the Central Bank was waiting for additional information on how US tariffs would affect the economy before adjusting the rates. It goes without saying, that this wait-and-see approach did not sit well with President Donald Trump, who advocated for reduced rates well before the tariff announcement, citing the potential for lower rates to boost economic growth. The White House’s displeasure with what it viewed as an overly cautious approach by the Fed, prompted speculation in some quarters, that the President could move to have the head of the Fed replaced. For his part, in July, Mr. Trump indicated that he did not view such a move as necessary at the time.

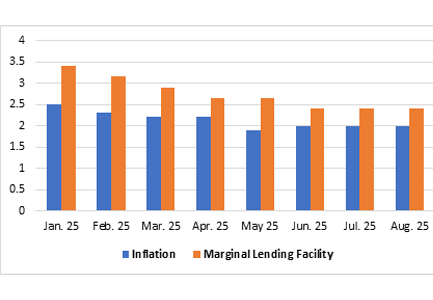

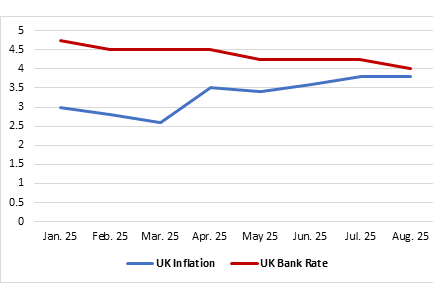

Unlike the Fed, the Bank of England (BOE) and the European Central Bank (ECB), reduced their policy rates several times during the first eight months of 2025. The ECB’s most recent decrease came in June and was preceded by three others (Figure 1). Its benchmark rates are now within the 2 – 2.4 percent range, down from 3 – 3.4 percent in December 2024. In September, the ECB held rates at the 2 – 2.4 percent range for the third consecutive month, with Eurozone inflation at the targeted 2 percent rate. The ECB also cited continued global economic uncertainty, including the yet unknown full impact of US tariffs on Eurozone GDP, among the main reasons for its decision. The BOE executed three rate reductions thus far in 2025, with the latest coming in August, taking its main interest rate to 4 percent (Figure 2) from 5 percent in December 2024. The BOE decided to cut rates in August, notwithstanding a projected rise in inflation to 4 percent in September, well above its 2 percent target. The decision was taken, considering the struggling economy and fears of further weakening of the job market. After rising to 4.7 percent in May, unemployment remained at that level in the succeeding two months. The unemployment rate was 4.4 percent at the end of 2024.

Figure 1: Eurozone Inflation & ECB MLF (Upper Bound Policy Rate)

Source: European Commission

Figure 2: UK Inflation & BOE Bank Rate

Source: UK – ONS, BOE

The Fed’s latest rate cut comes after months of pressure from government officials and in response to signs of a stalling job market, notwithstanding still low unemployment. In June 2025 the US economy lost 13,000 jobs, the first decline in more than three years. This was followed by gains of 79,000 in July and a significantly weaker 22,000 in August. In his statement, Mr. Powell indicated that while unemployment is low, there are downside risks confronting the labour market. In August, unemployment rose slightly to 4.3 percent from 4.2 percent a month earlier, suggesting that activity may be slowing in the economy. Nevertheless, with unemployment below 5 percent, the economy is considered to be in a state of full employment, where joblessness is typically frictional or structural.

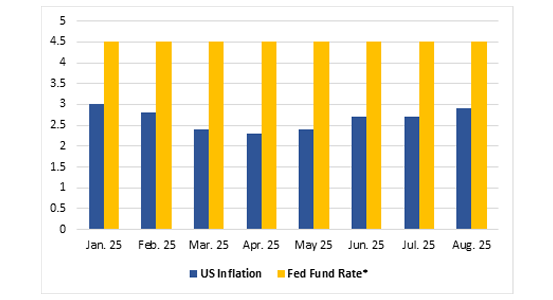

The Fed’s September policy announcement was the first time in months where concerns about the labour market superseded inflation fears. Ironically, this came just days after it was confirmed that the rate of inflation increased to 2.9 percent in August (Figure 3), which was the fastest acceleration since January. Inflation is also still above the Fed’s 2 percent target. Moreover, forward guidance from the Central Bank suggests that its benchmark rates may be cut by a further 50 basis point in the fourth quarter of 2025 to 3.5 – 3.75 percent.

Figure 3: US Inflation & Fed Fund Rate (Upper Bound)

Source: US – BLS, FRED

Beyond US consumers and investors, changes in US interest rates can have significant impact on the global economy. For this reason, policy actions and announcements by the Fed are closely monitored by individuals and organisations the world over, with global investors, policy makers and central banks keen to ensure that their decisions are sufficiently guided by developments in the US economy.

For instance, a cut in US interest rates could provide a boost for emerging and developing economies because a sizeable portion of their debt is normally in dollars. This essentially reduces the cost of their foreign debt, allowing the respective governments to direct finances, that would otherwise have gone toward debt servicing, to investments that could benefit their economies. In this regard, economic growth in those countries could be more robust than it would otherwise have been. Sadly, many developing countries’ external debt stock is at or near crisis levels and in this regard, any relief would be welcomed. Data from the United Nations Conference on Trade and Development (UNCTAD) indicates that in 2023 the external debt of developing countries hit a record US$11.4 trillion, equivalent to 99 percent of their export revenue. According to UNCTAD, the associated high interest payments have been applying significant pressure on the affected countries’ fiscal accounts, forcing governments to choose between paying debt or funding essential government services and projects. The need to prioritise debt servicing over social programmes and public sector investment can impose very harsh consequences on a nation’s citizens and economy. While many countries would need debt restructure and write-offs to bring their debt portfolios to sustainable levels, a notable fall in the cost of debt could prove quite beneficial to others. In this regard, the Fed’s September rate cut would likely be viewed as at least a step in the right direction for such nations.

Rising US interest rates tend to push up the value of the dollar relative to other currencies, all else being equal. For emerging and developing economies with fixed exchange rate regimes, this may result in a depletion of foreign exchange reserves, as they seek to defend the value of their currencies. Since the reverse is true, such countries would likely be pleased with the Fed’s latest rate cut. Developing countries with flexible exchange rate regimes would benefit from cheaper imports from the US as a result of the fall, since their currencies would appreciate against the dollar. This could ease imported inflation. Finally, when US interest rates are high, capital flows to emerging and developing economies could be constrained if the return on investment in those jurisdictions are not at least equivalent to yields in the US. In fact, when domestic yields fall below the levels in the US, those countries usually face a flight to quality, where local investors move portions of their capital abroad to take advantage of the more attractive returns. This can negatively affect economic growth in the affected countries.

The influence of US interest rates on the global economy was on display following the announcement of the Fed’s latest rate cut. Global equity markets rose measurably in the wake of the statement, with some markets in Asia matching previous historic highs. When US interest rates fall, international investors expect growth to accelerate in the US and the wider global economy and are therefore more likely to invest. When interest rates rise, investors tend to invest less and are also a lot more selective, often at the expense of emerging and developing economies.

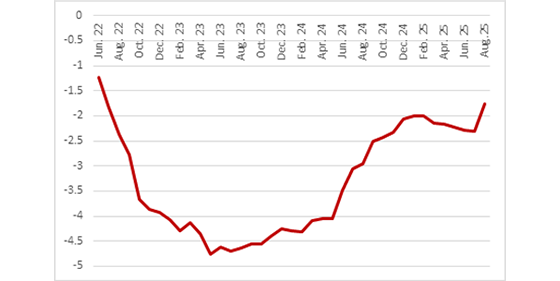

The decisions of the Fed are also closely monitored by other central banks. Changes in US interest rates can potentially impose a myriad of challenges on other economies including capital flight, lower growth, debt crises and weaker currencies, to name a few. To mitigate these risks and fulfill their mandate to promote economic and financial stability, global central banks are often called to respond to US monetary policy actions in a timely manner. Nevertheless, determining the appropriate policy response is seldom a simple matter. For example, in Trinidad and Tobago the Central Bank (CBTT) adopted an accommodative monetary policy stance since 2020, seeking to facilitate non-energy sector growth. Accordingly, the bank has kept its policy rate, the Repo, at 3.5 percent since March 2020. Nonetheless, CBTT’s policy decisions became increasingly complex when US rates began to rise in the middle of 2022 and remained at elevated levels, despite decreases in 2024. The higher US rates resulted in a widening of the spread between US and domestic short-term interest rates from -1.23 percentage points in June 2022 to -4.06 percentage points in May 2024 (Figure 4). Simply put, US short-term yields, which were already above domestic interest rates, became even more attractive. This increased the potential for capital flight and put additional pressure on the country’s foreign exchange reserves, with local investors seeking to benefit from the relatively higher US returns. This development placed the CBTT in a position where it was repeatedly forced to weigh the net benefit of continuing to prioritise economic growth versus the potential impact of matching US interest rate increases to help the country attract capital. The Bank opted to maintain its focus of stimulating growth, a position that was aided by controlled inflation for much of the period. With the differential trending down since March 2024, the latest reduction of the Fed Fund rates would further ease some of the external pressures facing the CBTT, though it may not necessarily result in marked reduction in the complexity of the environment.

Figure 4: US-TT Differential for 3-Month Treasuries (%)

Source: CBTT, FRED

The Fed’s policy decision will continue to command significant global attention, with its next few policy announcements expected to be preceded by widespread anticipation. Given the forgoing, it is clear that the Fed does not and can’t afford to make policy decisions in a vacuum, since its actions can potentially have deep and widespread impact domestically and globally. It is important for the relevant stakeholders to closely monitor and in some cases, try to anticipate those decisions, making sure to appropriately assess the major implications. The September reduction in the Fed Fund rates was, no doubt welcomed by many, both within the US and globally. Because of their heavy external debt levels, urgent need for capital and other factors, many emerging and developing economies would likely have breathed a sigh of relief after the announcement. On the other hand, US consumers and investors are also pleased, if not with the magnitude of the cut, at least with the fact that it likely represents the start of a cycle of gradual reductions by the Fed.

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2025 Republic Bank Limited. All Rights reserved.

Garvin Joefield

Garvin Joefield